The Important Function of Value Investments

How to Allocate Your Portfolio

My Top 12 Stock Recommendations

---

Cabot Investors Conference

Ten days ago, Cabot held their first annual Investors Conference in the historic Hawthorne Hotel in Salem, Massachusetts. Located in the midst of a vibrant city of quaint shops, fine restaurants and a multitude of attractions, the Hawthorne Hotel outdid itself providing excellent food, unique conference rooms, endless coffee and plenty of electronics for our presentations!

Conference attendees were attentive and asked many meaningful questions running the gamut from simple to very complex. I learned a great deal about how investors view investing and what they need to learn to become better investors.

I was dubbed: “the value guy” and was asked pertinent questions regarding the role of value stocks in investors’ portfolios. There was one misconception that was quickly brought to my attention: value stocks are for dividends; growth stocks are for price appreciation.

That’s not true. Value stocks create dividend income AND price appreciation. To prove my point, Standard & Poor’s has divided its S&P 500 Index into two groups of stocks: Value and Growth. The S&P 500 Value Index has outperformed its growth counterpart during the past one-year, three-year, five-year and 10-year cycles as of June 30, 2013. That’s right! Value stocks have outperformed growth stocks consistently during the past 10 years and beyond.

During the past year, for example, the S&P 500 Value Stock Index is up 25.0% compared to the S&P 500 Growth Stock Index’s gain of just 16.8%. I urge you to take advantage of this little known fact. Invest part of your portfolio in value stocks and reap the rewards.

Portfolio Allocation

I recommend diversifying your portfolio with an allocation of 50% value stocks and 50% growth stocks. There will be times when growth stocks will outperform value stocks, but value stocks will outperform growth stocks more than half the time. The value portion of your portfolio must include high-quality, conservative stocks along with some medium risk stocks.

I strongly recommend diversifying across various industry sectors in the value and growth portions of your portfolio. Diversification will help lower your risk. In addition, invest equal dollar amounts in each stock, whether it’s a value stock or a growth stock.

Many investors like to invest in other types of stocks: including small-cap stocks, emerging market stocks, stock options and, of course, the investing tips from Uncle Louie. That’s fine and dandy, but limit your “other” investments to 10% of your portfolio. In general, a portfolio made up of 45% Value, 45% Growth and 10% other will work very well for you.

In my July 30, 2013 Cabot Wealth Advisory, I stressed the importance of starting with a core group of stocks. Whether you are young, old or somewhere in between, you need a sturdy base for your portfolio. Our homes rest on solid concrete foundations. Our portfolios need to rest on a reliable core of durable companies: low-risk companies with good five-year growth prospects at reasonable stock prices. If you missed my Cabot Wealth Advisory, which provided step by step instructions for investing in value stocks and portfolio development for retirement, click here.

Also, my list of 12 stocks and ETFs is still available. I believe these 12 will get you started in the right direction and will provide an excellent foundation for your investment portfolio. I will review one of the companies here, but I encourage you respond to this email if you are interested in discovering the other 11 companies and ETFs. (You will incur no cost nor have any obligation if you view these stock picks!)

---Advertisement---

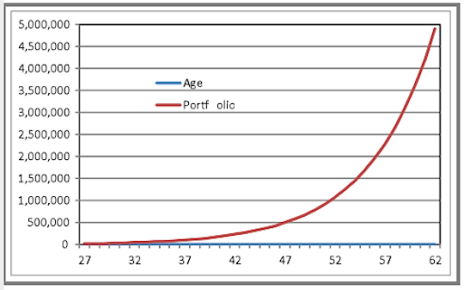

The best route to financial independence is to slowly accumulate wealth as opposed to get-rich-quick investments. You should never expect to double your money every year. According to the American Association of Individual Investors, the average annual return for common stocks is 10 to 12% per year during the past 85 years. Nevertheless, an individual who invests $10,000 at the age of 27, adds $2,000 every year to his or her account for 35 years, and can average 11% annual returns including dividends, will end up with a cool $1,069,000 at age 62. Not too shabby!

However, investors who have followed my advice during the past 17 years have averaged 14.4% price appreciation plus 2.0% dividend yields annually. I dislike extrapolating numbers but can’t resist pointing out that the scenario spelled out in the previous paragraph using my total annual return of 16.4% will grow to a whopping $4,907,000 at age 62 with dividend income of about $100,000 thereafter! And that’s starting from a base of just $10,000, as depicted on the accompanying chart!

Click here to subscribe to the best value investing advice anywhere. You’ll be glad you did!

---

One of the great companies in my list of 12 conservative core stocks is Prudential.

Prudential Financial (PRU)

Industry: Financials – Life Insurance; 2.2% Yield.

Prudential Financial (PRU: 77.84), a financial services leader with more than $1.0 trillion of assets under management, has operations in the U.S., Asia, Europe and Latin America. Prudential offers investment management, group insurance and other financial services in the U.S., and life insurance overseas.

Sales moved up sharply in 2012 as a result of acquisitions and two new major contracts for pension services. Acquisition costs, sluggish growth in the insurance business, and higher claims in the disability business caused earnings per share to slip 5%.

Prudential has a lot going for it in 2013. Acquisitions and new contracts will add considerable sales and earnings. Higher assets under management and increased pricing in the annuities business will add profits. The investment management division in the U.S. and insurance sales overseas will also provide a boost in 2013.

My forecast includes sales growth of 10% and an EPS increase of 15% to 8.60 for the 12 months ending 6/30/14. The company’s purchase of Hartford’s individual life insurance business in January and two new contracts is providing a big increase in sales and earnings in 2013. In the new contracts, with General Motors and Verizon, Prudential will manage part of these companies’ pension plan risk transactions.

At 10.5 times latest earnings per share, and with a dividend yield of 2.2%, PRU shares are clearly undervalued and will likely rise to my Minimum Sales Price target of 109.24 within two years.

Until next time, be kind and friendly to everyone you meet.

Sincerely,

J.Royden Ward

Editor of Cabot Benjamin Graham Value Investor

Editor’s Note: You can find additional stocks selling at bargain prices in our new and improved Cabot Benjamin Graham Value Investor. Find out why our subscribers are showering us with compliments!

In every issue, you’ll find Roy’s legendary Maximum Buy and Minimum Sell Prices for over 275 well-known stocks. Just buy at the Max Buy Price and sell at the Min Sell Price—it’s that easy. Click here to get started today!