Is the Stock Market Overvalued?

U.S. stocks as a whole are not cheap, evidenced by the multitude of new highs set by the major indexes since the November 8 U.S. Presidential election. While several industry groups are clearly overpriced, other groups have been left behind during the last couple of years, including bargain stocks in the energy, financial, industrial and materials sectors. In addition, a few stocks in the most favored sectors—technology, consumer, and health care—are selling at bargain prices due to management missteps and short-term problems.

[text_ad]

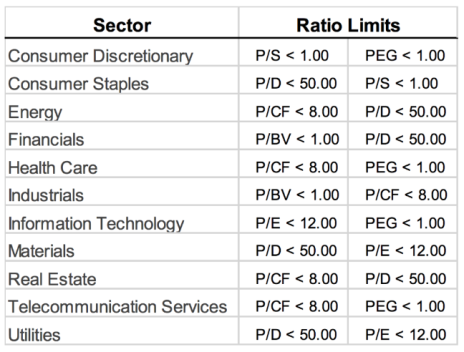

How can you find bargain stocks when a majority of stocks are high? In my January 24 Wall Street’s Best Daily, I outlined how to evaluate stocks in each of the 11 industry sectors using six simple price multiples (ratios). In case you missed it, click on this link to review my methodology (also used by Warren Buffett) to find stocks selling at bargain prices. The table below summarizes the proper measures to use when considering a stock for purchase.

Key

<: Less than

P: Current stock price per share

BV: Book value per share

CF: Cash flow per share

D: Dividends per share

E: Earnings per share

PEG: Price to earnings ratio (P/E) divided by expected E growth rate, plus dividend yield.

Six Bargain Stocks

Without further ado, here are six bargain stocks that are clearly undervalued, and remarkably, are poised to grow sales and earnings rapidly during the next two years.

Bargain Stock #1: Triumph Group (TGI) Industry: Industrials–Aerospace & Defense; P/BV = 1.33; P/CF = 3.0

Triumph Group (TGI: Current Price 26.27) makes a wide variety of structural products for military and commercial aircraft, and designs, manufactures and retrofits a variety of aircraft components. Triumph was founded in 1993 and currently resides in Berwyn, Pennsylvania.

Sales and earnings have suffered during the past 18 months because construction of older model airplanes at major manufacturers has slowed. New management at Triumph is implementing a plan to downsize the company’s manufacturing operations, improve efficiency and cut costs. Several aircraft makers will begin work on new aircraft in 2017, which will provide a boost to sales for Triumph. The company also won a new contract from Raytheon.

Sales will likely slip another 4% during the next 12 months because of Triumph’s ongoing downsizing. EPS will rise 5% to $4.56 spurred by management’s new plan to streamline operations throughout the company. A corporate income tax cut by the new Republican administration could propel earnings considerably higher.

TGI shares sell at only 1.49 times current book value and 3.0 times cash flow, which is extremely low. I expect TGI to nearly double and reach my sell target of 48.44 within two years. Buy at the current price.

Bargain Stock #2: Gilead Sciences (GILD) Industry: HealthCare–Biotechnology; P/CF = 6.1; PEG = -1.68

Gilead Sciences (GILD: Current Price 65.95; develops treatments for HIV/AIDS, liver diseases such as hepatitis B virus and hepatitis C virus, and serious cardiovascular/metabolic and respiratory conditions.

Gilead’s Sovaldi, and Harvoni, the biggest selling drugs for the treatment of the hepatitis C virus, are experiencing declining sales. New drugs from AbbVie and Merck are competing effectively with Sovaldi, and Harvoni, which has forced Gilead to reduce prices by as much as 50% in response. Investors fear that President Trump will pressure Gilead to lower Sovaldi and Harvoni drug prices, but the company has already lowered prices significantly. Gilead’s sales woes will likely reverse by the end of 2017 when the company is expected to report positive sales comparisons as new drug sales from recently approved drugs overtake the sales declines in hepatitis C drugs.

Gilead has a huge cash hoard of $32.4 billion ($24.60 per share), much of which is sitting in overseas accounts. If President Trump declares a tax holiday to repatriate overseas funds, Gilead will become a major beneficiary.

At 6.1 times current cash flow, a PEG ratio of -1.12, and a dividend yield of 3.1%, Gilead shares are super cheap. The company is a good candidate to be acquired because of Gilead’s expanding HIV drug sales and several additional drugs in development that could add significant sales in future years. I expect GILD to nearly double and reach my sell target of 124.81 within two years. Buy at the current price.

Bargain Stock #3: Spectra Energy Partners LP (SEP) Industry: Energy–Oil & Gas Storage & Transportation; P/D = 16.1; P/CF = 8.0

Spectra Energy Partners LP (SEP: Current Price 44.28) is a master limited partnership operating as an investment arm of Spectra Energy Corp. Spectra Energy Partners LP transports natural gas through interstate pipeline systems, and also stores natural gas in underground facilities in the U.S. Spectra’s operations in the U.S. and Canada include more than 21,000 miles of pipeline, 300 BCF (billion cubic feet) of natural gas storage, and 4.8 million barrels of crude oil storage.

