Do you still own Wells Fargo stock? If so, you should sell it now. Let me explain…

I gave a speech to a college investment club in October, discussing my growth & value stock investing strategy. Afterward, I gave them my personal advice for life:

- Show up on time. People who are too chronically disorganized to be on time for work and appointments are generally disorganized in other areas of their lives, too. Plus, being late conveys disrespect.

- Don’t become addicted to anything (alcohol, shopping, computer games, etc.), because addictions end up controlling your life. Exercise self-control.

- Don’t spend more money than you make. Accumulate savings.

Ironically, I used the Wells Fargo (WFC) scandal as a good example for rule no. 3.

[text_ad use_post='129629']

Lost in the hullabaloo of the opening of over a million checking accounts and 565,443 credit card accounts without customers’ knowledge was the fact that thousands of bank employees participated in the wrongdoing.

We know that 5,300 employees were fired as a result of this scandal. I’m sure there were quite a few among them who were unfairly terminated, and many, many more who committed what amounted to identity theft in order to please their managers and keep their jobs.

So as I spoke to the students, my questions become, “Why were those job worth keeping?” and “Why didn’t Wells Fargo employees quit their jobs when they were asked to lie, cheat and steal?”

Granted, some of those employees may have been dishonest people who would have been game for cheating within the context of any job they might have held. But I believe the vast majority of these Wells Fargo “cheaters” simply did it because they didn’t have a cash cushion in the bank, so they didn’t have the financial flexibility to walk away from a bad situation and seek a better opportunity.

That’s what I discussed with the college students. “Spending less than you make” isn’t actually difficult to do, especially when you’re just starting out in life. I suggested that building up emergency savings in the bank can not only support a person through job transitions, but also help with all kinds of other things that randomly happen to people: medical expenses, car repairs, etc. That’s why they call it “emergency savings”.

Wells Fargo employees weren’t the only people who got stung in the fake-account scandal. Wells Fargo shareholders were also left in the lurch.

One of the mantras in my stock investing strategy is “do not hold shares of a scandal-ridden company.” No matter how bad the news, and no matter how much the stock might fall upon the news announcement, scandals have a way of leading to more bad news, and ongoing share price problems.

I said it with Valeant Pharmaceuticals (VRX) and I’m saying it today with Wells Fargo stock: sell WFC and invest in an undervalued growth stock, so that your capital has a better near-term chance for appreciation.

Need more ammo to support your sell decision? Here it is.

Wall Street consensus estimates show Wells Fargo’s earnings per share (EPS) falling 2.9% in 2016, then rising 1.7% in 2017 (December year-end). Both of those EPS projections have been consistently declining all year. I expect the company’s revenue and earnings to continue to miss corporate targets, because Wells Fargo’s reputation has been heavily tarnished. Customers are still leaving Wells Fargo, so we’re a long way off from the day when the bank’s deposits and loan portfolios begin growing again.

Wells Fargo is expected to earn $4.10 per share in 2017, the same amount the company earned in 2014, with very little variance from year to year. So even if there were no scandal in place, owning stocks with stagnant annual EPS is not the goal. The goal is to see earnings rise as an impetus for share price appreciation.

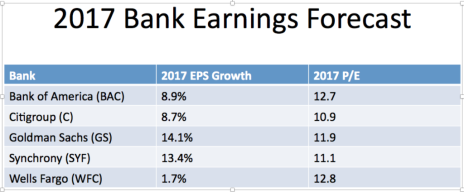

I did a little research to find other big banks that are projected to have better earnings growth and lower P/Es than Wells Fargo in 2017. It was not a difficult endeavor. I only looked at four banks, yet all four are expected to have better earnings growth than Wells Fargo, and all four have lower P/Es. Both of those factors should, in theory, contribute to better capital gain potential than investors can foresee by sticking with WFC.

Goldman Sachs (GS), for example, has been in the Cabot Undervalued Stocks Advisor Growth & Income Portfolio since June. Since I recommended it, shares have risen 35%.

I’m not saying you should buy these four stocks today; I’m just saying that it’s fairly easy to find better stocks than WFC.

Wells Fargo stock peaked at a closing high of 57.94 in July 2015. The stock proceeded to ratchet downward for 14 months, establishing price support at 44 in September and October 2016.

WFC participated in this month’s post-election surge among financial stocks, rising about 13% month-to-date. Based on previous trading patterns, the stock is most likely to trade between 50 and 56 in the coming months. And of course, if more bad news emerges—regarding the scandal, or earnings prospects—Wells Fargo stock could easily fall again.

Here’s the chart.

If I owned Wells Fargo stock, I would sell today, and reinvest my capital into an energy stock, many of which are entering seasons of growth after several recent dismal years. I added a big-name energy stock to the Buy Low Opportunities Portfolio in Cabot Undervalued Stocks Advisor last week. You haven’t missed your chance to buy low, lock in a huge dividend, and catch the rebound on the share price!