Before we get into this recommendation, I just wanted to highlight our upcoming annual conference.

9th Annual Smarter Investing, Greater Profits Online Conference

It will take place from August 17-19 and you will hear from many experts (including me!) about opportunities in the market.

Today, we are recommending an energy name with strong momentum and downside protection.

Some additional details:

It’s levered to natural gas which has recovered sharply in 2021.

- Strong earnings growth and free cash flow generation.

- Downside protection (no debt and significant cash on its balances sheet).

- Insider ownership (management and board own 25% of shares outstanding) and recent insider buying.

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 821

[premium_html_toc post_id="235431"]

“Trades” vs. “Core Positions”

My favorite stock to recommend is a growth-at-a-value-price name like Performant Financial (PFMT), my recommendation last week.

These companies are great because they can grow revenue and earnings significantly, and also benefit from a valuation multiple re-rating.

This is what can generate 5x or 10x returns.

I like to own these types of names for many years, if possible, as long as they keep growing and keep executing (think of PIOE or IDT).

I view these types of investments as “Core Positions.”

But occasionally I like to recommend names that I view more as a “Trade.”

These are names that I see 50% to 100% upside in the medium term (six months to 12 months). They aren’t names that are core positions or that I expect to own for many years. But they are attractive nonetheless.

In the past couple of months, investors have become more concerned about the Delta variant of COVID and cyclical stocks have given back some of their strong performance.

As a result, I think it has provided an opportunity to trade into some cyclical names that look cheap and have downside protection.

In particular, I think energy looks very attractive right now.

Despite high prices, drillers aren’t drilling additional oil/gas wells as they don’t trust the recovery. As a result, I expect energy prices to stay higher for longer than many expect.

In this environment, I believe it makes sense to own producers or royalty companies (DMLP is an example) that will benefit from high prices.

The name that I’m recommending today looks very attractive. It’s cheap (trading at ~5x free cash flow), has high insider ownership, and downside protection (no debt on its balance sheet).

At the same time, this isn’t a name that I necessarily want to own forever. If it rallies 50-100%, I will be happy to move on to another opportunity.

Let’s get into this week’s recommendation: Epsilon Energy.

New Recommendation

Epsilon Energy: Cheap, No Debt, and Hidden Value

Company: Epsilon Energy

Ticker: EPSN

Price: 4.86

Market Cap: $116 million

Enterprise Value: $97.8million

Price Target: 6.49

Upside: 34%

Recommendation: Buy Under 5.50

Recommendation Type: Trade

Executive Summary

Epsilon Energy (EPSN) is a cheap, debt free company, that is generating gobs of cash and buying back stock. Insiders already own 25% of shares outstanding but are buying stock in the open market. The company has downside protection with a net cash balance sheet and a valuable midstream business. I see significant upside over the next 12 months as the company benefits from high natural gas prices.

Epsilon Energy Financial Overview

Background

Epsilon Energy (EPSN) is a North American oil and natural gas development and midstream company with a focus on the dry gas area of the Marcellus Shale of northeast Pennsylvania.

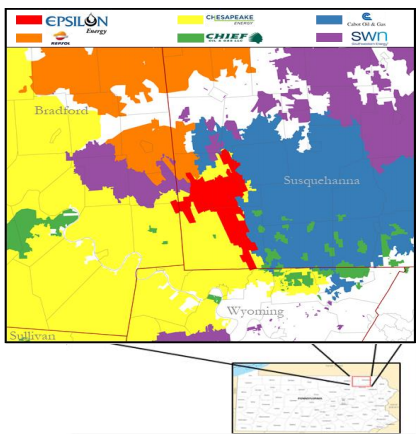

Primary assets are located within the highest quality area of the Marcellus gas resource in Susquehanna County, Pennsylvania.

See below for a map of where Epsilon’s wells are located.

One thing that is important to recognize is that Epsilon’s acreage (in red) is sandwiched in between major oil and gas companies (Chesapeake in yellow and Cabot Oil & Gas in blue). As such, Epsilon could make for an interesting takeout candidate.

The company is focused on low-risk development of multi-year undrilled inventory.

It was focused on generating positive free cash flow before that became “in vogue” in the industry.

