“It pays to have nerves of steel.” That was the lesson set forth in a recent issue of Barron’s, in which Mark Hulbert wrote about “The Little Newsletter That Crushed the Market.” Mr. Hulbert is a regular contributor to Barron’s after authoring the Hulbert Financial Digest for 36 years. The Digest, which closed more than a year ago, tracked and ranked the performance of about 200 investment newsletters over various time periods. In Barron’s, Mr. Hulbert (pictured at left) zeroed in on what is perhaps the best undervalued stock investment newsletter during the past 40 years, The Prudent Speculator.

The Speculator, created in 1977 by Al Frank, who later turned the reins over to John Buckingham (pictured below right), often garnered Hulbert’s number one rank for 10-year, 20-year, and 30-year performance—a lofty feat, indeed. However, Mark Hulbert and his Hulbert Financial Digest were unable to track all investment newsletters published in the U.S. Inexplicably, Mr. Hulbert never included my advisory, Cabot Benjamin Graham Value Investor, in the 200 newsletters that he followed.

I’m not whining, though, because I’ve had great success in attracting and holding investors to my investment advisory. My subscribers know from experience that investing in my recommendations of the market’s best undervalued stocks will lead to better performance than any of Hulbert’s newsletters, including The Prudent Speculator. In fact, my subscribers’ performance during the past 21 years has exceeded not only Hulbert’s best undervalued stock investment newsletter, but also Warren Buffett’s Berkshire Hathaway (BRK-B).

What lessons do I teach in Cabot Benjamin Graham Value Investor that lead to great performance?

[text_ad]

3 Lessons You Can Learn from My Experience

Most importantly, I agree with the authors of The Prudent Speculator: successful investing requires nerves of steel. Baron Rothschild said it best, “The time to buy is when there’s blood in the streets.” And I agree with Warren Buffett’s philosophy, “Be fearful when other investors are greedy.” Subscribers need great fortitude and discipline to carry out many of the lessons that I teach. Here are three.

- Stay Fully Invested

One of my philosophies, with which The Prudent Speculator and Warren Buffett agree, is to stay fully invested at all times. Too many investors try to time the market by selling when the stock market or an individual stock holding begins to slide. Investors almost always take too long to get back into stocks after the market begins to recover. Selling late and buying late will lead to poor performance in most instances.

In Barron’s, Mark Hulbert points out that The Prudent Speculator portfolio declined 60% during the financial crisis of 2007 to 2009. My holdings declined 40% and Warren Buffett’s Berkshire Hathaway declined 44% during the financial crisis, but we both recovered quickly. Both Buffett and I stay fully invested at all times, and this philosophy has worked wonders for our investors.

Occasionally, my subscribers question my discipline to stay invested while the stock market is declining—but they cheer when their stocks take off in the early stages of a vigorous rebound!

- Don’t Sell Too Soon

Most investors are familiar with Warren Buffett’s quip: “My holding period is forever,” but the quote brings up an important point—don’t sell too soon. The Prudent Speculator’s average holding period is four years, and my average holding period is 27 months.

The mistake that many investors make occurs when they sell too soon. They may choose the right stock in which to invest, but then sell before the stock has a chance to blossom. Hold onto your stocks until they reach your sell targets or the financial fundamentals and outlook for the company turn negative.

- Diversify

I agree with The Prudent Speculator and Warren Buffett on three very important criteria for successful investing: develop nerves of steel, stay fully invested all of the time, and hold for the long term. One of the investing philosophies, though, that sets me apart from my fellow advisors and analysts is my methods of diversification.

I believe you should invest in as many stocks as you can comfortably follow, and apply different investment methodologies to find your buy candidates.

The Actual Best Undervalued Stock Newsletter?

What is the performance that I have been rambling on about?

Fourteen years ago, the Model was first published in Cabot Benjamin Graham Value Investor. During the ensuing 14 years, the Model has increased 248.0% compared to increases of 136.2% for the Dow and 157.6% for the Standard & Poor’s 500 Index. All performance numbers do not include dividends.

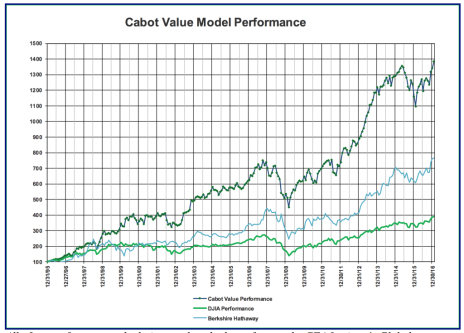

The Cabot Value Model was also used extensively by investment advisors since 1995 and by individual subscribers since 2002, and has outperformed the Dow Jones Industrial Average by a wide margin during those past 21-plus years. Since inception on 12/31/95, the Cabot Value Model has provided an impressive return of 1,102.5% compared to a return of 674.0% for Warren Buffett’s Berkshire Hathaway. During the same 21-year period, the Dow has gained just 310.6%. Here’s a chart of that performance through the end of 2016.

Cabot Benjamin Graham Value Investor has easily beaten some of the best investors on the planet!

Until next time, be kind and friendly to everyone you meet.

[author_ad]

*This post has been updated from an original version that was published in February 2017.