At the beginning of April, newscasters were celebrating electric car manufacturer Tesla Inc. (TSLA) becoming bigger than Ford Motor Co. (F). Then this week, Tesla became more valuable than General Motors (GM). However, in conversations with friends, investors and media representatives, it quickly became clear to me that many people had no idea what it meant for Tesla’s value “to be greater than Ford’s.” They assumed, in some way, that Tesla had surpassed Ford in revenue or quantity of cars produced or profit or number of employees.

Actually, no. None of those things happened.

What Tesla’s Value Really Means

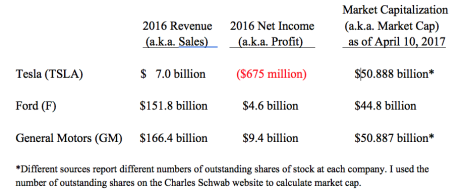

For many investors, this will be old news. But for other investors, I’d like to offer an explanation about Tesla’s value. This table should put everything in better perspective, and then I’ll explain what each column on the chart represents.

Let’s start with revenue. This is the value of all the products and services that the companies sold to customers in 2016, including autos, auto parts, energy storage systems and financial services. You can see that Ford and General Motors achieved way over $100 billion in revenue last year, while Tesla’s revenue was less than 5% of the bigger companies’ revenues.

That makes sense, right? I mean, you knew that Tesla was sort of a big deal, but at the same time, you might not personally know more than one or two people who own a Tesla vehicle; whereas Ford and General Motors vehicles fill up the parking lot at your office or church. So when you heard on the news this month that Tesla was “bigger than Ford and General Motors,” you probably thought, “Hurray for Tesla! Hmmm, how can they be bigger than Ford and GM? Oh well, I heard it on the news, so it must be true.”

Well, now we know that it wasn’t revenue that made Tesla’s value greater than Ford’s or GM’s. How about profits?

[text_ad]

Looking at the chart, you can see that last year Ford and General Motors each earned billions of dollars in profits, officially referred to as “net income.” Profits are good! Profits allow a company to stay in business. I know that there are groups of people in America who insist that “profit is bad,” but truly, if a company does not have any profit, it will eventually go bankrupt. Profit keeps a company in business, and keeps people employed, so that they in turn can pay their bills and take care of their families and communities.

Profit works the same within your family. The money that you have left over at the end of the month after you pay your bills is your net income, or profit. If you spend more money than you earn, you will need to borrow money in order to maintain your lifestyle. Eventually, you max out your credit lines and you can’t borrow any more money. Yet the bills keep arriving each month. That’s the moment when people often file for bankruptcy.

In light of the seriousness of profits vs. losses, you’re probably looking at Tesla’s $675 million loss with a little bit of confusion. How can a company be hailed in the news as surpassing Ford and General Motors, when the company’s losing money? Maybe it was a one-time loss, and all the other years were profitable? No such luck. Tesla lost money in eight of the last 10 years.

Clearly, the news media is not touting Tesla’s profitability.

Here’s the lowdown on the meaning behind Tesla’s value: In April, Tesla’s stock (not the company) surpassed both Ford’s stock and General Motors’ stock in total value. The stock’s value is referred to as market capitalization, or commonly “market cap.”

A company’s market cap can easily bear no relation to its revenues or profitability. It’s simply calculated by multiplying the number of outstanding shares of stock by the current share price. For example, the market cap of TSLA at the end of trading on April 10 was $50.888 billion. If Warren Buffett wanted to buy every single publicly available share of Tesla—and presuming that every shareholder was willing to sell their shares—he would pay $50.888 billion (plus transaction fees) for the privilege of owning every share of Tesla stock.

Therefore, what the news stories are attempting to convey is that the share price of Tesla stock rose so high that the company’s stock is now worth more total dollars than Ford’s stock and General Motors’ stock. Tesla’s value as a company still trails the two big U.S. auto manufacturers’ by a long shot.

Tesla the Stock vs. Tesla the Company

Here’s what’s important for you, as an investor, to understand about Tesla’s rising share price: The stock did not go up based on any particularly wonderful thing that happened at the company. The stock went up because there were “more buyers than sellers” (see chart below).

- When people buy Tesla stock, that pushes the share price up.

- When people sell Tesla stock, that pushes the share price down.

If Tesla is losing money each year, that means the company needs to borrow money to stay afloat, to pay its bills and to pay its employees. The people who are buying the stock and pushing the share price upwards are betting that the company will become profitable one day soon, and betting that the company will be able to continue borrowing money to stay afloat.

Please understand, when investors all over the world purchase Tesla stock, Tesla Inc. does not receive the money from all those stock purchases.

Please read that again, because each time I tell this to people, they seem stunned:

When investors all over the world purchase Tesla stock, Tesla Inc. does not receive the money from all those stock purchases.

I’ll make an analogy that you can relate to, and then you’ll understand what happens to the money when people buy Tesla shares.

Let’s say that I purchase a Toyota Camry for $23,000. I buy it brand new from the dealership. The money that I pay goes to the dealership, and essentially to Toyota Motor Corp.

Two years later, I sell the Camry to my co-worker Steve. Steve pays $17,000 for the Camry. Steve does not give the money to Toyota Motor, because the auto company does not own the car. I own the car, so Steve gives the money to me.

Three years later, Steve sells the car to his sister-in-law Gloria. Gloria pays $9,000 for the Camry. Gloria does not give the money to Toyota Motor (TM), because the auto company does not own the car. Steve owns the car, so Gloria gives the money to Steve.

I know that you’re familiar with buying and selling new and used cars, and that scenario makes sense. New and used shares of stock work in exactly the same manner—except, unlike automobiles that naturally depreciate over time, the value of stock can go either up or down.

The only time that Tesla receives money for its stock is when the company issues brand new shares of stock. For example, the company could “go public” by issuing an initial public offering of 50 million shares of stock at $10 per share (a.k.a. an IPO). Tesla receives the $500 million that was raised from the sale of stock, pays a fee to its investment banker, and then uses the money as it pleases. But from that day forward, as those 50 million shares of stock are bought and sold each business day, the money goes back and forth between the people who are buying the shares and the people who are selling the shares. Tesla never sees a dime from those transactions.

What Tesla’s Value Means for Tesla Stock

The underlying value of the company will loosely determine the value of the shares of stock—although stocks can certainly become severely undervalued or overvalued—but that’s a story for another day.

As for whether Tesla is a good investment, that’s not for me to say. There are many different investment styles. Tesla stock does not fit my personal investment style. But clearly, lots of people have made money by owning the stock!

I prefer lower-risk investing. You’re welcome to join me at Cabot Undervalued Stocks Advisor, where I typically recommend 25 to 30 undervalued growth and income stocks.

[author_ad]