With inflation beginning to rear its ugly head, investors should focus on hedging their investments. Here are three inflation hedging ETFs.

For decades, inflation was the bogeyman that was always believed to be just around the corner ... yet never quite revealed its face. But after a year of runaway fiscal stimulus and drastically expanded central bank balance sheets, the dreaded “I” word is closer to becoming a reality, and now might be the time to consider investing in inflation hedging ETFs.

Already we’ve seen early signs of inflation in the form of higher commodity prices and Treasury yields—both of which tend to reflect inflation expectations. Food and fuel costs have also been on the rise this year, along with other market prices. That said, it’s imperative to know which assets tend to outperform in an inflationary environment, for doing so can drastically improve your investment returns and protect you from inflation’s ravages.

[text_ad]

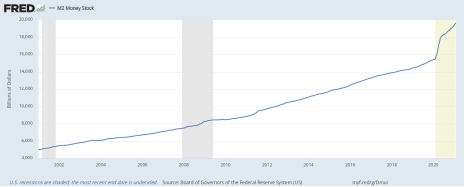

Fueling the trend toward inflation has been the U.S. Federal Reserve allowing the M2 money supply to increase at an historic rate since the pandemic started. Since last March, M2 has soared by nearly 30% to over $4.2 trillion. This amounts to annualized growth of around 15%, which far exceeds the 6.5% annualized rate of past decades.

Economist Scott Grannis points out that the U.S. public has been hoarding most of the M2 money increase in the form of bank savings and deposit accounts (likely due to pandemic-related worries). He estimates that M2 is currently over $2 trillion above its long-term growth trend, which amounts to an extra 12% increase in the amount of money the public would normally hold. Says Grannis:

“If the public decides to reduce its cash holdings relative to income, this ‘extra’ M2 could fuel a 12% increase in inflation over the next few years.”

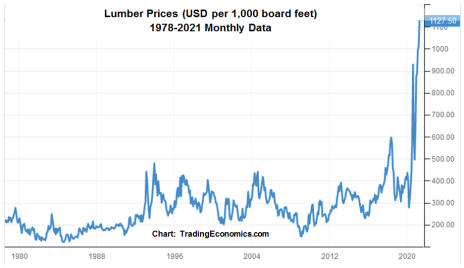

Inflation’s bite is also being felt in many areas, but perhaps none more significant right now than the housing market. The huge demand for housing, coupled with diminished inventories, has priced out many prospective homebuyers. But lumber prices, which soared 400% between March 2020 and March 2021, are another example of how inflation is impacting an important segment of the economy.

Commenting on this development, real estate expert Robert Campbell observed:

“The National Association of Home Builders (NAHB) said that soaring lumber prices had added $24,400 to the cost of a new home—which may help to explain this: After New Home Sales hit a 14-year high in August 2020, the number of new homes sold has fallen by 26.7% through February 2021.”

In view of this, let’s take a look at three ETFs that should appreciate as commodity prices increase.

Inflation Hedging ETF #1

The first (and arguably best) way to take advantage of higher commodity prices is to own shares of a commodity-focused ETF. The Invesco DB Commodity Index Tracking Fund (DBC) is one way of having exposure to commodities without having to own the physical assets involved. The fund is designed to track changes in a diversified commodity index (heavily weighted toward energy prices) and is designed for investors who want a cost-effective and convenient way to invest in commodity futures.

Inflation Hedging ETF #2

Another way to hedge against an increase in inflation is by owning silver. The white metal provides excellent diversification of an equity portfolio since it is weakly correlated to stocks, and is only moderately correlated to other commodities. One of the most actively traded silver-tracking ETFs is the iShares Silver Trust (SLV). It has been consolidating for several months, but if the inflation rate accelerates this year, I expect SLV to outperform other inflation-sensitive assets.

Inflation Hedging ETF #3

A worthwhile consideration for bond investors is the iShares TIPS Bond ETF (TIP). This fund holds Treasury inflation-protected securities (TIPS), which are indexed to inflation and is designed to outperform an aggregate bond index when inflation is increasing.

If you want the best performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where chief analyst Mike Cintolo provides you with some of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.