Today, I’m recommending a company that has grown revenue at a 30% CAGR and EBITDA an 80% CAGR over the past 10 years. Despite this impressive growth, the company trades at just 5.3x EBITDA.

Other key points:

- •Top 3 player in the U.S. paper shredding industry.•Massive opportunity for organic and acquired growth.•High insider ownership (over 30% of the company).

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider Issue: June 8, 2022

Lots of Opportunities Out There

While the market has come back a bit in the past couple of weeks, it still feels bleak out there. Walmart (WMT) dropping 20% in a single trading day due to its inventory build. Target (TGT) dropping 26% after a disappointing quarter and then two weeks later warning investors about “excessive inventory.”

While environments like this are psychologically challenging, I’m encouraged – continuing a theme from last month – by the number of attractive opportunities that are available in the market.

Last year, many of my recommendations had price targets that implied 30% to 40% upside – nothing to scoff at. But there are many opportunities in the current market that offer 100%+ upside on a conservative basis (more on that below).

I’m even seeing attractive opportunities in the large-cap space. Usually, I stick to the small- and micro-cap markets as I typically find the best values there, but I’m very happy to own large-cap stocks at a 50% discount to fair value.

Despite a dismal stock market, I do have a few things to be grateful for:

- The Celtics are in the NBA Finals.

I don’t know if they will be able to knock off the Golden State Warriors, but it’s been a good series so far, and I expect it to go at least 6 games.

Until now, I haven’t had a chance to watch Steph Curry for an extended series, and this has been a treat.

The only downside is the NBA games start at 9 p.m., which is way too late for me.

- Summer is finally here.

I know summer technically doesn’t begin until June 21, but it’s definitely summer in Massachusetts. The weather has been wonderful: 80 degrees with no humidity.

Alright, let’s get into this month’s new idea: RediShred Capital (RDCPF).

New Recommendation

RediShred Capital Corp: 30% Grower Trading at 5x EBITDA

Company: RediShred Capital Corp

Ticker: RDCPF

Price: 0.60

Market Cap: $55 million

Price Target: 1.20

Upside: 100%

Recommendation: Buy under 0.70

Recommendation Type: Rocket

Executive Summary

RediShred is a Canada-based, leading document destruction services company. Insiders own more than 30% of the company. It has grown revenue at a 31% CAGR and EBITDA at an 80% CAGR over the past 10 years through organic and inorganic growth. Future growth is poised to continue yet the stock trades at just 5x forward EBITDA. I see 100% upside over the next 12 months and significantly more upside looking out a few years.

Company Overview

Background

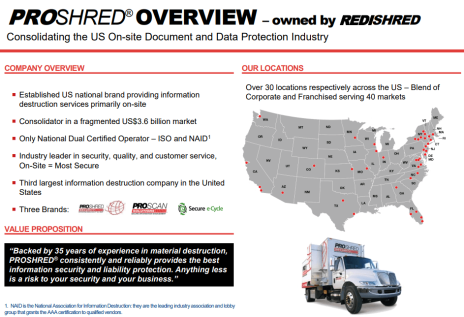

RediShred is the third-largest document destruction firm in the United States. Its most notable business line is PROSHRED, a paper shredding franchise business for small- to medium-sized enterprises (SME). It also does some electronics disposal.

RediShred is managed in Canada but operates mainly in the U.S. PROSHRED operates in 21 different states and 40 different markets. RediShred has been around since 2006. It began when PROSHRED started in the Philadelphia market.

The paper shredding and disposal industry is a $3.6b market in which RediShred is the third largest. The largest player is Iron Mountain with a 25% market share, however, its focus is working with large companies. Next is Shred It, which is owned by Stericycle as of 2015 and controls a 20% market share.

This is RediShred’s main competitor as Shred It has mainly focused on SMEs similar to PROSHRED. PROSHRED holds a little over 1% market share. The next 30% of the market share is accounted for by independent operators who almost universally have two trucks or less and less than $500k in revenue annually. Finally, the last 25% use in-house shredding facilities.

Paper and physical documents are increasingly being viewed negatively by investors. This has caused an exodus especially when many speculated that paper would become obsolete during and after the pandemic.

However, paper usage for the purposes that need to be shredded is steadily increasing over time, and the returns of companies in the sector show this to be true. There were hits to the industry on a short-term level in Q1 and Q4 of 2020, but the sector has since fully rebounded.

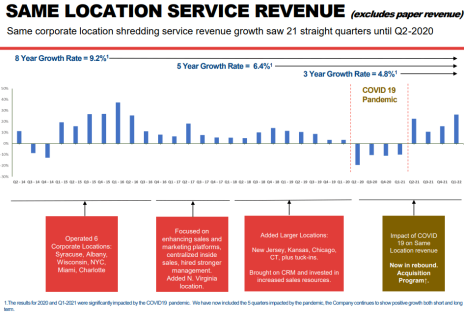

Amazingly, RediShred has generated strong organic shredding revenue growth (“same location service revenue”) since 2014, except for during the pandemic.

