Bank stocks got good news in late June, when the Federal Reserve completed its annual Dodd-Frank Act Stress Test (DFAST), a review of 34 banks’ abilities to withstand a severe economic downturn. All of the banks passed the test. Then on June 28, the Federal Reserve announced results of its Comprehensive Capital and Analysis Review (CCAR), in which all but one of those banks received a green light to proceed with their capital plans. A capital plan consists of an intention to increase dividend payouts and share repurchases in the coming 12 months.

U.S. banks have over $100 billion more capital than regulators require them to hold. Therefore, this year’s CCAR results brought announcements of very large increases in bank dividends and stock buybacks. Most of the participating banks will typically announce their new capital plans immediately, although it’s the approval process that is the more important catalyst to potential share price increases, since the approval signals the pending capital returns.

[text_ad]

Many bank stocks are undervalued and offer attractive earnings growth. Bullish sentiment on the stocks is just beginning to gain momentum. Compounding that bullishness is a sector rotation out of overvalued technology stocks, which began in June. As professional investors sell tech stocks, they’re seeking more undervalued stocks with strong earnings growth potential. The banking industry is a primary target for new investors right now.

A Bank Stock with Growth and Value

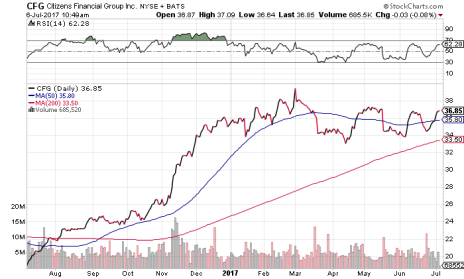

If I were to buy one more bank stock today, it would be Citizens Financial Group (CFG). The stock meets all of my growth and valuation criteria, and the price chart appears to have more upside than some of its peers (many of which have already jumped in price in recent days).

Citizens Financial is a retail bank holding company that was spun off from the Royal Bank of Scotland in September 2014. The company owns 1,200 Citizens Bank branches in 11 states spanning the Midwest, mid-Atlantic and New England, with headquarters in Providence, Rhode Island.

The company is focused on optimizing current and new client relationships, attracting new deposits and growing its loan business. All of the major balance sheet items are expected to grow consistently through December 2019, including revenue, net loans, total assets, return on equity (ROE) and profit. Adjusted net income is expected to grow from $1.06 billion to $1.42 billion from year-end 2016 through year-end 2019.

A consensus of Wall Street analysts expects earnings per share (EPS) to grow from $1.97 in 2016 (December fiscal year-end) to $2.44 and $2.77 in 2017 and 2018, reflecting very attractive earnings growth rates of 23.9% and 13.5%. The corresponding price/earnings ratios (P/Es) are 15.1 and 13.3.

On June 28, Citizens Financial announced its intention to repurchase up to $850 million of stock in the next 12 months and to increase the quarterly dividend payout from $0.14 to $0.18 in the third quarter of 2017, with another increase to $0.22 in early 2018.

The current dividend yield is 1.5%. The proposed dividend increases will bring the yield up to about 2.4% for investors who buy shares at the current price.

CFG is a mid-cap stock valued at $18.7 billion. Financial institutions, such as mutual funds and pension funds, own over 90% of Citizens Financial’s common stock. That means professional investors deem CFG to be an attractive investment.

The stock had a huge run-up in late 2016, rising to new highs at 39.5 in early March 2017, and has since traded sideways between 33 and 38.

The market is embracing financial stocks in light of rising interest rates that enhance banks’ profitability, the outsized returns of capital from this year’s stress test results, and investors are following the flow of tech stock money into bank stocks. CFG is a great choice for investors seeking capital gains, value and dividends.

[author_ad]