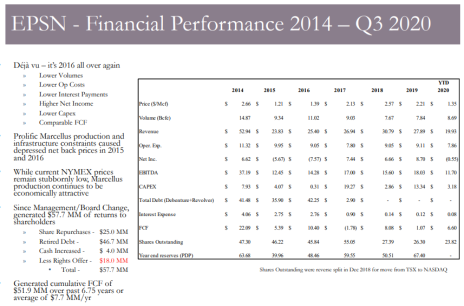

Amazingly, Epsilon even generated positive free cash flow (+$8.3MM) last year during the pandemic.

The other thing that is very important to note is that management is very focused on returning cash to shareholders.

For instance, in 2020, it spent $9MM buying back its own stock and as a result, shares outstanding decreased by 11%. In 2021, the company continues to buy back its own stock.

Midstream Business

In addition to its gas wells, Epsilon owns 35% of midstream assets (gathering facility), which generates stable cash flow and is very valuable.

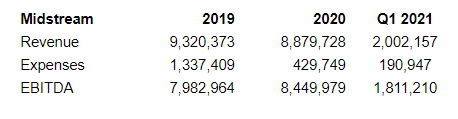

In 2020, Epsilon generated $15.7MM of EBITDA. Its midstream business (as shown below) has generated a solid contribution (54% of total).

Midstream businesses are less reliant on the price of the underlying commodity and so they provide a measure of stability that is very attractive. They also tend to be higher valued than upstream businesses.

Business Outlook

With commodity companies, it’s very hard to predict the future.

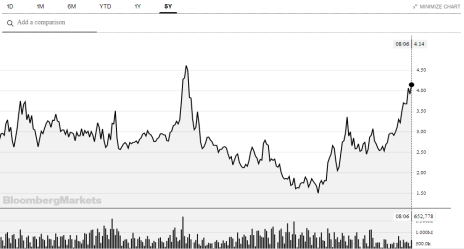

The current price of natural gas has recovered sharply and appears in an uptrend. As such, Epsilon is generating significant free cash flow.

However, I don’t have confidence in my ability to predict the future price of natural gas.

But what is reassuring is that the company has been able to generate positive free cash flow almost every year since 2014 in a wide variety of natural gas pricing scenarios.

Further, as you can see in the chart above, the company has increased cash on the balance sheet by $4MM while also buying back $25MM of stock and repaying $28.7MM of debt (additional debt was paid back via cash from a rights offering).

So I have high confidence that the free cash flow that is generated by Epsilon will make its way to shareholders.

The other equally attractive aspect of Epsilon is that downside is very limited.

The company currently has $17.9MM of cash on its balances sheet and no debt.

Insider Ownership

Insiders own 25% of the company and have been buying in the open market.

As Cabot Micro-Cap Insiders know, insider alignment is high on my checklist.

Even better is when the company is buying back its own stock in the open market because that effectively increases insiders ownership in the business. In 2020, Epsilon bought back and retired 11% of shares outstanding.

Valuation and Price Target

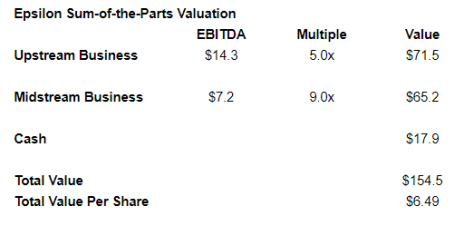

I think the best way to value Epsilon is on a sum-of-the-parts basis as the company has a very valuable midstream operation.

On an annualized basis, the midstream business is on pace to generate $7.2MM of EBITDA in 2021. Typically, midstream businesses trade at 8x to 12x EBITDA. We can assume a 9x multiple for Epsilon’s business given it is relatively small.

The upstream business is on pace to generate $14.3MM of EBITDA in 2021. Cabot Oil & Gas trades at 5.4x EBITDA. We can assume fair value for Epsilon’s upstream business is 5x EBITDA.

Add it all up (including cash), and you get fair value of 6.49, significantly above where the stock currently trades.

My official rating is Buy under 5.50.

As always is the case with micro caps, use limits as volume is quite low.

Risks

This is an energy name and commodity markets are hard to predict. Nonetheless, risk is limited given the company has $18MM of cash, no debt and generates positive free cash flow.

Recommendation Updates

Changes This Week

Increasing limit for ATTO to Buy under 30.00.

