For a glimpse at which asset classes or themes may be rotating into leadership, it’s worth checking out ETF inflows.

It’s also important to understand who is buying ETFs these days.

Many investors don’t fully comprehend that purchases by individuals don’t move the needle on stocks or other securities. If an individual is wealthy enough to acquire 5% of the stock in a company, that ownership stake is reported to the Securities Exchange Commission.

Other than those somewhat rare occurrences – think Elon Musk and Twitter (TWTR) – the largest shareholders in individual stocks have long been institutions.

According to data compiled by Citigroup in 2021, the ETF ownership landscape is also changing.

[text_ad]

Citigroup found that financial advisors now comprise the largest ownership block when it comes to U.S.-listed ETFs. Advisors account for 40% of ETF ownership, according to funds’ assets-under-management value.

That’s up about 5% from 2016.

The growth makes intuitive sense, as financial advisors have long used mutual funds in client accounts. But more advisors are now turning to ETFs instead, as these vehicles generally have lower expense ratios and more favorable tax treatments, as well as the ease of intraday trading.

So, given that professional investors are increasingly responsible for ETF purchases, what are they buying these days?

Here are some of the top ETF inflows, or additions of new shares in existing funds:

Top 5 ETFs by Inflows

Health Care Select Sector SPDR ETF (XLV)

This is a very basic ETF sector fund. The health care sector hasn’t done much year to date, showing an 8.8% decline, but it’s performed better than the S&P. This is always a fairly reliable sector for investors, as it’s home to companies with consistent demand, and it’s ripe for technological innovation.

iShares iBoxx $ Invmt Grade Corporate Bond ETF (LQD)

With fixed income as a whole being well off prior highs and lagging equities, this appears to be a case of advisors trying to bottom fish and snag shares at a discount.

In theory, there’s nothing wrong with that, and ultimately these low-priced purchases will rally, but how long must investors wait to see a return?

Most advisors long ago shifted away from stock-picking as their primary value-add, and toward financial planning and asset allocation. The mantra of “stay the course” makes sense, particularly if you have a long time horizon. However, I’m not especially a fan of adding lagging assets to one’s portfolio as they are continuing to fall.

It’s tempting to try catching the lowest price as a security falls, but in actuality, that’s impossible, unless you’re just very lucky.

The technicals on this ETF are also terrible, with short-term moving averages below the longer-term price lines. In short: It’s best to avoid making a buy on this for the moment, unless you have a time horizon of 10 years or more and have the ability to sit through a long period of underperformance.

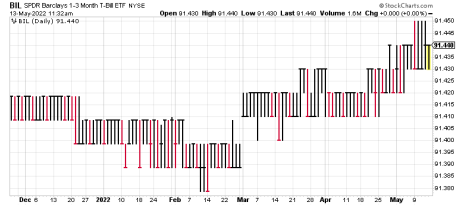

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL)

This ETF tracks U.S. Treasuries with a remaining maturity between 1 and 3 years. In other words, pretty much the least risky asset class you could imagine.

That means it’s basically a place to park cash. It’s closer to a money market fund than another fixed income ETF, such as LQD. Year to date, this ETF has returned a whopping 0.01%.

Yes, that’s better than the SPDR S&P 500 ETF Trust EFT (SPY) and LQD, both of which are down -15.5% year to date. But make no mistake: Advisors only like this fund as a cash alternative, not as a growth engine.

VanEck Semiconductor ETF (SMH)

As the name suggests, this ETF tracks an index of chip-industry stocks. This appears to be a bet that the industry will rebound soon, and advisors are hoping to grab shares at currently low valuations.

My take on this? It’s nothing to get excited about at the moment. The price continues to decline, and it’s another example of short-term moving averages falling below longer-term lines, with no imminent signs of that trend reversing.

Eventually, the chip industry will pull out of its current doldrums, so you’ll have plenty of opportunity in the coming months and years to invest. For now, at least wait until an uptrend resumes.

iShares Core High Dividend ETF (HDV)

This ETF offers exposure to established, high-quality U.S. companies that pay dividends. It’s a way to generate income, even while equity prices are falling.

It’s not a bad core holding, and I agree with the premise of stemming losses through dividend payments. For U.S. investors, holding large-cap domestic stocks makes a lot of sense, as this asset class has been reliable, and you want to capture the returns of the world’s biggest companies.

Looking at ETF inflows (and outflows) is a useful tool in identifying where money is flowing in rotational environments. It’s not an automatic buy or sell signal (as we can see with LQD and SMH), but it’s definitely a metric worth paying attention to.

To learn which ETFs we’re recommending consider signing up for Cabot ETF Strategist today!

Do you consider money flows before making buy or sell decisions on your ETFs?

[author_ad]