What to Watch for at Consumer Electronics Show 2018

The 2018 Consumer Electronics Show (CES) kicked off in Las Vegas yesterday. Over 4,000 exhibitors, including many small-cap tech stocks and roughly 200,000 technology-obsessed people, will flock to the desert for a peek at the latest gadgets.

As the analyst of Cabot Small-Cap Confidential 2.0, I keep a close eye on the show and the companies that participate there.

Will there be anything truly remarkable, or just modest updates to devices and artificial intelligence (AI) platforms that we’ve already become accustomed to?

We’ll just have to wait and see. The most likely areas of interest will be robotics, autonomous driving, smart home devices and wireless charging.

Of all the companies that will be there, I’ve picked five small-cap tech stocks that are worth watching, and could make stock-moving announcements this week.

[text_ad]

Here’s what they’re all about, and what they could reveal this week.

Stand-Out Camera Technologies

Small-Cap Tech Stock #1: Ooma (OOMA)

Ooma (OOMA) is a $228 million market cap company that was founded in 2003 to provide affordable communications solutions to small businesses and consumers. The company’s solutions include on-premises hardware, a Software-as-a-Service (SaaS) based Voice over Internet Protocol (VoIP) platform, and mobile apps. The basic setup includes a router-like device that acts as the hub, then satellite phones with bases that replace your landline phone system. If you want to step up from that, you can buy Ooma’s home security products (debuted at CES 2017), which include water sensors, door and window sensors, and motion sensors. I have the basic system, along with one water sensor, and can say with absolute conviction that it works well and is reasonably priced (roughly $10 a month for a premium subscription). It also integrates with Nest, Echo and other smart products.

It operates in a crowded market, but Ooma has been growing at a decent clip, with revenue up 23% in 2016 and 18% in 2017. Consensus revenue growth estimates for fiscal 2018 currently sit at 9%, and analysts expect an EPS loss of $-0.10. Things that are going well include Ooma’s consumer business, which seems stable, and its small business segment, which is growing faster due to a partnership with WeWork. What’s not going well are its non-core businesses, though to be fair it divested one in 2017 and the other is likely on the chopping block.

The most interesting thing right now is that a few weeks ago, Ooma bought Butterfleye, a smart video security platform for consumers and businesses. The camera has some cool features, including being wire-free and having internal storage. In my mind, it is a necessary addition to Ooma’s do-it-yourself home security solution, which is now much more robust. Expect the company to make a PR push at this week’s CES, and, most likely, tout the growing ecosystem of smart products that work with its platform.

Small-Cap Tech Stock #2: MySize (MYSZ)

We’ve all been there. You know your size, you are online, ordering a basic piece of clothing—boots, sweatshirt, jacket, whatever—and when it arrives it doesn’t even come close. This is part of why consumers only buy around 20% of their apparel online. There is a huge opportunity for retailers and consumer brands to attract consumer dollars for apparel—if they can get the sizing right.

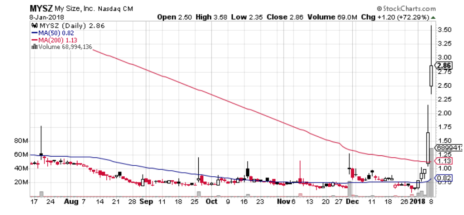

MySize (MYSZ) is hoping to help. The company is tiny, with a market cap of roughly $50 million. And that’s after rising by almost 300% over the past week! It makes smartphone apps for measuring things. SizeUp is a tape measure app. But the reason the stock is moving is the new MySizeID app. This is a white label app that allows consumers to create a secure profile of their online measurements, then use the profile to help with ordering from partnered retailers. It sounds like the Israel-based company is building up some Intellectual Property, and it just raised $2.5 million through an equity and warrant offering led by Roth Capital Partners. That’s good because it only had $260,000 in cash and securities at the end of September, the later of which includes a position in Diamante Minerals (DIMN), which currently has a share price of $0.04.