Downgrade DFIN to Hold

Upgrading FPAY to Buy under 2.50

Updates

Aptevo (APVO) continues to be weak on no news. The thesis remains the same: if you back out Aptevo’s cash and the value of its royalty payments, the company’s pipeline is being valued by the market at negative-$14MM. This doesn’t make sense given that Aptevo’s main drug, APVO436, has shown promising data and the company has a pipeline of other assets. This is a high risk/reward trade because the upside could be substantial, but downside could also be substantial if it continues to burn cash with little to show for it. Original Write-up. Buy under 40.00

Atento S.A. (ATTO) reported a great quarter and the stock has shot up. Despite the run-up, I think there’s more upside ahead. In the quarter, revenue increased 22% to $382MM, beating consensus by 4%. EBITDA increased 123% y/y to $50.7MM. EBITDA margin increased to 13.3%, up from 7.1% a year ago. Despite the strong performance, ATTO is still only trading at 3.7x my estimate for 2022 EBITDA. Peers such as Concentrix (CNXC) trade at 10x or high. With the strong performance, I’m increasing my buy limit to 30. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) had no news this week besides that Angelo Gordon, a sophisticated private equity investor, bought more stock in the open market and now owns 9.7% of shares outstanding. I look forward to BBX Capital reporting Q2 results soon (I expect some time in August). I continue to like the stock despite its run-up in performance. My new target is 10.25, which corresponds to 60% of book value. Original Write-up. Buy under 8.00

Donnelley Financial Solutions (DFIN) reported a strong quarter last week. Revenue grew 5% beating consensus expectations by 12% as capital markets activity remains high. The company beat expectations on the bottom line too with EPS of $1.38. Despite the stock’s strong performance it’s still cheap, trading at 8.4x free cash flow and 5.7x forward EBITDA. Nonetheless, I have a few concerns that the company is “overearning” currently given buoyant capital market activities, which tend to be cyclical. I’m going to re-underwrite my investment case to determine if there is enough upside remaining to justify recommending the stock. In the meantime, I’m going to downgrade it to Hold. Original Write-up. Hold

Dorchester Minerals LP (DMLP) reported Q2 2021 earnings of $0.46 or $1.84 on an annualized basis. As such, the stock is trading at 8.6x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a yield of 12%. I continue to like this low-risk stock which will continue to benefit from higher oil prices. Original Write-up. Buy under 17.50

Drive Shack (DS) reported an excellent quarter with revenue growth of 130%, beating consensus expectations by 9%. The company reported EBITDA of $7.7MM versus consensus expectations of $1.2MM. The investment case is on track for Drive Shack. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target is 6.00. Original Write-up. Buy under 4.00.

FlexShopper (FPAY) recently reported a strong quarter but missed expectations slightly. Revenue grew 25% y/y to $30.7MM. Looking out to the rest of the year, strong growth should continue as the company is expanding its pilot program with an undisclosed national retailer and has added a second national retailer to its pilot program. Further, the company’s chairman, Howard Dvorkin, has been consistently buying in the open market, demonstrating his confidence in the long-term growth of the business. My 12-month price target for FlexShopper is 4.70. I recently downgraded the stock to rebalance my portfolio, but I’m not upgrading it to buy under 2.50. Original Write-up. Buy under 2.50.

Greystone Logistics (GLGI) is primed to continue performing well. Last quarter looked weak on the surface, but it was all driven by the timing of one order. As a result, next quarter (expect it to be released within a few weeks) should be very strong. It’s trading at 8.3x current-year earnings, which is too cheap given strong growth potential. When I published my original investment case, my price target was $1.58. It’s likely that I will update that price target once the company reports quarterly results. I arrived at my initial $1.58 price target by multiplying its historical P/E multiple (10.5x) by my estimate for fiscal 2021 EPS ($0.15). I want to wait to see fiscal Q4 results before I adjust my price target. My rough estimate is that GLGI could earn $0.27 in fiscal 2022. If that’s the case, and we assume it trades at its five-year median multiple of 9.3x (the historical multiple came down slightly), my price target could increase to ~$2.50. Original Write-up. Buy under 1.30.

HopTo Inc (HPTO) has been relatively weak on no news. I expect the company to report earnings soon and it will be good to see an update with regards to revenue growth. I hope to see some acceleration. Longer term, I believe the stock is worth ~0.80. Nonetheless, I recently downgraded the stock as I’m rebalancing my portfolio. Original Write-up. Sell 3/4.

