Oil prices have been relatively stable since OPEC agreed to cut production at the end of 2016, triggering numerous energy industry upgrades and a rally in many energy stocks. But after the carnage of 2014 and 2015, and the numerous failed rallies of 2016, many of the highest-quality stocks in the industry are still underpriced. Here are my top three energy stocks for investors looking for New Year’s bargains.

Cheap Energy Stock #1: Exxon Mobil (XOM)

With a market cap of over $360 billion, Exxon Mobil isn’t just one of the largest companies in the energy industry, it’s one of the largest companies in the world. That size gives the company more flexibility during industry downturns because it can use its significant cash hoard and borrowing ability to maintain operations until prices rise again, and even make opportunistic investments at low prices.

And, crucially to income investors, the company can also ensure common stock dividends are protected.

[text_ad]

Exxon has paid dividends for more than three decades, and increased the dividend every year since 1983, including last year.

The year wasn’t without its challenges, of course. Free cash flow fell from over $24 billion in 2011 to a mere $3.8 billion last year, and is expected to fall to $600 million in 2016. At these levels, free cash flow per share doesn’t cover Exxon’s annual dividend payments, and the company’s payout ratio crept above 100% in 2016. But management drew on the company’s significant cash reserves ($3.7 billion at the end of 2015) and borrowing ability to maintain dividend payments, even delivering an annual increase on time last spring.

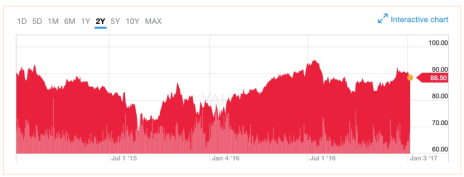

XOM Chart:

In the meantime, the company’s stock has been in purgatory, chopping around between 70 and 95. The stagnation in the share price has caused XOM’s book value per share to climb from $33 to $41 over five years. The stock’s current P/E is still high, at 41, but its forward P/E is close to half that, at 21, reflecting the significant earnings rebound expected in 2017. Revenues are expected to rise 34% next year, supporting a 90% increase in earnings per share. And estimates are rising—four analysts have increased their 2017 estimates over the past month.

Even after the Trump rally, this earnings growth is still far from priced into XOM shares. And at today’s prices, the stock’s very safe dividend yields 3.4%.

Cheap Energy Stock #2: Schlumberger (SLB)

Schlumberger is smaller than Exxon, with a market cap of $120 billion, but the company is the largest energy services provider in the world. Management has five consecutive years of dividend increases under their belt, and the stock currently yields 2.3%.

SLB’s payout ratio also rose above 100% last year, as low oil prices forced customers to cancel orders and curtail investment. But revenues and earnings are expected to rebound next year. 2017 revenues are expected to be 13% above last year’s levels, while EPS are expected to surge 65%.

As with Exxon, most of this growth is not yet priced into the stock.

SLB Chart

Cheap Energy Stock #3: Canadian Pipeline Company

My third reasonably priced oil stock comes from North of the border. This Canadian company is in transportation, not production, so it has less exposure to oil prices than either XOM or SLB. But the stock has still been in a funk for the better part of two years due to concerns about how slowing production in the Canadian oil sands could affect demand for its services.

As a result, the stock now yields a generous 4.6%. And even higher dividends are in the cards: earnings are expected to increase 45% next year, and to continue to grow by double digits as new investments come online over the next five years.

To learn more about this pipeline company, just click here.

[author_ad]