This is clearly a super-speculative stock, and I wouldn’t buy it, especially after the recent move. But I think the concept of a smartphone app that helps overcome the sizing issue has merit. Keep it on your watch list for a little while and enjoy the show! MySize says it will be showing a movie of its app at CES.

Small-Cap Tech Stock #3: GoPro (GPRO)

GoPro is one of those stocks that people must love to read about. Just look at the number of articles that pop up whenever something happens! Unfortunately for shareholders, reading about GoPro isn’t fun anymore—pretty much anything that can go wrong has. This week’s news that the Karma drone business will be closed and that price cuts were required to help move inventory are just the latest announcements to dent the stock. The company’s market cap is now less than $1 billion.

But it’s not my intention to pour salt on the wounds of GoPro shareholders. Rather, to touch on what could be coming down the pike this week. At CES 2018, GoPro should show its video editing and sharing software updates, including for spherical content, the capabilities of its GP1 video chip, as well as hints (or maybe the real thing) at the next entry-level camera to replace the Session, at around the $150 price point. It’s an interesting story from a technology and consumer perspective. From a potential investor’s perspective, not so much.

Interested in Self-Driving Cars and Robotics?

Small-Cap Tech Stock #4: Ambarella (AMBA)

Ambarella (AMBA) is a $2 billion market cap semiconductor stock that specializes in system-on-a-chip (SoC) systems for security and surveillance cameras, wearable sports cameras, camcorders and broadcast encoders and IP video traffic cameras. It’s been lumped into the same category as GoPro since it was a significant supplier, but that relationship has been winding down, and with GoPro closing its drone business, Ambarella is now one more step removed from the GoPro conversation.

The exciting thing about Ambarella is its embryonic computer vision chip, which should be leading to significant deals with automotive customers this year. Computer vision chips are significant because they are the building blocks that enable driver assistance and autonomous driving, not to mention consumer and industrial IoT applications where cameras will be used to automate tasks. These CV chips have been sent out to potential customers and have met performance goals. They will also be demonstarted at this week’s CES, and could be part of a more significant autonomous driving demo at Ambarella’s March analyst day.

Ambaralla is a story about the next big thing (autonomous driving), not yesterday’s cool gadget (GoPro). And it appears to have a powerful horse in the race. Analysts aren’t forecasting any revenue growth this year (management has guided for roughly 10% revenue growth in 2018, excluding GoPro), and currently predict EPS will decline 20% to 30% in 2018 and 2019. But that outlook could easily change for the better over the next three months, and drive a potentially massive move in the stock.

Small-Cap Tech Stock #5: iRobot (IRBT)

iRobot (IRBT) makes robotic vacuum cleaners (RVC), which have been steadily growing market share to over 20%, even while the broader vacuum market expands. The company also makes robots for cleaning pools and mopping floors, and is rumored to be working on a robotic lawn mower. The $2.3 billion market cap company has been a steady grower, with sales growth averaging 11% a year from 2013 through 2016. Then in early 2016, management announced it would sell off its military division (roughly 9% of sales in 2015) to focus exclusively on consumers. Shares traded up over $100 in early summer as expectations for 30% revenue growth powered investor enthusiasm, but then they began falling on concerns of competition and price discounting.

Shares appeared to have stabilized in the 60s, and news of a patent dispute settlement with Black and Decker (SWK), which will see that company discontinuing sales of all home robotic vacuums for an undisclosed amount of time, have helped them begin to recover. The company has also purchased its largest European distributor, and with sales in Europe up 31% in Q3, this acquisition could provide a material boost to overseas expansion. Analysts are coming around on the stock again; look for new product news from the CES to help bullish sentiment improve.

For further updates on these stocks or to find out about small-cap stocks featured in Cabot Small-Cap Confidential 2.0 portfolio, click here.

[author_ad]