Today, we are recommending a small Canadian specialty pharma company that checks all the boxes of what we typically look for:

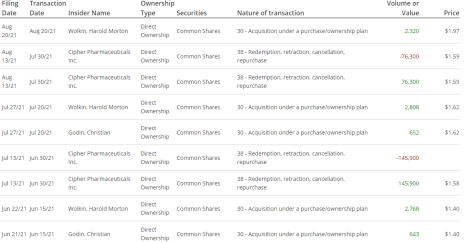

- High insider ownership (insiders own ~41% of shares outstanding)

- Recent insider buying (insiders bought as recently as August 21)

- Strong momentum (stock is near 52 week high)

- Low valuation (P/E of 5.2x)

- Low share count (only 26MM shares outstanding)

- Strong revenue growth potential (promising pipeline)

- No debt (29% of market cap is in cash)

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 921

[premium_html_toc post_id="237105"]

Back to School

My daughter started kindergarten last week while my son will be starting his second year of pre-school next week.

School starts with half days, but by next week, we will be on to full days and back in the swing of things.

While summer is nice, I do enjoy the change of season and being back in a normal school schedule for the kids.

Also, September is my favorite month – the weather is perfect.

In terms of stock market returns, September is usually not a good one for stocks….so don’t be surprised if stocks take a step back.

Whenever I give a webinar presentation, I highlight the characteristics that I look for when picking stocks for Cabot Micro-Cap Insider.

I typically look for stocks that have the following attributes.

- Low valuation

- Strong momentum

- Low liquidity

- High insider ownership

- Strong growth potential

Statistically speaking, these types of micro-caps tend to perform the best.

The name that I’m recommending this week “checks all the boxes” on my list.

Without further ado, let’s discuss this month’s idea: Cipher Pharma.

New Recommendation

Cipher Pharma: Growth Potential at a Dirt Cheap Valuation

Company: Cipher Pharma

Ticker: CPHRF

Price: 1.69

Market Cap: $45 million

Enterprise Value: $16 million

Price Target: 2.50

Upside: 48%

Recommendation: Buy Under 2.00

Recommendation Type: Rocket

Executive Summary

Cipher Pharma (CPHRF) is a cheap, Canadian specialty pharma company that has a promising pipeline. Despite strong potential, the stock trades at a draconian valuation. Insider ownership is high and insiders have been buying the stock in the open market. Further, the company is buying back its own shares in the open market. Downside protection is high given net cash on its balance sheet and strong free cash flow generation. My price target of 2.50 implies good upside over the next 12 months.

Company Overview

Background

Cipher Pharma is a Canadian specialty pharma business that was spun out of CML Healthcare Inc in 2003.

CML Healthcare was founded by John Mull in 1970. It was focused on the diagnostics lab and imaging business and grew substantially in Canada both organically and through acquisitions.

In 2003, CML Healthcare announced that it would convert itself into an income trust and pay out the steady stream of cash flows that it receives from its existing lab and medical imaging businesses.

Prior to the conversion, CML Healthcare spun out Cipher Pharmaceuticals, which was its drug development business.

Cipher Pharma’s strategy was to develop drugs on its own and then to license those drugs to other pharma companies for distribution.

In 2015, Cipher acquired a company called Innocutis for $46MM. At the time, Innocutis had ~$10MM of sales and 31 sales representatives.

Cipher changed its strategy away from relying on third parties to sell its products and began to sell all of its products itself. This proved to be a mistake and Cipher has abandoned that strategy and gone back to its roots of relying on third parties.

Current Business

Cipher’s drug portfolio is comprised of the brands listed below.

