Using Stock Screeners

Two Stocks that Will Not Decline

---

I love roller coasters that take me on dizzying rides around amusement parks. In Florida, we have plenty of opportunities in Tampa and Orlando to ride the Cheetah Hunt, Kumba, Tower of Terror, Space Mountain and countless other coasters. However, when it comes to roller-coaster rides in the stock market, count me out. The dizzying thrill-ride we’ve seen during the past month is not my cup of tea.

Stocks have been on a one-way ride since May 1. A quick check of my database of 1,000 stocks shows that the top 100 performing stocks since May 1 gained an average of 3.3%, whereas the bottom 100 performers lost a disheartening 22.0%. If you lost money during this period, you’re not alone!

My approach to investing is conservative: the tortoise wins the race. But the tortoise only wins the race over an extended period of time so patience is an absolute necessity. My strategy is to stay fully invested at all times in stocks and bonds, and only invest in stocks and bonds that, on average, decline a minimal amount during market corrections.

How can you achieve the best results for your portfolio? If you want to use a value approach and avoid timing your stock purchases and sales, here’s a simple stock screening process that will provide superior results by finding value stocks that increase almost every month and every year.

My best stock screener, which is easy to create, searches for companies with all of the following: Standard & Poor’s (S&P) Star Ratings of 4 or higher, S&P Fair Value Rankings of 4 or higher, S&P Earnings/Dividend Ratings of A- or higher, S&P Beta Ratings below 1.40 and dividend yields greater than 0%. In addition, I require companies to be included in one of these S&P Sectors: Consumer Discretionary, Consumer Staple, Health Care, Information Technology or Utility.

My brokerage firm has a handy website that provides the necessary screeners to effortlessly find stocks fitting the criteria above. Your broker likely has similar screening capabilities. Holding a good portion of your portfolio in companies that meet the criteria will greatly reduce your chances of suffering large losses during unforeseen market declines.

How has this system performed in sharply declining markets? Very well: from April 30, 2010 to July 2, 2010 when the S&P 500 Index dropped 13.8%, the nine stocks which fit the criteria for undervalued stocks with low volatility and high quality decreased only 11.8%. In the following year from July 8, 2011 to August 9, 2011, the S&P 500 Index fell 12.7% but again, nine new stocks which fit my criteria only slipped 10.4%. Finally in the most recent decline, from May 1, 2012 to May 18, 2012, the S&P 500 Index tumbled 7.9% but seven new stocks which fit my criteria slid just 5.7%.

The performance numbers during declining markets during the past two years doesn’t look overly impressive, but if you can beat the stock market during every decline and during most advances, your results will be more than satisfactory. You can easily avoid the loop-de-loops of the volatile stock market roller coaster by investing wisely.

I write the Cabot Benjamin Graham Value Letter and the secret to my success is finding high-quality undervalued stocks. I do this by screening ... just as Ben Graham prescribed. My screening methodology provides me with the ability to whittle my 1,000-stock database down to a few buy candidates.

If you pay attention to the numbers, and you hold patiently, profits will be your results!

Speaking of profits, consider Nike.

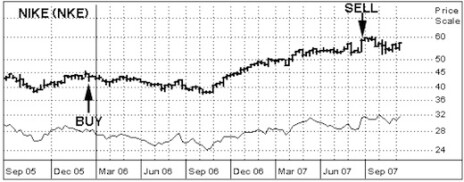

In the December 2005 issue of Cabot Benjamin Graham Value Letter, I stated: “You can expect NKE shares to increase to our Minimum Sell Price of 57.23 within two years.” (See Buy in first chart.)

Many of my subscribers followed my advice and locked in a nice 38% gain when I recommended selling Nike in June 2007 at 58.45 after just 18 months. (See Sell in first chart.)

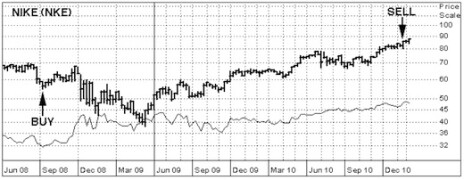

I then advised subscribers to buy Nike again in July 2008. After the stock took off once more, we took profits of 58% in November 2010! (See second chart for Buy and Sell.)

