Warren Buffett has officially retired (at least as CEO of Berkshire; he’ll remain on the board as Chairman as he hands over his day-to-day responsibilities to Greg Abel), but over the years, he’s shared a lot of very valuable investing advice that we can all take advantage of.

For me, there’s one obscure quote about the attraction of small-cap stocks that sticks in my mind. It was back in 1999.

Elephants or Mosquitoes

He said, “If I was running $1 million today, or $10 million for that matter, I’d be fully invested … It’s a huge structural advantage not to have a lot of money … The universe I can’t play in has become more attractive than the universe I can play in. I have to look for elephants. It may be that the elephants are not as attractive as the mosquitoes. But that is the universe I must live in.”

Buffett was saying he can’t buy small-cap stocks (the mosquitoes) because he has too much money. He would move the stock too much. He must “look for elephants,” which are, of course, the large caps.

This one stuck with me because it gets to the heart of one of the defining characteristics of small-cap stocks: many are young, attractive investments and tend to move around a lot!

[text_ad]

Sometimes, great small caps can pop 10%, 15%, or more in a single day.

This volatility can be absolutely maddening for those who are new to small-cap investing (and even to those who aren’t). And it’s especially frustrating for those who want a quick answer to the question of whether the stock is a buy, hold or sell.

Why Do Small-Cap Stocks Move?

The honest truth is that often there isn’t a clear reason for a small-cap stock’s move. At least not immediately.

The reason might be buried in a press release, an earnings conference call or SEC filing. Or it could be a newsflash sent out over a Bloomberg terminal that the average investor does not have access to. Or an automated media feed misreads a press release and posts a misleading headline (this happens with earnings releases at times). Or it could simply be due to mere speculation about something impacting a company in a similar market.

Other times, there is no answer, at least none you’ll be able to pinpoint. As Buffett’s comments suggested, it could be that a big investor (or several) might be dumping, or buying, a sizeable position. You wouldn’t know that until you check SEC filings at a later date.

This type of volatility is more pronounced when the market is dealing with uncertainties and during earnings season, when a lot of information is being thrown at investors.

My message to you is this: Don’t let this volatility drive you away from small-cap stocks if you’re inclined to invest in them. Volatility comes and goes, and over the long term, small caps tend to beat the market.

You just need to keep your head on straight during bouts of volatility.

As Buffett inferred, even the world’s greatest investors are attracted to small-cap stocks. He might not buy small caps today. But he did back in 1972 when he bought See’s Candies for just $25 million (equivalent to over $637.5 million today).

The reason is relatively simple – growth is greatest in the early stages of a company’s development.

There are a few simple rules you can follow to help you increase your odds of success, especially during uncertain markets.

Five Simple Rules For Success with Small-Cap Stocks

Rule #1: Commit To The Long Haul or Don’t Bother: One of the more frequently quoted Warren Buffett quips is, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.”

I don’t think you need to own every small-cap stock you buy for the next decade. But you do need to look out at least a year or two if you expect to have significant success.

Yes, there are select examples of investors making money trading in and out of small caps in the short term. But very few can do it week in and week out, year after year. All the studies say the same thing: Your odds of making money go up the longer you stick with small-cap stocks.

A study from Ibbotson, a financial research firm owned by Morningstar, found that investors have a 70% chance of making money with small-cap stocks if they stay invested for one year. That probability goes up to 82% after three years, 86% after five years and 98% after 10 years. The percentages aren’t all that different for large caps.

Don’t fight the odds.

Rule #2: Average Out Your Cost Basis: Small-cap stocks can be irrational in the short term. That’s why you never do anything too drastic. Don’t go all in on an individual stock on a big pullback, or a big breakout. Instead, average into a position by buying shares at different prices and on different days. The strategy helps to reduce the risk of buying a full position in a stock at an unlucky time, which is bound to happen occasionally.

The period over which you average in should be dictated by your holding time horizon. If you’re investing for just a year or two, you’ll probably average in over a week or two, maybe a month. If you’re in it for three or more years, you can average in over a year, or more.

Rule #3: Take Partial Profits: If averaging in makes sense, then averaging out should too. Consider selling a quarter or a half position on the way up, especially if a gain has surpassed 100%. This doesn’t have to mean giving up on the stock. It’s simply a risk-mitigation strategy. The original capital can be allocated to a lower-risk investment.

Also, it’s fine to average back into a position even if you sold shares at an earlier date. Sometimes, especially during corrections, investors are forced to dump some shares to protect their gains. Months later, the stock might be doing just fine. If the growth story is intact and the market is trending up there’s no reason you can’t build up your position again.

Rule #4: Use a Stop-Loss: Many advisors advocate a 10% to 15% stop-loss for large caps. For small caps, I like to widen this to 15% to 30%. The reason is that we often see quality small caps drop 20% or so during market corrections. Often, these are the times to average down if and when the stock has stabilized, assuming the stock’s growth story is intact.

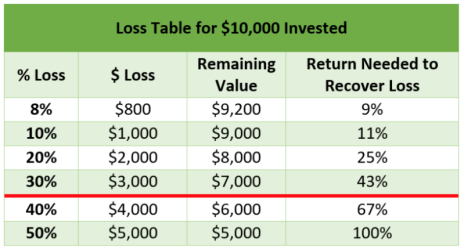

That said, it can also be a time to sell a partial, or full, position to protect gains, or help avoid catastrophic losses. How close you are to your desired position size will usually determine if you’re averaging in, or out. The underlying reason for using stop losses is that the bigger the loss, the bigger the return you need to get back to break even (see table below). Don’t go below the red line!

Rule #5: If You’re Not Sure What to Do, Do Nothing: Just because the market is open doesn’t mean you need to participate in it. If you’ve had a streak of losses, or things just don’t feel right, take a break. Focus your attention on a few stocks you’d like to own eventually and read up on those so you’re ready to go when the market improves, and your confidence returns.

As Warren Buffett said, “I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.”

Finding Small-Cap Stocks for Your Inner Buffett

One of the reasons for Buffett’s sustained outperformance is that he bought insurance companies. His love of insurance first materialized with the acquisition of National Indemnity in 1967.

Over the years, he’s purchased more than 10 companies that offer and underwrite various forms of insurance. Today, roughly 70% of Berkshire’s listed assets are in the “Insurance and Other” category.

These businesses are massive and sophisticated, way beyond the scope of anything you’d ever encounter in a small-cap stock. But Berkshire’s success, due in no small part to the regular collection of insurance premiums, can still serve as a valuable lesson for small-cap investors.

Year in and year out, people buy insurance for their cars, houses, boats, health, and even to insure their insurance policies! Insurance is just a fact of life, a regular bill for most people.

While it’s a relatively slow-growth industry overall – growth is in the low single digits – consistent market demand makes insurance big business. Finding small-cap stocks that address similar market demands, “picks and shovels” if you will, is critical to our success.

To find out which small-cap stocks I’m recommending right now – click here.

[author_ad]

This post has been updated from an original version.