In my December 23, 2016 column, I recommended homebuilder stocks, citing their attractive earnings growth and low valuations. And now, under the new U.S. political administration, prospects for increasing employment and wages are likely to enhance new home purchases—which is why today I’m recommending another housing stock.

Two months ago, I specifically recommended homebuilder M.D.C. Holdings (MDC), which is up 11% since that day. What’s more, its stock price chart still looks terrific. I think you could see MDC rise all the way to a high of 35 this year as it retraces its high from four years ago.

The caveat is this: MDC is no longer on my Buy list. That’s right, I’m no longer recommending the stock to new investors. It’s still an undervalued stock with a good dividend yield, but the forward earnings estimates have arrived, and they’re not enticing. According to Wall Street’s consensus expectations, MDC’s earnings per share (EPS) are only expected to grow 8.3% in 2018.

[text_ad]

When I recommend a new stock, I need the earnings growth rate plus the dividend yield to equal 15 or higher. In the case of MDC, that number now comes to 11.8. Since the price chart is bullish, my current recommendation is to hold MDC until it reaches 33, then plan your exit strategy.

So where’s the silver lining in this news? For that, let’s circle back to my December recommendation of housing stocks. In the column, I mentioned three additional attractive companies: D.R. Horton (DHI), PulteGroup (PHM) and Toll Brothers (TOL).

Now that 2018 earnings estimates have arrived, I’m no longer recommending new purchases of DHI and TOL because their EPS are only expected to grow 9.5% and 7.8% in 2018.

PHM: My New Housing Stock Recommendation

But PulteGroup (PHM) is expected to more than double its peers’ earnings growth rates in 2018. That’s going to bring the company a lot of attention from Wall Street, and presumably, more institutional dollars will flow into PulteGroup stock, pushing the share price higher.

PulteGroup provides mortgages and title services through its Pulte Mortgage business. But its main business is homebuilding, in the form of single-family detached, townhomes, condos and duplexes. The company’s brand names include Centex, Pulte Homes, Del Webb, DiVosta Homes and John Wieland Homes.

The company is growing organically, with increasing orders, closings and average sale prices per home. In addition, the company is increasing sales of its homes in California, which bring in higher revenue per home than elsewhere in the U.S.

PHM reported EPS of $1.59 in 2016 (December year-end), meeting analysts’ most recent estimates, which had risen by $0.30 as the year progressed. Estimates for 2017 are increasing, too. The current 2017 consensus EPS estimate is $2.22, up from $2.07 a mere four weeks ago. That’s year-over-year earnings growth of 39.6%, with 2018 expected to bring another 20.7% growth to $2.68 per share.

I love strong earnings growth, but unless the price-earnings ratio (P/E) is below the earnings growth rate, I’m not going to recommend the stock. In the case of PHM, the stock passes the P/E test with flying colors. The 2017 and 2018 P/Es for PHM are 9.7 and 8.1, below both the long-term industry average P/E, and well below PHM’s average P/E.

The stock pays a quarterly dividend of $0.09, yielding 1.7%. The dividend increases periodically, but not on an annual basis.

PHM is a mid-cap stock, with a market capitalization just under $7 billion.

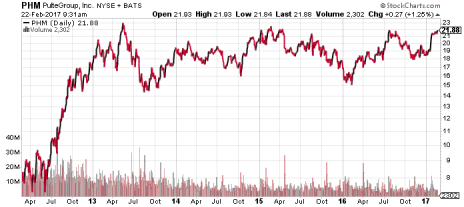

One of the most attractive things to consider about PHM is its price chart. As with many housing stocks and financial stocks, PHM had a higher share price prior to the housing crisis in 2008. In order to get a more clear idea of the direction of the stock’s momentum, take a look at the five-year price chart.

PHM has repeatedly risen to upside resistance in the 22 to 23 area for four years. Based on its trading pattern in recent weeks, combined with the bullish price charts on other housing stocks, I believe that PHM is finally ready to break past price resistance and begin a sustainable run-up. You haven’t missed your opportunity to make money in this particular housing stock!

I recommend that you buy PHM now for significant capital gain potential in 2017.

[author_ad]