Sector rotation is in full swing, and right now several sectors are benefiting. These three ETFs are the most efficient ways to play them.

In recent months, retail traders have been heavily focused on a short-squeezing strategy. The hope here is to make a quick gain by forcing short-covering rallies in “oversold” stocks (with GameStop (GME) being a high-profile example).

But with the short-covering craze likely nearing a crescendo, investors would do well to consider a more durable strategy. And one of the most durable, all-weather investment strategies is one that is based on sector rotation.

Indeed, sector rotation is one of Wall Street’s most venerated stock selection systems. While its popularity has waned somewhat since its heyday in the 1990s and early 2000s, it’s still a worthy all-season approach for both aggressive and conservative participants—regardless of one’s experience or skill level.

Just how useful is sector investing? In a widely publicized study on sector rotation over a 10-year timeframe, mutual fund tracking firm CDA/Wiesenberger set out to answer that question. The firm started with just $1,000 and invested in a portfolio at the start of each year comprised of one of the following six sectors: energy, technology, financial services, healthcare, utilities and basic materials. By the end of the 10 years, the initial $1,000 had turned into $63,000—an eye-popping gain in percentage terms!

[text_ad]

Sam Stovall wrote what is probably the seminal work on sector investing, the aptly named Standard and Poor Guide to Sector Investing. In it he explains the basis of the stock and mutual fund sector rotation (the book was written in 1995, before exchange-traded funds were widely accessible, though it still applies to ETFs).

Standard & Poor’s classifies the U.S. broad equity market into 11 sectors, with each one of them divided further into various industry groups. The sectors include: Info Tech, Health Care, Financials, Consumer Discretionary, Communication Services, Industrials, Consumer Staples, Energy, Utilities, Real Estate and Materials. Fortunately, there are numerous ETFs and mutual funds dedicated to each of these 11 sectors, making it easy for even small-time investors to employ a sector rotation strategy.

As Christopher Narcouzi observed in a 2002 research paper:

“The goal of sector investing as explained by Stovall is to buy the strongest stocks in the strongest sectors. This approach is also called top down analysis. You begin by selecting sectors that are in an uptrend and whose relative [performance] lines are going up.”

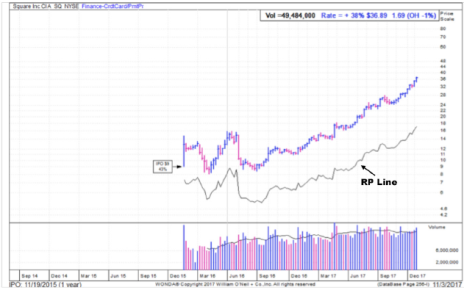

Stovall emphasized that sector rotation investing is based mainly on the concept of relative strength, also known as relative performance. And the best way to measure a stock’s (or ETF’s) strength is to use a relative performance (RP) line, which is basically the ratio between the price trend of a stock compared with the price trend of the market (e.g. the S&P 500 Index).

In a recent special report, Cabot Top Ten Trader chief analyst Mike Cintolo described the RP line as follows:

“The RP line compares the stock’s price to a major market index (we usually use the S&P 500). If the RP line is trending higher, the stock is outperforming the overall market. If the RP line is falling, the stock is underperforming the market. And a sideways RP line means the stock is basically performing with the market.”

He added, “The steeper the line, the more the stock has been outperforming the market…[and] a stock whose RP line remains strong when there’s turmoil in the general market indicates super-strong buying pressures.”

ETF for Sector Rotation: Financial Select Sector SPDR Fund (XLF)

With these basic principles in mind, let’s examine some sectors and sub-industries that are showing exceptional relative strength in what has been a decidedly choppy market environment of late. Doing so will allow us to discern which areas of the market we should be focusing on from a sector investing perspective.

Bank stocks have shown visible strength recently, thanks largely to the steepening yield curve. In fact, the banks have been arguably the top leader for the broad market in terms of relative performance so far this year. This is reflected in the RP line for the Financial Select Sector SPDR Fund (XLF), an ETF which tracks the S&P financial sector.

After being out of fashion on Wall Street the last couple of years, financial stocks are among the favorites for big institutional investors and market-moving traders. In my opinion, the above chart provides a good example of the types of stocks investors should be looking at when using a sector rotation approach.

ETF for Sector Rotation: Invesco Dynamic Food & Beverage ETF (PBJ)

Surprisingly, there’s also some above-average strength in several leading food and beverage stocks, which are in the consumer staples sector. I say “surprisingly” since the consumer staples have generally lagged the S&P in the past few months. But food stocks—along with other segments of the consumer staples—are climbing back into favor.

Below is the RP line for my favorite food-related ETF, the Invesco Dynamic Food & Beverage ETF (PBJ), which illustrates the extent of the recent strong performance of this key consumer staples industry.

ETF for Sector Rotation: iShares U.S. Home Construction ETF (ITB)

Another relative performance leader among the major sectors right now is real estate. In fact, several key aspects of this group are showing increasing relative strength and forward price momentum, including REITs, construction and home improvement stocks. One of my favorites is the iShares U.S. Home Construction ETF (ITB). Below is the RP line for this ETF.

Despite the threat of higher interest rates, the real estate group just keeps rising as a shrinking supply of homes meets a massive demand for housing in the wake of record money supply creation—the ideal confluence of factors for a bullish real estate sector.

In closing, by focusing on the strongest-performing stocks and ETFs during a period of broad market turbulence, you can achieve superior gains over the long haul. With this in mind, investors should continue to track the best and strongest areas of the market in the coming weeks and months as measured by relative performance (RP) lines. Doing so will allow you to avoid the market’s soft spots while resting on decidedly firmer ground.

If you want the best-performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week Chief Analyst Mike Cintolo provides you with some of the market’s strongest growth stocks from both a technical and a fundamental perspective, including the use of relative performance analysis.

To learn more, click here.

[author_ad]