Value is Indeed Back

Last week, I suggested that value stocks are poised to outperform growth stocks during the next several years. Since 2000, growth stocks have outperformed value stocks by a very wide margin. But now, growth stock valuations are stretched to the limit, while value stocks are too inexpensive to ignore. Value stocks are totally neglected and due for a comeback—and the best value stocks could net huge returns.

In my year-ago Wall Street’s Best Daily (formerly the Cabot Wealth Advisory) dated April 26, 2016, I listed 10 stocks that had steady book value growth during the past decade. To review last year’s analysis and list of 10 buy recommendations, click here. Those recommendations increased handsomely during this past year. Now I’ll repeat the strategy to give you new stocks that should perform very well in the next year.

Finding Consistent Book Value Growth

I find that a lot of investors are unfamiliar with the concepts of book value and book value per share, so, a quick definition is in order. Book value is shareholders’ equity (also called retained earnings). Book value per share is simply the shareholders’ equity or retained earnings divided by the number of common shares outstanding.

[text_ad]

Is book value per share important? By itself, no. But when book value is rising at a steady, rapid pace, the company’s stock price will also rise at a steady, rapid pace.

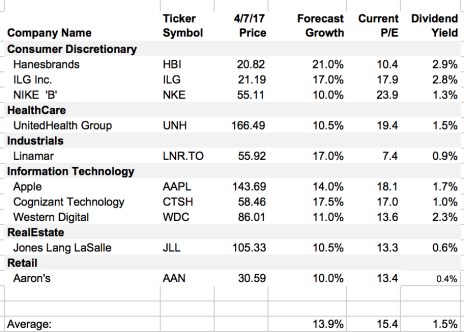

I have listed 10 high-quality companies that have steadily increased book values at least 10% per year during the past decade and are forecast to continue increasing book values at a 10% pace during the next five years or more. In addition, each of the companies is paying dividends, and each company’s stock price is undervalued. In my mind, these are 10 of the best value stocks you can buy in today’s market. See chart below.

You can easily find these undervalued stocks with steady book value growth, and learn more about these companies in my Cabot Benjamin Graham Value Investor. I sincerely hope you will subscribe right now.

The 10 Best Value Stocks

Until next time, be kind and friendly to everyone you meet.

[author_ad]