Spectra recently completed multiple capital expansion projects, which will bolster 2017 sales and profits. Lower natural gas and commodity prices and higher operating expenses hurt earnings in 2016.

Sales will likely advance 8% and EPS will rise 8% to $3.42 in 2017. Spectra’s price-to-dividend ratio of 16.1 translates to a dividend yield of 6.3%. With a price-to-cash flow ratio of 8.0, SEP shares are clearly undervalued. The company has been hiking the dividend every quarter during the past several years and will very likely continue the increases.

President Trump will likely ease regulations allowing companies to build pipelines in the U.S. I expect SEP to rise 40% and reach my Min Sell Price of 62.06 within one year. Buy SEP at the current price.

Bargain Stock #4: LyondellBasell Industries NV (LYB) Industry: Materials–Commodity & Chemicals; P/E = 9.6; P/D = 25.9

LyondellBasell Industries NV (LYB: Current Price 87.88), based in Rotterdam, The Netherlands, is one of the largest plastics, chemicals and refining companies in the world. Lyondell produces and markets olefins and other petroleum-based products. Lyondell’s refining segment is a significant producer of gasoline, diesel fuel and gasoline blending components.

Falling oil prices negatively impacted sales and earnings during the past two years. Future results will be aided by increasing global demand for petrochemicals, and more favorable raw material costs from a projected increase in U.S. natural gas supply. LyondellBasell’s capital expenditure program will also help to drive EPS growth from investments in high return projects.

Sales will likely increase 6% and EPS will rise 1% to $9.90 in 2017. A pickup in the U.S. economy, increased infrastructure spending and the possibility of lower corporate tax rates could enable sales and earnings to grow much more rapidly. At 9.6 times current EPS and 25.9 times dividends (3.8% yield), LYB is clearly undervalued. The company’s stout cash flow has enabled management to shape up the balance sheet after LyondellBasell’s emergence from bankruptcy in 2010.

I expect LYB to advance 35% to my Min Sell Price of 118.93 within two years. Buy at the current price.

Bargain Stock #5: TRI Pointe Group (TPH) Industry: Consumer Discretionary–Homebuilding; P/S = 0.82; PEG = 1.00

TRI Pointe Group (TPH: Current Price 12.34) engages in the design, construction and sale of single-family attached and detached homes in the U.S. TRI Pointe operates across eight states, including Arizona, California, Nevada, Washington, Texas, Colorado, Maryland and Virginia. In addition, TRI Pointe has acquired five homebuilders during the past five years.

TRI Pointe, headquartered in Irvine, California, was awarded 2016 “Builder of the Year” honors in Orange County, California and “Best Place to Work” in 2016.

TRI Pointe Group delivered disappointing third-quarter sales and earnings, which sent the stock down without a recovery. The soft results appear to be a one-time event. The stock has disappointed investors during the past several months, but the outlook for homebuilding is excellent. Sales and earnings growth is typically bumpy for companies in the home construction business, and TPI Pointe, as a small company, is prone to some short-term volatility.

Sales will likely climb 10% and EPS will rise 9% to $1.38 in 2017. Sales and earnings could exceed expectations if President Trump’s growth initiatives come to fruition, or if his tax cut plans are enacted. Tri Pointe’s income tax rate is 35%, substantially higher than the proposed new rate of 15% to 20%. I expect TPH to rise 83% to my Min Sell Price of 22.62 within two years. Buy at the current price.

Bargain Stock #6: Alliance Data Systems (ADS) Industry: Information Technology–Data Processing & Outsourced Services; PEG = 1.10

Alliance Data Systems (ADS: Current Price 238.82) provides data-driven and loyalty transaction-based marketing services to businesses in a variety of industries. Recent acquisitions and new loyalty program initiatives are boosting sales and earnings growth.

The company increased sales in 14 of the past 15 years, and improved EPS (earnings per share) by at least 10% every year during the past 15 years. Sales and earnings increased 12% during the past 12 months, and will likely rise more than 12% during the next 12 months.

Alliance Data received some good news recently. Activist investor ValueAct Capital Management disclosed that it has purchased a 6.8% stake in ADS. ValueAct intends to open dialogue with Alliance Data management and board members to discuss how to enhance shareholder value. The investment by ValueAct is good news for ADS shareholders.

ADS is undervalued after considering the company’s low PEG ratio of 1.02. The company’s balance sheet is strong too with almost $2 billion in cash. ADS will likely climb 48% and reach my 354.42 sell target within two years. Buy ADS at the current price.

Additional Bargain Stocks

The six stocks summarized above offer excellent examples of bargain stocks selling at low P/BV, P/CF, P/D, P/E, P/S and PEG ratios. These are clearly undervalued stocks even though the overall stock market is quite high. You can find many more stocks selling at bargain prices in my Cabot Benjamin Graham Value Investor. Subscribe today by clicking here.

Until next time, be kind and friendly to everyone you meet.

[author_ad]