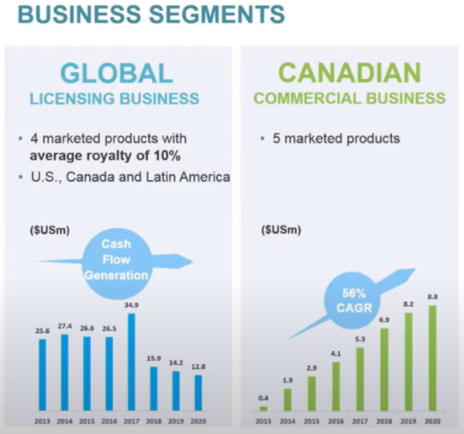

Over the past three years, revenue has declined slightly from $22.7MM in 2018 to $21.6MM in 2020.

In reality, there have been many moving parts in the business. The global licensing business is relatively mature and declining while the Canadian Commerical business is growing rapidly.

The big decline in the U.S. business has been driven by generic competition for the company’s biggest product, Absorica (acne).

However, Cipher has launched a low dose version of Absorica called Absorica LD which has reversed the franchise’s revenue decline.

In Q2 2021, Absorica and Absorica LD sales increased 25% to $2.5MM.

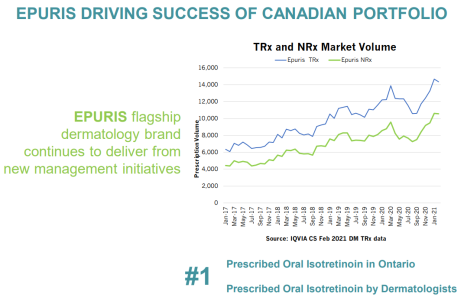

Cipher’s big Canadian revenue driver is Epuris (acne). It is the same chemical as Absorica, but has a different brand name.

In Q2 2021, Epuris grew 63% to $3.1MM.

The acne market is growing nicely and Epuris is taking market share as it’s the best drug on the market.

Business Outlook

As discussed above, revenue has trended slightly down over the past couple of years. However, in the most recent quarter (Q2 2021), revenue grew 30% to $6.1MM driven by stabilization of Absorica and the strong growth from Epuris as discussed above.

Given these trends, I expect revenue to grow through 2022, at which point the pipeline may begin to contribute strongly.

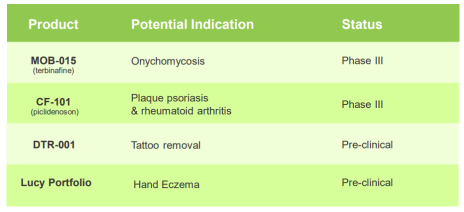

Cipher has two phase III drugs that could contribute in the near term.

First, MOB-015 is a drug in development for nail fungus. The market in Canada for this indication is ~$85MM. We could have approval within 12 months.

Second, CF-101 is a drug in development for psoriasis and rheumatoid arthritis, a multi-billion dollar market. Most treatments for psoriasis and rheumatoid arthritis are biologics (injectable), but this is an oral drug and would be easier to take.

Finally, the company has plenty of cash to evaluate licensing deals or potential acquisitions. However, given that prior acquisitions have been unsuccessful, the management team is being incredibly patient to find the right opportunity.

Insider Ownership

As Cabot Micro-Cap Insiders know, insider alignment is high on my check list.

Insiders own ~40% of the company and have been buying in the open market. Further, the company has been buying back its own stock in the open market.

Valuation and Price Target

The valuation analysis is pretty easy given how much free cash flow Cipher generates. In 2020, it generated ~$11MM of free cash flow.

Through the first half of 2021, the company has generated $7.6MM of free cash flow, or $15.2MM on an annualized basis.

But for the sake of conservatism, let’s assume Cipher deserves to trade at 6x 2020 free cash flow (a large discount to other specialty pharma peers). In this case, the stock is worth $2.50.

The seems very conservative given that the company has no debt and 36% of its market cap in cash. However, I’m going to do confirmatory due diligence and may increase my price target after I have a chance to speak with the company.

