In Pursuit of the Next Big Small Cap Winner

It’s somewhat of a tradition to feature holiday-themed investment ideas when the big days roll around each year. And given that most Americans will be stuffing their faces with food and drink tomorrow, I thought it would be entertaining to feature a few food and alcohol-related small cap stocks today.

My market research has been exhaustive. I’ve been shopping at all the local grocery stores. I’ve tried all sorts of new foods (mainly baked goods). And I’ve even upped my weekly beer intake, all in the pursuit of that next big small cap winner.

What I’ve found is that the old standbys still make good products. But they’ve now grown so much that they’re no longer small caps! All the Sam Adams (SAM) beer I drank was for naught now that the market cap is over $2 billion. Same goes for the Heady Topper IPAs and Sip of Sunshine IPAs that I drank out of Ball Corporation’s (BLL) cans—that company now has a market cap over $13 billion.

I’m a fan of WhiteWave Foods’ (WWAV) coconut ice cream (sold under the So Delicious brand), but I sold the stock when its market cap topped $10 million upon the buyout offer from Danone. And the best spice and condiment stock in the world, McCormick (MKC), now has a market cap over $11.5 billion!

[text_ad]

The fact that all these quality food and beverage companies have grown too big for me to feature them in an article focused on small cap stocks should teach investors one valuable lesson. And that is that they all started out as smaller companies, but grew relatively quickly. Flavor-of-the-month stocks don’t tend to generate very good returns over the long haul. But investors that bought these four stocks early and held on have made boatloads of money.

Over the last 15 years, Sam Adams is up by 1,155%, Ball is up by 910%, McCormick is up by 472% and WhiteWave (which only went public in 2012) is up over 220%.

Here are three new ideas for small cap stocks that I think could become the next big winners.

Supplements and Whiskey?

The first opportunity is Nutraceutical International (NUTR). The company has a market cap of $288 million, so it’s still a legit small cap. And that small size means that it can grow more rapidly by acquiring small brands to add to its stable.

This is a familiar strategy in food and beer stocks, and it’s exactly what worked for WhiteWave for so many years. Nutraceutical isn’t as focused on dairy and dairy alternatives as WhiteWave. In fact, it’s more focused on vitamins, minerals, herbs and other dietary supplements. Its owns the Solaray, Natural Balance, Nature’s Life, Lifetime and a few other brands.

I have two natural food stores near my home that make great baked goods, which is how I’ve come to see Nutraceutical’s products. The company also operates its own health food stores, operating under The Real Food Company, Thom’s Natural Foods, Cornucopia, Community Market and Granola’s trade names.

I must confess that I’m not a big supplements guy. But with over 7,500 SKUs (including 750 sold internationally), consistent single-digit revenue and EPS growth, a stock buyback program and an acquisition-led growth strategy, Nutraceutical appears to be doing a lot of the right things. Plus, the stock is up 30% since the beginning of August.

A Small Cap Beverage Stock

To wash all those supplements down, you’ll need a good drink. And for that you could turn to MGP Ingredients (MGPI), a small-cap company that I featured in May of this year.

At that time, I wrote, “MGP Ingredients is quite possibly the least known food and beverage company in the country. The company makes food ingredients (specialty wheat proteins and starches) and distilled spirits (bourbon, whiskey, vodka and gin). With the spirits business making up nearly 90% of revenue, it’s really in the business of making alcohol. And that business is about as steady as they come. The company is far from being a growth stock (revenue growth in 2015 was 4.5%), but it has been a long-time dividend payer and has been increasingly profitable since re-focusing its business in 2013. Last year it delivered EPS of 1.48. Even though its market cap is a mere $450 million, MGP Ingredients is the largest supplier of rye whiskey and distilled gin in the U.S. And with consumer demand picking up for premium and craft spirits, the company is introducing its own branded products to try and capture a slice of this high margin business. It’s newest offering, the limited edition Metze’s Select Indiana Straight Bourbon Whiskey, launched in the third quarter of 2015 at $75.00 a bottle.”

When I wrote that, MGP Ingredients was trading for around 26. It has since risen by 86% and now has a market cap of $800 million. The company has had to overcome an October chemical spill at a plant in Kansas that apparently spread a chemical plume over the area (a worker poured the wrong thing into a mixing tank). That cloud dissipated in under three hours (no serious injuries) and the stock quickly recovered. Total revenue in Q3 was essentially flat as the company continues to shift its focus to beverage alcohols vodka, gin and whiskey (which grew by 16.1%), and away from industrial alcohol (which shrank by 21.8%). With a greater mix of this higher margin business, MGP grew EPS by 44.7% to $0.55.

My Favorite Food-Related Small Cap Stock

My favorite food-related small cap stock right now doesn’t manufacture any food or beverages. Instead, it helps farmers grow organic and GMO-free produce.

Organic produce costs more to grow, and consumers pay more for it. But it’s cleaner, and helps health-conscious parents feed their families with far less stress about what chemicals they are consuming. The organic food market is growing north of 10% annually in the U.S., versus 3% for conventional food. Organic growers face many restrictions on the types of pesticides and herbicides they can use to fend off bugs, bacteria and other pests. And I’ve been researching solutions. That led me to uncover an agricultural chemical company that’s helping farmers.

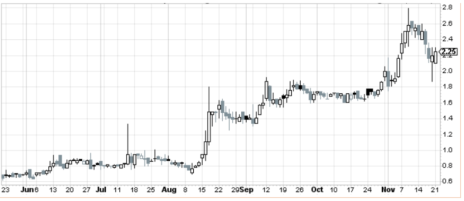

The company makes bio-based pesticides that are more friendly to people, plants and the environment than its competitors’ synthetic chemical products. Biopesticides are created from living organisms, including the very pests that destroy plants. By isolating specific microorganisms from bacteria, plants and fungi, and creating naturally occurring compounds to treat plants, roots and soil, scientists have essentially figured out how to fight pests by pitting nature against them. Biopesticides are emerging as a key part of the solution to the growers’ dilemma, because their effectiveness isn’t limited to one type of farm. They have been shown to work on organic farms, farms using conventional chemicals, and farms using GMO seeds. The science behind the company’s products is fascinating. And the stock is doing well too, largely because revenue growth over the last four quarters has been 73%, 29%, 50% and 44%, respectively.

The stock has a price under 3 and it’s a micro-cap, so it’s only appropriate for risk-tolerant investors. That’s why I left no stone unturned when I put together the research report that I sent to Cabot Small-Cap Confidential subscribers recently. I’m nearly certain you won’t find anybody else covering this stock. But over the next 12 months, I expect that to change as this company continues to execute its recovery plan. If you want to get in early on this and other small cap stocks, I urge you to subscribe to Cabot Small-Cap Confidential today.