My friend Jacob was chatting with me about his favorite stock, Apple (AAPL). He complained that AAPL should be worth way more than its current price. But when I asked him about his rationale for the share price valuation, he couldn’t answer me. It became clear that his love for the company’s products had determined his general belief that the share price should always be rising. Clearly, Jacob wasn’t invested in tech stocks during the “dot-com bubble” in 2000, or else he’d be showing more humility and wisdom about Apple’s share price today.

Sector Rotation Out of Tech Stocks

Unlike Jacob, investment professionals do not make stock selection decisions based on hopes and dreams, emotional attachments to products, or beliefs such as “tech stocks will always rise more than other stocks.” And since investment professionals move the markets, it’s important for the individual investor to understand how the pros think.

[text_ad use_post='129629']

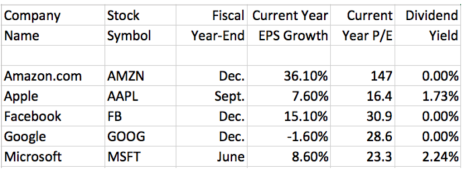

Equity portfolio managers commonly use a stock’s price/earnings ratio (P/E) to gauge whether the stock is undervalued vs. overvalued. A very simple rule of thumb is this: an undervalued stock has a P/E that’s lower than its earnings growth rate. Let’s take a look at the valuation of some popular NASDAQ technology stocks:

Uh-oh. As you can see on the chart, these famous technology stocks are drastically overvalued. You might begin to scramble and rationalize, “This time it’s different!” or “My tech stock isn’t overvalued!” or “I don’t care, I’m a long-term investor!”

Just stop right there. You buy stocks so that you can earn capital gains. Odds are strong that you already earned outsized capital gains in these stocks. Did you really believe that they were going to go straight up forever?

Stock market industries take turns rising and falling, sometimes by exaggerated amounts. And that’s what we have seen with both tech stocks, which rose a lot, and financial stocks, which languished. Again, please visit Wikipedia and read about the “dot-com bubble”.

When we reach the catalyst moment when a sector that’s been rising begins falling, and a sector that keeps lagging begins rising, that’s called a sector rotation, and I believe we’re entering that phase. Every professional on Wall Street knows that technology stocks are overdue for a price correction. These professionals will begin selling tech stocks, and they’ll purchase stocks within undervalued areas: financials, energy and basic materials. Those industries are chock full of stocks with very attractive earnings growth rates … the kinds of growth rates that are missing from the tech stock chart, above.

The sector rotation out of tech stocks will most likely be a multi-month process, during which there will be increased volatility among tech stocks, with price charts that ratchet downward. Each time the stocks fall, and bounce back a little, some investors will be fooled into thinking “we’ve reached the bottom.” You don’t have to participate in that turmoil! Begin paring back some of your tech stocks and use stop-loss orders on the others. Remember, you’re in this to earn capital gains! So let’s move a portion of your portfolio into financial stocks, right along with the money managers whose purchasing power will be pushing those share prices up, up, up!

In the financial sector, profits are growing nicely at asset management companies, banks, insurance companies and brokerage firms. Those companies’ profits get a boost each time the Federal Reserve raises the fed funds rate. And among banks, there’s another bonus for investors on the immediate horizon.

We’re just weeks away from the Federal Reserve’s annual Comprehensive Capital Analysis and Review (CCAR) of large banks that’s due on June 28, also known as the Fed’s banking “stress test.” CCAR results will authorize most banks to proceed with their plans to increase share buybacks and dividends, and that will likely boost share prices. Morgan Stanley estimates that 18 of the largest U.S. banks have $120 billion more capital than regulators require them to hold. That’s an awful lot of money that’s going to be handed to investors. And that’s going to entice money managers to say to themselves, “I’d better get on this train before it leaves the station.”

My Favorite Bank Stock

I recommended an excellent large-cap bank stock to the subscribers of Cabot Undervalued Stocks Advisor on June 12. Here’s another great choice among banks.

KeyCorp (KEY) is a large retail and commercial bank that’s based in Cleveland, OH. The company has about $140 billion in assets. Revenue is expected to grow about 20% in 2017.

Wall Street expects KeyCorp’s earnings per share (EPS) to grow by 18.8% and 17.3% in 2017 and 2018, with corresponding P/Es of 14.0 and 12.0. In an analysis of a dozen famous banks that I published for subscribers to Cabot Undervalued Stocks Advisor on June 12, KeyCorp had far more attractive earnings growth and valuation than 10 of the other bank stocks.

The company historically announces an annual dividend increase in the middle of May.

KEY has traded between about 16.5 and 19 since mid-November. Many financial stocks are breaking out of six-month trading ranges this month, and KEY appears immediately ready to follow suit. KEY could appeal to growth investors, dividend investors, value investors and traders. And as a reminder, your favorite tech stocks do not have the numbers to support any of those investment styles, except for the occasional dividend.

It’s time to get a jump on a major market move, by shifting some portfolio dollars out of tech stocks and into financial stocks. Test the waters. Move just one stock, and as you relax about the prospect of earning capital gains in KeyCorp., come visit Cabot Undervalued Stocks Advisor for ideas on additional excellent undervalued growth stocks.

And just so you know that I’m putting my money where my mouth is, I sold four Nasdaq stocks this year within the Cabot Undervalued Stocks Advisor portfolios, precisely because they were overvalued: Amazon.com (AMZN), ASML Holding (ASML), Adobe Systems (ADBE) and Applied Materials (AMAT). Those portfolios now hold seven financial stocks. Join us by clicking here!

[author_ad]