Trump’s victory has dramatically altered the investing landscape in ways the market is racing to comprehend. I’ve been devouring analysis from left, right and center at an obsessive pace. And my takeaway is that very few commentators have a firm grip on what the U.S. economy will look like over the course of his Presidency (and beyond, for that matter).

I certainly don’t pretend to have all the answers. But there are a few areas of market research worth prioritizing given Trump’s proposed agenda and evolving administration. As always, small cap stocks top my list of considerations. And they should top yours too, given that they’ve been trouncing the market since the presidential election.

[text_ad]

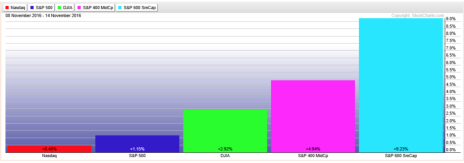

Since Trump won, the S&P 600 is up 9.2%. That’s huge. Especially when compared to a rise of 0.5% for the Nasdaq, 1.2% for the S&P 500, 2.9% for the Dow and 4.9% for mid cap stocks.

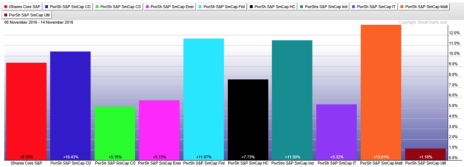

The rally in small cap stocks is broader-based than I had thought before digging into it. I expected to see small-cap financials, industrials and materials outperforming, and pulling the index along with them. They are, but they have a very light load to pull given that every single small cap sector, with the exception of utilities, is up over 5% since the election.

The simplest explanation for this broad-based performance is that small cap stocks are highly leveraged to the U.S. economy. Revenues are mostly derived from North America, and they have very little exposure to foreign currency fluctuations. Those are good qualities to have under an “America first” Presidency.

That’s not very actionable insight however, unless you plan to simply buy a small-cap ETF. Let’s dig deeper into three areas of the small-cap market that should be of particular interest to investors.

Three Small Cap Sectors that Stand Out

- Financials

Bank stocks have been rallying since Trump won. It seems a given now that interest rates will rise, and bank stocks with exposure to the long end of the curve have been moving higher, further and faster. Much of the analysis I’ve read suggests that even if the Fed holds firm in December, that’s just a timing issue. Ultimately, rates will go up.

Equally important, with the Republicans now in control of the Presidency, House and Senate, regulatory relief is almost a given. The SEC commissioner has already announced her departure, and Trump will be able to fill two additional openings on the five-member commission.

What underbrush he’ll cut to clear the path to policy reform remains a source of much speculation. But a blue-sky scenario that includes higher interest rates, fewer regulations, loan growth, a lower tax rate and stock buybacks suggests 20% to 30% EPS growth for many small- and mid-cap bank stocks.

Even if that scenario fails to play out, the mere potential has unleashed a furious rally in financial stocks. One of the easiest ways to play the strength for small-cap investors who don’t want to dig into loan balance details is to go with the PowerShares Financials ETF (PSCF). It’s up over 10% since the election and is skewed toward banks on the small end of the small cap market cap curve. It’s also relatively thinly traded, so take that into account if buying and/or selling.

- Biotech

Biotech stocks are on fire. Look at the iShares Biotech ETF (IBB). It’s up over 17% since Trump won. Why? Trump has said he wants to clear the FDA’s pipeline of drugs awaiting approval.

Getting those drugs through the system, not just calling for more approvals, is a different matter. But even if the pace of FDA approvals doesn’t pick up, the industry is benefiting from speculation that Trump will help repatriate offshore cash, which could help U.S. biotech companies initiate share buybacks and a fresh wave of M&A activity. The President-elect has softened his stance on Obamacare already, so it remains to be seen if he’ll make concessions with the Democrats with respect to pricing (this has been one of the darkest clouds over biotech stocks).

Consider looking at Clovis Oncology (CLVS) and Five Prime Therapeutics (FPRX). Both were holding up reasonably well before the election and have the added benefit of being cancer-fighting drug companies (oncology was already a strong area of the market).

- Infrastructure & Construction

Infrastructure and certain construction-related stocks are rallying for the simple reason that Trump has talked about upgrading U.S. infrastructure.

What types of projects will get priority remains to be seen, but at this early stage, it looks like investors are happy to buy up just about anything with exposure, and figure out the details later. I have three ideas from my watch lists that have rallied since the election.

First up is U.S. Concrete (USCR), a pure-play ready-mix concrete small cap that’s been growing quickly through price increases and acquisitions. The company’s major markets of Texas, California and New York/New Jersey have it well positioned for any infrastructure-build out—as does its historical end-market exposure of 59% commercial, 25% residential and 16% public works. It was retreating until Trump won; now it’s hot.

Next up is Advanced Drainage (WMS), a manufacturer of thermoplastic corrugated pipe with a market cap of $1.1 billion. The company’s products are used in general construction and infrastructure projects where storm and septic piping is necessary (for example, under a parking lot at a large shopping complex). Revenue growth isn’t that robust, just 10% in 2015 and 9% in 2016. But EPS growth of 28% and 52%, respectively, suggests profit margins are expanding. The company was plagued by some accounting issues and the stock had declined from 28 to 19 prior to the election. As I recall, those were related to foreign exchange fluctuations that affected raw inventory pricing. Admittedly, I don’t recall the details. But it seems the market hasn’t completely forgiven Advanced Drainage, yet. Trump’s victory drove shares up over 10%, but they’ve been relatively unstable over the last couple of days. This might be one to watch for signs of more than a Trump bounce.

Certain oil and gas infrastructure and technology stocks have also done well. One from my watch list is Willbros (WG), a specialty energy infrastructure contractor with a market cap of $130 million. The company specializes in pipelines, compressor stations and related facilities for onshore and coastal projects. Revenue breakdown in 2015 was 42% utility, 25% Canada and 33% oil and gas. It’s been far from a growth stock, with 2012 being the last year of revenue growth. Since then, revenue has been cut by more than 50%, to $909 million in 2015, and EPS has been negative. The Trump rally has investors looking for a possible return to growth. Shares have been generally weak in 2016, but had stabilized in the 1.80 to 2.20 range this fall. A quick retreat preceded the election, but since that event, shares have rallied from 1.60 to 2.20, a better-than 37% move. The stock traded north of 12.50 in 2014, so clearly there is a lot of upside potential if 2016 marks a trough in the cycle.

I think much of the market’s recent rally relates to Wall Street breathing a collective sigh of relief at Trump’s conciliatory tone during (and since) his acceptance speech (how long he can keep that up is anybody’s guess), as well as the potential for a concerted effort to juice domestic growth through stimulus spending and tax cuts.

At the same time, my gut tells me that there are many investors just waiting for that first inflammatory statement to motivate them to hit the sell button. The world is watching closely to try and gauge his real temperament. And the bottom line is that the impression Trump puts out there matters.

If you buy and sell individual stocks, each of which is a play on a specific theme, it’s in your best interest to consider how each could be influenced by Trump’s proposed policies. I’ve been updating Cabot Small-Cap Confidential subscribers on my outlook for every stock under coverage. Over the last week, we’ve locked in partial profits on three positions, each of which yielded a return of over 45%.

And in just over two weeks, I’ll be sending out my first official recommendation since Trump was elected. I haven’t fully decided what it will be just yet. But I can guarantee one thing: it will be a small cap stock poised to double with Trump in the White House.

You can find out more details here.