Of all the small-cap sector ETFs I follow one has jumped out in 2018 - the SmallCap Health Care ETF (PSCH). While the broad market is up just 1% this year, and small-cap stocks are up 4.1%, this small-cap health care ETF is up a whopping 20%! That outperformance is all the more impressive when you consider that the best direct large cap comparison, the Health Care Select Sector ETF (XLV), is down 2.4% year-to-date. Some of the strongest performing stocks in the small-cap health care space are small-cap medical device stocks. I’ve written about these types of stocks numerous times over the last year, and we continue to build exposure in my Cabot Small-Cap Confidential advisory.

Broadly speaking, the performance in small-cap medical device stocks is being driven by improving fundamentals and protected pricing relative to other areas in health care. With expectations of forward revenue and EPS growth inching higher, investors have kept buying shares, even before many medical device stocks reported Q1 2018 results.

[text_ad]

Here are a few small-cap medical device stocks worth a look right now. All have reported within the last two weeks.

Small-Cap Medical Device Stocks Soaring On Earnings

Small-Cap Medical Device Stock #1: Inogen (INGN)

Inogen (INGN) is a $3.8 billion market cap company that makes portable oxygen concentrators for patients with chronic respiratory conditions. I featured the small-cap medical device stock back in October of 2017, when the stock price was about half of what it is now. The near-doubling in value over the last seven months should give you some indication of how fast Inogen is growing!

The company’s pitch is as straightforward as it was in October; patients can tow around a cart with a big, cumbersome oxygen tank (or stay at home), or use one of Inogen’s products, which are roughly the size of a medium-sized handbag.

In the first quarter of 2018 (reported on May 1) revenue was up 51% to $79 million. The company sold a total of 45,400 units in the quarter, which was an increase of 77%. Notably, the direct-to-consumer channel was up 68% to $29 million, meaning it now accounts for just over a third of sales. The vast majority of Inogen’s revenue (93% in Q1) still comes from equipment sales, while the remining portion comes from rentals, which declined in the quarter. A quick review of products on its website shows most systems are priced in the $2,500 to $3,500 range.

Management provided guidance for 2018 of $310 million to $320 million in revenue. The low end of that range is more than $5 million above prior consensus, and the high end implies 28% revenue growth. Coupled with EPS growth that’s likely above that range you can see why shares of Inogen jumped 18% after reporting. It’s a great growth story.

Small-Cap Medical Device Stock #2: Tactile Systems Technology (TCMD)

Tactile Systems Technology (TCMD) is a $810 million market cap company that has developed a range of medical devices to deliver at-home care for patients with vascular disease. Its current priority is to advance the standard of care in treating lymphedema and chronic venous insufficiency (CVI), both of which are costly and lifelong conditions affecting 4.5 million to 6 million people in the U.S. Together, these two end-markets are estimated to be worth more than $4 billion a year.

Traditional treatments for Tactile’s primary market, lymphedema, include therapist massage to help train lymph fluid, decongestive exercises, skin care, and compression with multilayered bandages. Therapy usually begins with three to five clinic visits per week, for one to two months. This is expensive, time consuming, and very inconvenient for patients, many of whom have a difficult time getting around.

To better address the market’s needs for lymphedema, Tactile has developed the Flexitouch System, a pneumatic pump that integrates with form-fitting garments that are worn by the patient. When turned on, the Flexitouch system mimics the clinic-based manual lymphatic drainage therapy. And treatment can be completed at home.

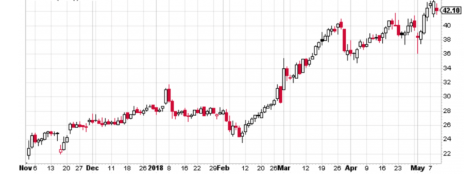

The company has been growing at a good clip; average revenue growth over the last four years is 31%. And it’s profitable. In 2017, EPS of $0.37 represented an increase of 164%. Despite the growth, the stock’s advance was cut short last September when it abruptly fell from $38 to $25 in less than three months. Buyers stepped back in late in 2017 and while shares spent the first months of 2018 advancing back toward their previous high, it wasn’t until after Q1 2018 results were reported on Monday that the stock broke out to an all-time high.

The company beat expectations by a wide margin in the quarter, with sales of the Flexitouch system helped by an expanding salesforce and strength in the Veterans Administration hospital system driving revenue up 35.3% to $26.9 million (beating by $3.1 million). Earnings per share of $0.00 beat by $0.13, an improvement from a loss of -$0.09 a year ago. Management also said it just released the latest generation of its Flexitouch system, and that it bumped up 2018 guidance by $1 million to a range of $132 million to $134 million, which would represent growth of 21% to 23%.

(Still) My Favorite Small-Cap Medical Device Stock

In the middle of 2017 I released a report on one small-cap medical device stock that I felt held great promise for investors. I can’t reveal its name since it’s still rated buy in our exclusive Cabot Small-Cap Confidential advisory. But I can tell you why I like it and let you know how to get my in-depth report.

The company makes implantable surgical products for peripheral nerve injuries. The complex structure of these implants supports nerve cell regeneration in the patient’s body. They are all off-the-shelf products, meaning they can be purchased, stored and made available for use at a moment’s notice. This should help adoption moving forward as many nerve repair surgeries are unplanned, and surgeons who have repair devices in stock are more likely to use them, for obvious reasons.

The company has a compelling story, is a small cap and growth is terrific. Revenues have been growing north of 40%, and on its Q1 earnings conference call management stated that it expected at least 40% revenue growth throughout the rest of the year. Powering this growth is expansion into adjacent nerve repair markets where there is little competition and this company’s products offer immense benefits to both surgeons and patients.

Plus, the chart looks terrific!

You can find out more about this small-cap medical device powerhouse here.

[author_ad]