The markets have been so great the last couple of years that many insiders—the executives and board members of companies—have been busy cashing in some of their shares at the higher prices. But recent market volatility has prompted a spate of insider buying. According to CNBC, insiders bought $428,413,873 worth of their company’s shares in May, and the ratio of insider buying to selling was 262-to-29 during the month.

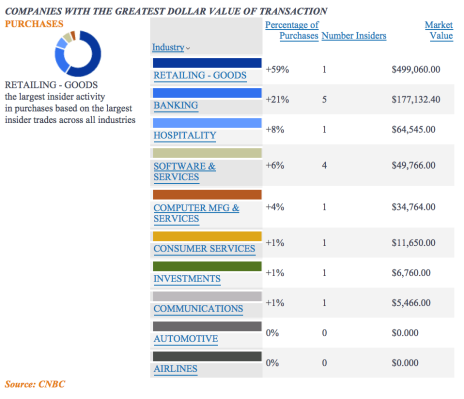

And the following sectors were the big winners:

Most of the insider buying has been on the open market, instead of as a result of exercising stock options. That’s usually a good sign—since the insiders are digging into their own pockets to buy at market—and is often seen as a signal that the company’s fortunes are improving.

[text_ad]

How to Know When Insider Buying Is Important

There are a variety of catalysts that prompt insider buying—actions that might spell opportunities for investors to also load up on shares of some of these companies. They include:

- A direct correlation between increased insider trading—the legal kind—and directional market shifts. Research has shown that when lots of folks who are “in the know” start stockpiling their company shares, there’s a good chance that they have reason to believe that the broad markets are gaining ground. They are in a position to see positive signals such as growing backlogs, declining inventories, supply shortages, etc. And vice-versa. When these people start fire-selling their shares, you may want to rethink your overall market strategies to prepare for a possible market drop.

- Conditions of employment. When they hire on, CEOs, CFOs, and other top insiders often are required to buy shares. What’s important to note is when they make big and unusual purchases, adding significant holdings of their company stock—especially when they are market transactions, and not option transactions.

- Buying by non-execs. What may also be valuable to you is watching what other company insiders—such as line supervisors or employees with direct product production responsibilities—are buying. These folks generally have the pulse of the company’s fortunes; they see demand and supply up close. So, if they start buying big chunks of stock, it may be important.

Not All Insider Buying Is a Big Deal

There have been plenty of cases when companies or individual executives have announced they are making big share purchases. Sometimes, those announcements are pure hype. So, make sure you check reliable sources to see if the purchases have actually been made. (More on that in a moment.)

Option exercising is always interesting. I marvel at just how generous some of these programs are. A lot of them are fabulous perks for the executives—giving them the ability to buy shares at rock-bottom prices, and then when the shares rise, these insiders can really clean up. But that kind of insider buying is generally business as usual, and doesn’t tell us much about a company’s prospects.

Some Extra Tips

Here are a few more ideas on following insider buys:

- ? Identify the purchaser. Certainly, the C-suite officers should be cognizant of what’s going on with their company. Not so much the directors. Consequently, I don’t pay a lot of attention to what the directors are buying and selling.

- ? Watch for good-sized buys from several insiders—not just one or two. The more, the better.

- ? Insider buying in smaller companies is usually more telling. Generally, insiders will own a pretty good portion of company stock at small- and mid-sized businesses. For instance, utility companies and conglomerates often have less than 5% insider ownership. So, any exec making purchases would have to buy a whole lot of stock for the market to notice it. However, if a small regional bank suddenly has several insiders buying big blocks of shares, that may be very meaningful. Perhaps a sale of the company is in the offing, or grand expansion plans are around the corner. But please know that because of strict SEC rules regarding insider trading, you most likely won’t see immediate action following large purchases. It may take a while for any upcoming event to occur that would make the stock price rise.

Sources for Investigating Insider Buying

The SEC requires several forms from insiders, including Forms 3, 4, 5, and 144. You can access the information from these filings at any number of websites, but my favorite is:

https://finance.yahoo.com – Just type in your stock symbol, look across the top menu, and you can click on Holders to find out which insiders are buying or selling, the size of the transactions, and how many shares each one currently holds.

You can also find graphical representations of insider trades at https://www.nasdaq.com. On the left side menu, you can click on Ownership Summary or Insiders.

Many of our contributors to Wall Street’s Best Investments advisory use insider buys as one of their screens in determining if a stock is buy-worthy. In most cases, it’s just one characteristic that can influence a recommendation—not the primary or sole reason for buying. In any good analysis, it’s important to look at the whole picture—not just one parameter. But if you see a lot of insiders rushing into the shares, it will most likely be worth your while to delve a little deeper to see if the company meets your investment strategies and goals.

Recently, I noticed that three companies that have been recommended in my Wall Street’s Best newsletters have hit the lists of insiders making significant purchases:

General Electric (GE) was recommended as one of the Top Picks of 2018, by Sean Christian, editor of The Personal Capitalist. In his initial recommendation, Sean had this to say:

“General Electric is a true contrarian play. We feel the new CEO John Flannery is in the process of cutting the company’s sprawling business portfolio to focus on the higher margin units. The company plans to sharply cut capital spending next year, which should improve short-term cash flow. GE has been around for 125 years. We don’t think it is going away.” And he recently added, “GE stock is hated on Wall Street but is a contrarian play. Any good news could push it to $20.”

Charles A. Carlson, editor of DRIP Investor, chose Intel (INTC), also a Top Pick. Charles noted, “Intel is the sort of ‘old’ tech company that is gaining favor on Wall Street because of its pivot toward higher-growth markets in the technology space. Intel is remaking itself. I look for the transformation to continue in 2018, which should be reflected in better growth rates and higher profits. The yield enhances the stock’s total return. The stock is a low-volatility way to play the high-volatility tech sector and should outperform the broad market in 2018.”

Macquarie Infrastructure Company (MIC) was recommended by Michael Corcoran in Gordon Pape’s Income Investor. Michael commented, “All of MIC’s businesses offer the potential for growth either organically or through acquisitions. MIC has a diversified portfolio of businesses that offer defensive attributes and steady cash flow generation. This will drive steady dividend growth and provide some protection from commodity volatility barring a sudden and sustained increase in oil prices.”

These companies may provide the starting point for your research into recommended companies with recent hefty insider purchases. But remember, one statistic alone does not make a winning stock. But seeing the folks in the know piling money into their own companies’ shares is a great beginning.

To receive additional picks from Wall Street’s Top Gurus, consider taking a trial subscription to Wall Street’s Best Investments.

[author_ad]

*This post has been updated from an original version.