I need to get comfortable with the long-term outlook of the business. Absorica’s patents and royalty arrangements completely expire by 2024. I think it’s likely that Cipher will be able to retain a significant percentage of its revenue either through Absorica LD or through another formulation of the product. Nonetheless, I prefer to start with a relatively conservative price target given that Absorica represents ~41% of the company’s revenue.

My official rating is Buy under 2.00.

As always is the case with micro caps, use limits as volume is quite low.

Risks

- Revenue concentration. Absorica and Epuris represent ~91% of revenue for the business. Absorica has weathered generic competition nicely and Epuris is growing very well. Nevertheless, the revenue concentration is a risk that needs to be monitored.

- Mitigant: I believe revenue concentration will lessen as pipeline products are approved and other drugs are launched.

- Generic competition. Absorica (41% of revenue) is facing generic competition in the U.S.

- Mitigant: Absorica has weathered generic competition relatively well by launching an authorized generic through Sun and also by launching a different formulation (Absorica LD) of the product (low dose).

Recommendation Updates

Changes This Week

No changes.

Updates

Aptevo (APVO) seems to have stabilized. The thesis remains the same: If you back out Aptevo’s cash and the value of its royalty payments, the company’s pipeline is being valued by the market at negative-$13MM. This doesn’t make sense given that Aptevo’s main drug, APVO436, has shown promising data and the company has a pipeline of other assets. This is a high risk/reward trade because the upside could be substantial, but downside could also be substantial if it continues to burn cash with little to show for it. We will see preliminary phase II data later this year which could be a nice catalyst. Original Write-up. Buy under 40.00

Atento S.A. (ATTO) recently reported a great quarter, and after shooting up the stock has retreated. I think there’s more upside ahead. In the quarter, revenue increased 22% to $382MM, beating consensus by 4%. EBITDA increased 123% y/y to $50.7MM. EBITDA margin increased to 13.3%, up from 7.1% a year ago. Despite the strong performance, ATTO is still only trading at 3.5x my estimate for 2022 EBITDA. Peers such as Concentrix (CNXC) trade at 10x or higher. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) recently reported an excellent quarter with revenue increasing 132% y/y. The company is on pace to generate $22MM of free cash flow this year. The company benefited from strong consumer demand, especially in single-family and multi-family housing in many of the markets in Florida where BBX Capital’s real estate segment operates. My new price target is 12.00 which still represents a large discount to book value per share ($17.53). Original Write-up. Buy under 9.00

Dorchester Minerals LP (DMLP) was relatively stable on the week. The company disclosed that the CFO of the company bought stock in the open market. The company recently reported Q2 2021 earnings of $0.46, or $1.84 on an annualized basis. As such, the stock is trading at 9.0x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a dividend yield of 12%. I continue to like this low-risk stock which will continue to benefit from higher oil prices. Original Write-up. Buy under 17.50

Drive Shack (DS) recently reported an excellent quarter with revenue growth of 130%, beating consensus expectations by 9%. The company reported EBITDA of $7.7MM versus consensus expectations of $1.2MM. The investment case is on track for Drive Shack. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target is 6.00. Original Write-up. Buy under 4.00

Epsilon Energy (EPSN) has performed well as natural gas prices have rallied. The company recently reported solid earnings with 12% revenue growth y/y. Year to date the company has generated FCF of $6.3MM or $12.6MM on an annualized basis. As such, it’s trading at a 10x. Also this year, the company has bought back about 1% of shares outstanding. Insiders already own 25% of shares outstanding but are buying stock in the open market. The company has downside protection with a net cash balance sheet and a valuable midstream business. I see significant upside over the next 12 months as the company benefits from high natural gas prices. Original Write-up. Buy under 5.50

FlexShopper (FPAY) continued to see strong insider buying as several directors have bought shares in the open market. These insider buys follow a strong quarter from the company. Revenue grew 25% y/y to $30.7MM. Looking out to the rest of the year, strong growth should continue as the company is expanding its pilot program with an undisclosed national retailer and has added a second national retailer to its pilot program. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50