My system is simple: buy high-quality stocks when they are undervalued, and sell when the stocks becomes overvalued. Buy low and sell high--it doesn’t get any simpler!

---

Two companies which currently fit my screening criteria for undervalued stocks with low volatility and high quality are CVS Caremark (CVS) and Walt Disney (DIS).

CVS Caremark is the leading drug store chain in the U.S. and one of the largest pharmacy benefit managers. CVS drug stores offer prescription drugs (68% of retail store sales) and a wide assortment of over-the-counter drugs, beauty products, photo finishing services, seasonal merchandise, greeting cards and convenience foods. Pharmacy benefit management offerings include mail order pharmacy service, healthcare plan design and administration, and claims processing.

CVS’s in-house Minute Clinics, which are staffed by nurse practitioners and physician assistants, are a big hit. CVS has quickly become the largest retail clinic operator in the U.S. and plans to add another 100 in-store clinics per year during the next several years.

Favorable demographics will result in increased drug sales and a significant increase in pharmacy benefit management revenue. In addition, Walgreen’s falling out with a major pharmacy benefit manager (Express Scripts) is providing significant new business for CVS.

Total sales increased 20%, same-store sales climbed 6.8%, and EPS advanced 14% during the quarter ended March 31. The new contract with Aetna and additional market share from Walgreens helped boost sales. Management raised its full-year forecast based on momentum from the first quarter. I forecast solid 11% earnings growth during the next several years at CVS.

CVS shares are undervalued at only 13.6 times forward EPS with a dividend yield of 1.5%. The company ratings include: S&P Stars Rank of 5, S&P Fair Value Rank of 5, S&P Quality Rank of A+, and an S&P Beta Rating of 0.78. CVS operates equally in the Consumer Staple and Health Care sectors. Buy.

Disney is one of the world’s most-recognizable names. The leading entertainment company operates a multitude of giant theme parks and resorts around the world, as well as many other operations including television networks, movie studios and a cruise line.

Disney opened a new resort in Hawaii and launched two new cruise ships in 2011 and is building a new resort in Shanghai, China, which will open in 2015. Expansion is also in the works at Disney World in Orlando, Disneyland in California, and at Disney’s ESPN network.

Disney’s well-diversified holdings in the U.S. and overseas helped the company avoid a significant downturn during the recent recession. Revenues increased 7% and EPS rose 14% in 2011. I expect Disney to pick up the pace and produce sales and earnings increases of 9% and 22%, respectively, in 2012. Expansion and recent rate hikes at the company’s parks and resorts will spur growth. TV advertising rate increases will also help.

Sales climbed 6% and EPS jumped 29%, slightly below my forecast. Results were weighed down by the box office failure of John Carter. Strong sales from Disney’s theme parks and cable networks plus record-breaking revenues from The Avengers will bolster results during the next several quarters. Expansion and recent rate hikes at the company’s parks and resorts will also help.

Disney shares are a bargain at 13.9 times my 12-month forward EPS estimate of 3.18. Larger box office sales and additional price increases could cause my estimates to be conservative. The company ratings include: S&P Stars Rank of 5, S&P Fair Value Rank of 4, S&P Quality Rank of A+, and an S&P Beta Rating of 1.20. DIS operates equally in the Consumer Discretionary sector. Buy.

I will continue to follow CVS and Disney, as well as many other undervalued, high-quality companies in my Cabot Benjamin Graham Value Letter. My next issue, coming soon, will include a special feature on companies with low PEG ratios. I hope you won’t miss it!

Sincerely,

J. Royden Ward

Editor of Cabot Benjamin Graham Value Letter

Editor’s Note: You can find additional stocks selling at bargain prices in our new and improved Cabot Benjamin Graham Value Letter. Find out why our subscribers are showering us with compliments!

In every issue, you’ll find Roy’s legendary Maximum Buy and Minimum Sell Prices for over 250 well-known stocks. Click here now to get started!