IDT Corporation (IDT) continues to perform very well as its core business (legacy telecom) and high-growth subsidiaries (BOSS Money Transfer, National Retail Solutions, and Net2phone) continue to act well. I expect Net2phone to be spun off in early 2022 and National Retail Solutions to be spun off in late 2022 or early 2023. I recently increased my price target to 64, but longer term, I could see this stock trading up to 100 or higher. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) has been languishing recently. Its CFO resigned recently and it’s late in filing its financials. Nonetheless, I have full confidence that the financials will ultimately be filed and that a replacement CFO will be hired. Once this takes place (I hope by year end), the focus will be able to switch back to the company’s growth and excellent position in the podcast hosting market. I continue to have conviction in the stock. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) announced last week that medac received a Complete Response Letter from the FDA related to Treosulfan. Essentially, the FDA cannot approve Treosulfan until it receives additional data and analysis from medac. Medexus hosted a conference call on Friday to review the news. The call was generally positive. Here are the takeaways: Positive: 1) The FDA doesn’t require any additional trials to be run (medac can provide the additional analysis from their existing Phase III trial). 2) The Nasdaq uplisting hasn’t been forgotten. It will likely happen in the future (timing uncertain). 3) IXINITY just had one of its best months ever. Negatives: 1) Medexus has paid medac two $5MM payments and another payment which will be disclosed shortly. This is more than just the initial $5MM payment that I thought. In conclusion, I’m re-underwriting the opportunity, but my sense is the stock looks compelling. As long as the base business is growing (my sense is it is), the stock is very undervalued. Original Write-up. Buy under 5.00

Performant Financial (PFMT) is performing well. It has a fast-growing healthcare business which is being obscured by its declining legacy student loan recovery business. The healthcare business is poised to grow 30%+ for the foreseeable future. Despite its fast growth, the company is trading at a big discount to a competitor which was recently acquired. My price target implies ~70% upside, but longer term, this could be a multi-bagger. Original Write-up. Buy under 5.00

P10 Holdings (PIOE) continues to look attractive. It is currently trading at 10x free cash flow and 13.0x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE), which trades at 28.2x EBITDA and 21.5x free cash flow. Given the stock is valued so reasonably and has great room for growth, I recently upgrading it to Buy under 8.00. Original Write-up. Buy under 8.00

Stabilis Solutions (SLNG) reported record earnings last week with revenue of $16.1MM, up 221% y/y. It was 45% above Q2 2019 revenue (pre-pandemic) of $11.0MM. The investment case remains on track. As a reminder, Stabilis Solutions specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own over 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. I continue to watch this name. In the most recent quarter, revenue increased slightly. It trades at an EV/EBITDA multiple of 8.4x which is pretty reasonable for a company that has a strong outlook. The one area of concern is that 75% of sales go to GNC. Nonetheless, FitLife’s resilience in 2020 was amazing.

Gatekeeper Systems (GKPRF) is a Canadian hardware and software company that provides solutions and services for public transportation and school buses. The business is lumpy but is on an upward trajectory and will likely improve margins considerably over the next three years. The valuation looks reasonable.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 8/10/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 17.50 | -45% | Buy under 40.00 |

| Atento SA (ATTO) | 22.35 | 4/14/21 | 27.25 | 22% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 7.49 | 136% | Buy under 8.00 |

| Donnelley Financial Solutions (DFIN) | 14.54 | 11/11/20 | 33.57 | 131% | Hold |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 16.19 | 58% | Buy under 17.50 |

| Drive Shack (DS) | 2.58 | 5/12/21 | 2.75 | 19% | Buy under 4.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.36 | 11% | Buy under 2.50 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 1.32 | 63% | Buy under 1.30 |

| hopTo Inc (HPTO) | 0.39 | 4/28/20 | 0.37 | -5% | Sell Three Quarters |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 54.59 | 182% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.45 | 13% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 3.43 | 93% | Buy under 5.00 |

| Performant Financial (PFMT) | 4.66 | 7/14/21 | 4.75 | 2% | Buy under 5.00 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 7.50 | 279% | Buy under 8.00 |

| Stabilis Solutions (SLNG) | 7.85 | 6/9/21 | 7.37 | -6% | Buy under 9.00 |

*Includes 0.75 distribution and 1.35 distribution.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, IDT, FPAY, DMLP, PFMT, DS, and SLNG. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on September 8, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.