As Chief Analyst of Cabot Early Opportunities and Cabot Small-Cap Confidential I love small-cap stocks, and I particularly love trying to find the best small-cap stocks. But I strongly dislike the small-cap index. Investors should completely avoid it and only invest in individual small-cap stocks. That’s where the real money lies.

Why do I feel so strongly?

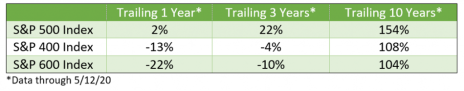

It starts with performance. Or to be more precise, lack of performance.

The basic pitch for small-cap stocks has been that they tend to do better than large caps over time. But the accuracy of that pitch has completely evaporated.

[text_ad]

As the table below shows, over the last one-, three-, and 10-year periods the small-cap index has lagged both the large-cap and the mid-cap index by a substantial margin.

If we dissect what happened during the recent COVID-19-inspired market crash the data tells a similar story.

Small caps fell 45% from their 52-week high, have only recovered 31% thus far, and remain 28% below their previous high. In comparison, large caps fell 35%, have recovered 36% and are only 14% off their previous high.

To make matters even worse for small caps, the asset class’s all-time high was back in August 2018! It never got back to within 5% of that level. In comparison, large caps hit an all-time high in February 2020 that was 15% above their 2018 high.

Small-Cap Index Suffers From Too Much Diversification

Investors are told time and time again to diversify, diversify, diversify. But the truth is the benefits of diversification are substantially reached when an investor owns around 30 stocks.

That’s not to say investors shouldn’t own more than 30 stocks. But if they do, they should do so knowing that the incremental diversification benefit of each additional stock goes down after that 30-stock threshold is crossed.

And there’s no need whatsoever to own over 30 stocks in the same asset class.

That’s especially true if you are blindly buying poor-quality stocks, which is what arguably happens when you buy a small-cap index. How else can you explain the dramatic underperformance over time?

There are several reasons I consistently argue that there are too many poor-quality stocks, and not enough high-quality stocks, in the small-cap index.

First is the diversification issue, not just in terms of the number of stocks but also in terms of the industry exposure.

The world, and the stock market, is changing. The emergence of new technologies, like cloud computing, is driving massive change. One of those changes is that the strong are getting stronger as these businesses scale up and retain customers more rapidly and more consistently than the businesses of yesteryear.

The best example to illustrate this dynamic is captured by the biggest tech holdings in the S&P 500. In that index, Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Facebook (FB) and Alphabet (GOOG) have a combined weighting of over 20%.

That’s huge. There’s no similar exposure in the S&P 600 small-cap index, where the two largest cloud stock holdings are Qualys (QLYS) and Stamps.Com (STMP), which have a combined weight of 1.3%. Altogether, the technology weighting in the small-cap index is only 15%. It just can’t compete.

Second, there’s the upward migration issue. Migration happens when small-cap companies get too big for the index and migrate up to the S&P 400 mid-cap index.

Growth investors know that good stocks go up! If all the best small-cap companies are getting bigger and getting booted out of the index, what’s the incentive to own the index?

It would be one thing if the IPO market refreshed the index at the low end with a constant stream of awesome new companies. But from what I’ve seen IPOs are getting bigger, not smaller.

The S&P 500 doesn’t suffer from this upward migration issue. A great growth stock can keep going up to infinity and that performance won’t lead to its eventual removal from that index.

Think about that for a second because it’s worth repeating. All the best small-cap stocks will eventually leave the small-cap index, but all the best large-cap stocks can stay in the S&P 500 forever.

Forever.

Where to Find the Best Small-Cap Stocks

As one who spends the bulk of his time looking for the next great small-cap stock I find the dynamics of the small-cap index supremely frustrating.

That’s because there are tons of great small-cap stocks that investors should own. The caveat is that they should purchase these stocks directly, not through an index. That’s the only way to get enough exposure to make a positive difference in your portfolio.

In Cabot Early Opportunities and Cabot Small-Cap Confidential my focus is 100% trained on finding small and early-stage growth stocks that will go up over the long term, helping investors buy them at a good entry point, and then keeping them invested for the long term.

My subscribers never have to sell out of these stocks, no matter how high they go.

One of our long-term holdings is bioprocessing specialist Repligen (RGEN). This company has a market cap of $6.7 billion. It’s not really a small-cap stock anymore, yet we continue to own it because the growth prospects are good. Investors that owned Repligen years ago have seen the weighting of this investment grow in their portfolio as the stock has gone up because they bought shares directly.

Here’s the three-year chart.

Bottom line – the average investor who doesn’t look any deeper than small-cap index performance is missing out on all the great small-cap growth stocks of today, which will likely become the mid-cap stocks of tomorrow.

And they don’t need to.

If you want help finding and sticking with the best small-cap stocks in the world, I encourage you to join me as a subscriber to Cabot Early Opportunities and Cabot Small Cap Confidential.

[author_ad]