2017 has thus far brought more precipitation to the lower 48 U.S. states than in the previous 19 years, subduing gasoline demand. Will rain and flooding impact the summer travel season, bringing earnings estimates down for purveyors of gasoline? Or will this summer’s lower gasoline prices encourage a boost in automobile travel? If it’s the latter, I know one undervalued energy stock that should benefit greatly.

Phillips 66 (PSX) is an oil and gas refiner and marketer, and a chemical manufacturer that’s based in Houston, Texas. Phillips’ annual profit trend is on an upswing, as companies throughout the energy sector rebound from several years of falling earnings and net losses. Phillips’ adjusted earnings per share (EPS) fell from $7.67 in 2015 to $2.82 in 2016.

At this point, a consensus of Wall Street analysts expects Phillips 66 to earn $4.32 and $6.18 per share in 2017 and 2018 (December year-end), reflecting very aggressive earnings growth rates of 53.2% and 43.1%. Revenue is expected to grow from $85.8 billion in 2016 to $111.2 billion in 2017. Frankly, the numbers look that attractive throughout the refining and marketing industry, and that’s good news because refining and marketing stocks are going to draw a lot of attention from professional investors. Those are the folks who buy enough shares to move markets.

[text_ad]

Phillips’ first-quarter report was characterized by a strong earnings beat, higher-than-expected margins, and higher taxes. The company is due to report second-quarter 2017 results on the morning of August 1. Investors can tune in to the live webcast at noon ET that day to hear management discuss the quarter’s results and ongoing business goals and developments. Go to www.phillips66.com/investors and click on “Events & Presentations.”

PSX Not the Only Undervalued Energy Stock

Unlike tech stocks—which are owned by every living and breathing investor, and therefore significantly overvalued—energy stocks are not widely owned, and therefore even the best ones are exceedingly undervalued. In that light, Phillips’ stock has 2017 and 2018 price/earnings ratios (P/Es) of 18.6 and 13.0, far below the earnings growth rates.

Will the market finally recognize the value among energy stocks in 2017, or will investors wait for oil prices to climb higher? Phillips’ shareholders are being paid to wait for investors to catch on to its value. The company has a history of declaring an annual increase in the dividend in early May. Shareholders are currently receiving $0.70 per share each quarter, with a current yield of 3.49%. That’s almost double the S&P 500 dividend yield of 1.92%!

The company repurchases stock on a regular basis. Total outstanding shares were reduced by 2.73% in 2016, and by 16.1% in the five years ending in December 2016. The company spent another $285 million on share repurchases in the first quarter of 2017. Both the high dividend yield and the stock buybacks serve to reduce potential volatility in the share price.

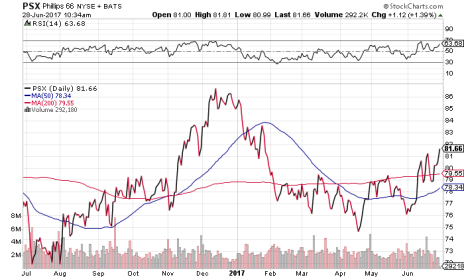

PSX is a large-cap stock in the energy sector. The stock has been trading in a sideways pattern with a gradual upward slope for the last 3.5 years. During that time period, the stock briefly traded over 90 in late 2015, and has since traded sideways between 75 and 89. PSX is currently rising toward its recent December 2016 high at 87.

I would not buy PSX for a short-term trade, but rather with the expectation that this undervalued energy stock will finally rise above 90 at some point in the next three to 12 months, beginning a sustainable run-up. PSX could appeal to growth investors, dividend investors and value investors.

[author_ad]