The last few months have been bumpy for global stock markets. But all the volatility has been good for one often-overlooked subsector: the exchanges on which all those stocks are being bought and sold. And four exchange stocks have outperformed the market by a substantial margin.

Just look at the year-to-date returns of these publicly traded exchanges:

Intercontinental Exchange (ICE): +25.8%

Nasdaq (NDAQ): +27.4%

S&P Global (SPGI): +51.9%

MarketAxess Holdings (MKTX): +67.3%

Granted, despite all the volatility of the last few months, stocks as a whole are still having a pretty darn good year, with the S&P 500 up more than 19% through the first eight and a half months of 2019. But these exchange stocks have all beaten those returns.

[text_ad]

Why?

According to The Wall Street Journal, most analysts attribute the strong showing from exchange operators to the wild swings in not just the stock market, but also in bond prices; currencies such as China’s devalued yuan, which rose to 7.0 against the dollar for the first time in more than a decade; and crude oil prices, which spiked 14.7% in one day this week after Saudi Arabian oil assets were bombed.

Intercontinental Exchange, for example, which owns the New York Stock Exchange among other exchanges, also operates an exchange for Brent Crude oil, which accounts for two-thirds of all global oil pricing. The pickup in crude oil trading volume has helped ICE’s share price, which is up 11% in the last three months, while the S&P 500 is up a mere 2.7% during that time.

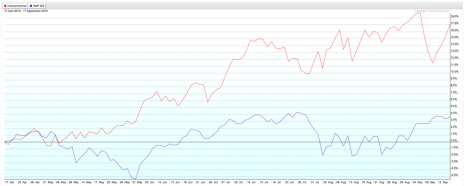

In fact, the disparity between the performance in all four of these exchange stocks and the broad market has been quite stark since the beginning of May, when stocks plummeted 6.8%. Take a look at this six-month chart juxtaposing the performance in ICE (red line) vs. the S&P 500 (blue line):

When stocks started to tumble in early May – meaning selling volume picked up – ICE began its ascent.

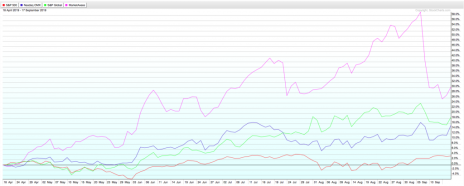

The other three exchange stocks have followed a similar pattern, with shares of MarketAxess Holdings (purple line), which owns and operates an international electronic trading platform, really taking off since May.

The moral of the story here is simple: If you’re looking for a hedge against market volatility, buying one of these exchange stocks is a good place to start. Of course, now that things seem to be calming down in the market – the VIX is down in the 14-15 range, and the S&P has settled into a tight trading range in the last couple weeks – you see that these stocks (namely MKTX) have fallen off a bit. So now may not be the time to buy them.

But if volatility returns, and the VIX spikes back above 19-20 like it did in May and August, exchange stocks are the way to go.

[author_ad]