Donald Trump’s 25% steel import tariffs and his trade policies have pressured technology, air conditioner makers, tool manufacturers, automobile producers, and other steel importers, but there is one industry that is playing a winner’s hand—the American steel industry. It’s a very cyclical segment of the market that has seen many highs and lows—but steel stocks are actually poised to benefit from the trade war, and one steel stock in particular.

Steel Prices on the Rise

With strengthening economies worldwide, global demand for steel continues unabated and—along with the tariffs—have boosted domestic prices. Some companies, like U.S. Steel (X), have rebooted non-working facilities, helping to pad the bottom line of U.S. steelmakers like the largest steel company, Nucor (NUE), who announced a doubling of its profits in Q2.

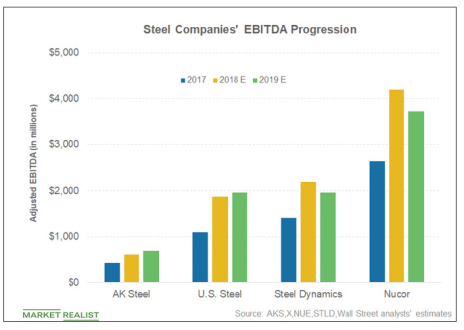

In a recent article, Marketrealist.com analyzed the effect of the tariffs on steel companies’ enterprise value to earnings before interest, tax, depreciation, and amortization (EV/EBITDA) multiple and found the tariff scenario very beneficial, as you can see by the chart below.

These numbers are based on earnings estimates, which look very attractive—especially for AK Steel (AKS)—a steel stock that was recently recommended in my Wall Street’s Best Investments newsletter by contributor Bill Mathews, of The Cheap Investor. Analysts are forecasting EBITDA for AK Steel to rise 14.1% in 2019, even though steel prices are expected to hit their peak in Q3 this year.

[text_ad use_post='129620']

Here’s what Bill had to say about AKS:

“AKS is a leading producer of flat-rolled carbon, stainless and electrical steel products, primarily for the automotive, infrastructure and manufacturing, including electrical power, and distributors and converters markets. Through its subsidiaries, the company also provides customer solutions with carbon and stainless steel tubing products, die design and tooling, and hot- and cold stamped components.

“The company has approximately 9,200 employees at manufacturing operations in the United States, Canada and Mexico, and facilities in Western Europe.

“AK Steel has been restructuring, and revenues were up 12% in the last quarter. In addition, shareholder equity is $24 million, up significantly from a $45 million deficit a year ago. If the company continues to successfully restructure and grow its revenues and earnings, we think it has the potential to move at least 25 to 50% from this low point.”

Analysts are paying attention to AKS. Its shares have recently received two rating upgrades from Wall Street, including:

Morgan Stanley, to ‘Overweight’, with a $5.50 price target. The analysts based the upgrade on rising steel prices (up one-third this year) as well as AKS’ strategy of selling 60-70% of its steel output on contract. Wall Street expects 25% of the spoken-for output will reprice higher in 2018 Q4 and another 50%in 2019 Q1, which should boost profits.

Next, Merrill Lynch raised its rating of AKS to ‘Buy’, with a $6 price target, based on the price of hot-rolled coil steel increasing from $700 per ton this year to $750 next year. Right now, analysts expect AKS to earn $0.71 in 2019, more than double the $0.30 forecast for this year.

Insiders are also buying up shares of the steel stock. According to reports, AKS’ CEO Roger Newport bought 10,000 shares at a $4.03 strike price. The company has seen 64 insider buys in the past 12 months, 22 of them just in the last three. As well, 113 institutions have purchased more than 27.5 million shares.

Certainly, these low-cost shares are speculative in nature. The company has a lot of debt, but rising profits—and its ongoing strategy to reduce debt (to the tune of $400 million since 2014)—should help alleviate that pressure.

A Buy-Low Steel Stock

The shares are trading at a forward price-earnings multiple of just 5, making them pretty cheap, but trading volume is low—just 12 million shares on average on a daily basis. So, please don’t chase the stock. But with prices rising, more Wall Street attention, insiders and institutions buying, this might just be an opportunity to buy low and sell high.

[author_ad]