We’ve all heard how well bank stocks have performed during the past few months, with both upside earnings surprises and big price run-ups. Let’s revisit my favorite bank stock, Goldman Sachs, to see if it has any more room to grow.

Goldman Sachs Group (GS) is a global investment banker, serving consumer, institutional and government clients. The company’s profit outlook continues to be revised upward, due to a wide variety of beneficial market and economic factors.

- Lower income tax rates (lower non-operating expenses)

- Higher interest rates (higher net interest income)

- Increased economic activity (enhances M&A activity)

- Increased activity in investment markets (higher trading and underwriting revenue)

- Rollbacks in legislation (e.g. a relaxing of liquidity rules could lead to higher returns of capital to shareholders).

Tim Lutts wrote about my Goldman Sachs stock advice in this column on May 31, 2016, when the stock was at 159. As I write, the stock is at 234, up 47% (plus dividends!), and the company reported excellent full-year 2016 results on Wednesday morning (January 18).

So now is a great time to review the stock. Is it overvalued? What’s the earnings outlook? What should I do with my shares?

[text_ad use_post='129629']

Let’s start with the 2016 results, then review the outlook for 2017. Goldman’s 2016 earnings growth was tremendous, but it came in comparison to a weak 2015, when the cost of a settlement over residential mortgage-backed securities litigation hindered its bottom line.

2016 Results

- Full-year 2016 earnings per share (EPS) rose 34.2% to $16.29 vs. the consensus estimate of $15.81, and $12.14 EPS in 2015 (December year-end).

- Fourth quarter EPS were $5.08 vs. the consensus estimate of $4.80.

- Full-year operating expenses dropped to an eight-year low.

- Fourth-quarter annualized return on equity (ROE) rose to 11.4%, with full-year 2016 ROE at 9.4%. Analysts expect ROE to be 11% in 2017/2018.

- The company repurchased $1.5 billion of stock during the quarter, and $6.07 billion for the year.

- Goldman surpassed all of its peers in 2016 M&A activity.

The fourth-quarter earnings beat was attributed to strong fixed income, currency and commodity trading, and a 6% increase in investing and lending, when analysts were expecting a downturn. Detracting from its earnings was a drop in equities trading revenue and a slightly higher-than-expected expense ratio.

Outlook for 2017

Wall Street consensus estimates project Goldman’s EPS to be $18.82 (up 15.5%) and $21.54 (up 14.5%) in 2017 and 2018, respectively. Keep in mind that analysts will continue to revise their estimates in the coming days, and the consensus estimates will likely increase in the near-term.

To give you an idea of how much higher those estimates could go, one major investment bank projects Goldman’s EPS to be $19.80 (up 21.54%) and $22.90 (up 15.7%) in 2017 and 2018, respectively.

Based on consensus estimates, the stock’s price/earnings ratios currently stand at 12.4 for 2017, and 10.9 for 2018. These numbers are slightly at or below historical averages, and very low compared to Goldman’s EPS growth, indicating that the stock is undervalued.

And there’s a 1.1% dividend yield to boot.

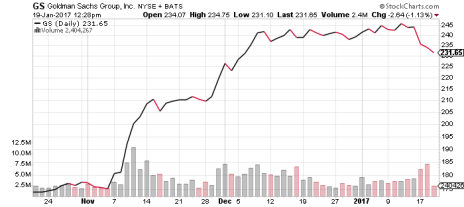

Goldman Sachs Stock Chart

Goldman’s share price peaked in October 2007 at 235, prior to the infamous 2008 financial meltdown, and has recently rebounded to that level, trading between 231 and 246 since early December 2016. GS has traded tightly for six weeks, forming a base from which it could launch upwards again.

Note that it’s a bullish sign that after the stock’s tremendous run-up in the second half of 2016, it hasn’t exhibited a price correction.

GS is a large-cap undervalued stock with outsized future earnings growth and a 1.1% dividend yield. The stock has had a good advance, but I don’t think you’ve missed the next run-up in the share price.

One more bonus to owning Goldman Sachs stock is that the company is overdue to implement its capital plan that was approved by the Federal Reserve in June 2016. That means that Goldman is likely to increase its dividend and announce a new share repurchase authorization between now and the next release of the Fed’s banking stress test results in June 2017.

Back in May 2016, I called GS stock “the clear choice among bank stocks in 2016.” Today, there are no clouds on Goldman’s horizon—on either its balance sheet or its price chart. My recommendation is to buy shares of Goldman Sachs today.

For more updates, consider joining Cabot Undervalued Stocks Advisor. For more details, click here.

[author_ad]