IDT Corporation (IDT) has pulled back sharply on no news. I view this as a buying opportunity. IDT’s core business (legacy telecom) and high-growth subsidiaries (BOSS Money Transfer, National Retail Solutions, and Net2phone) continue to perform well. I expect Net2phone to be spun off in early 2022 and National Retail Solutions to be spun off in late 2022 or early 2023. I recently increased my price target to 64, but longer term, I could see this stock trading up to 100 or higher. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) has been languishing of late, and I recently wrote an article that addresses why that might be the case. In short, it might become very difficult to buy companies that are not current on their financials or don’t report their financials to the SEC or OTCmarkets.com due to an SEC rule change (15c2-11). I believe this is pressuring Libsyn’s stock lower. But I also believe it represents an opportunity as when the company reports its restated financials it will show a company growing revenue at ~17%. At its current valuation of 2.5x 2021 revenue, it looks very attractive. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) has rebounded since its weak quarter. I think the risk/reward looks attractive at the current valuation. Nonetheless, I’m not going to be buying more stock until I start to see some good news/good execution from the management team. Sales should stay roughly flat sequentially over the next couple of quarters, but I think sales will perk up in the fourth quarter and into 2022. I believe IXINITY has strong potential longer term, and the company has several interesting pipeline opportunities which should drive growth into 2022. Assuming execution improves, there is a lot of upside. I still believe this could be a mid-teens stock within a couple of years. But I’m personally going to be waiting for improved results before adding to my position. If I have to pay a slightly higher price, so be it. It will be a small price to pay to gain increased conviction. Original Write-up. Hold

Performant Financial (PFMT) has rebounded from weakness related to a recent secondary offering ($40MM raise). While I’m disappointed in the dilution, it will improve the company’s balance sheet substantially and allow it to accelerate growth. All in all, the investment case is still on track. My price target decreases a little bit in the medium term to 6.60 (due to the dilution), but longer term, I think this stock could trade over 10. Original Write-up. Buy under 5.00

P10 Holdings (PIOE) continues to look attractive. It is currently trading at 10x free cash flow and 13.0x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 28.2x EBITDA and 21.5x free cash flow. Given the stock is valued so reasonably and has great room for growth, I recently upgraded it to Buy under 8.00. Original Write-up. Buy under 8.00

Stabilis Solutions (SLNG) recently reported record earnings with revenue of $16.1MM, up 221% y/y. It was 45% above Q2 2019 revenue (pre-pandemic) of $11.0MM. The investment case remains on track. As a reminder, Stabilis Solutions specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own more than 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

Watch List

Leatt Corp (LEAT) is a fast-growing South African based company that sells protective gear for motorcycle riders, but it is expanding into other product lines. It’s growing at 100% y/y but is only selling for an annualized P/E of 13x. More work to do but this one looks interesting.

Nanophase Technologies (NANX) is a fast-growing (~50%) skin care company that is trading at a reasonable valuation (22x 2022 EPS).

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 9/7/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 18.15 | -43% | Buy under 40.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 8.00 | 152% | Buy under 8.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 17.27 | 78% | Buy under 17.50 |

| Drive Shack (DS) | 2.58 | 5/12/21 | 2.74 | 6% | Buy under 4.00 |

| Epsilon Energy (EPSN) | 5.10 | 8/11/21 | 5.09 | 0% | Buy under 5.50 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 3.19 | 50% | Buy under 2.50 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 44.22 | 128% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.50 | 14% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.73 | 53% | Buy under 5.00 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 8.05 | 307% | Buy under 8.00 |

| Performant Financial (PFMT) | 4.66 | 7/14/21 | 4.80 | 3% | Buy under 5.00 |

| Stabilis Solutions (SLNG) | 7.85 | 6/9/21 | 6.86 | -13% | Buy under 9.00 |

| * Return calculation includes dividends | |||||

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, IDT, FPAY, DMLP, PFMT, DS, and SLNG. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on October 13, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.