Despite the rebound in revenue and earnings, RediShred’s stock still trades below 2019 levels.

Shredding is the core of these businesses, but another key is the sorted office paper (SOP) selling business. This is when PROSHRED or any of its competitors shred paper and recycle it to make more paper.

This is Charlie Munger’s idea of selling oil, putting it back in the ground, and selling it again in action. These businesses get paid on both ends of this system. They first get paid to collect and shred the paper and get paid again when they resell the recycled paper. This means that SOP sales are almost pure profit. It is important to note that the price of SOP can be volatile and that this has affected PROSHRED’s earnings, most notably in 2020 when SOP prices dropped to $67 per ton from its peak of $185 per ton in 2018. Over the past 10 years, the average price has been $135 per ton and the price is now hovering in the $150 per ton neighborhood after spiking to the $175-180 range in May 2021.

At a high level, three factors have contributed to RediShred’s growth.

First, the company is growing revenue on an organic basis.

Second, the company is trying to start new franchises to expand its footprint and personally assume little risk in testing new markets.

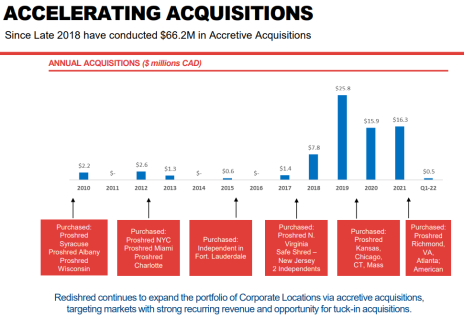

Third, it is making attractive acquisitions. working to repurchase franchises from franchisees in proven markets to assume more value from them. RediShred has paid up to 5-6.5x EBITDA for proven franchises. RediShred will also buy out their smaller competitors; however, these will be at lower multiples (4x EBITDA or lower).

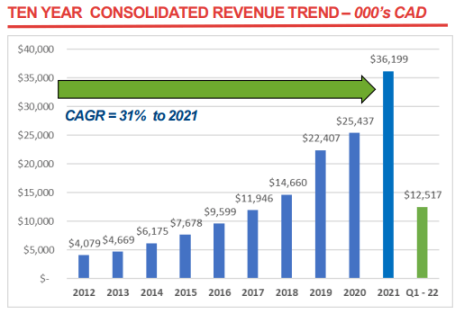

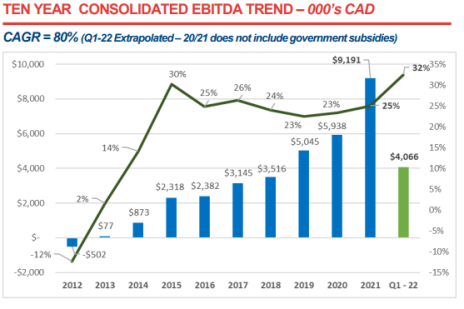

Over the past 10 years, the company has grown revenue at a CAGR of 31%...

…while EBITDA has grown at an 80% CAGR.

Business Outlook

While organic growth should continue, the big driver of growth for the company will be acquisition opportunities.Currently, RediShred has ~1% market share; 30% of the market share is accounted for by independent operators who almost universally have two trucks or less and less than $500k in revenue annually. Many of these would be perfect tuck-in acquisition opportunities.

Just taking RediShred’s business from 1% to 2% would double revenue.

I believe this opportunity is massive. And it’s one that the company has been focusing on.

It’s important to be cautious with companies that are highly acquisitive or “roll-ups.”

Some of the biggest frauds (MCI Worldcom, Tyco, etc.), were “roll-ups” but some of the best-performing stocks of all time were also “roll-ups” (Danaher, Constellation Software, etc.).

What gives me comfort is management owns a ton of stock, so we are highly aligned. The company isn’t just growing for growth’s sake.

Even though RediShred is a relatively small company, it does have competitive advantages:

- It’s much larger than most of its competitors which enables it to maximize efficiency with route planning and density.

- It can generate higher margins than smaller peers due to shared overhead.

- It has a better brand and compares favorably to other “a few guys and a truck” operations.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my check list and is critical when investing in micro-caps.

In total, insiders own over 30% of shares outstanding. The largest shareholder is billionaire Moray Tawse at ~15%.

The CEO and directors own ~20% of shares outstanding. Almost all board members purchased more shares at the end of April of this year, which bodes well.

Valuation and Price Target

On an absolute basis, RediShred looks attractive, trading at an EV/EBITDA multiple of 5.4x and an EV/Revenue multiple of 1.7x.

Iron Mountain (IRM), a much larger competitor with slower growth, trades at 14x forward EBITDA and 4.9x forward revenue.

In 2015, Stericycle bought Shred-It, another larger competitor for 3.2x revenue (EBITDA multiple is unavailable).

Based on these two data points, RediShred looks compelling on a relative basis.

Given expected revenue growth of ~30% for the foreseeable future, I think a 9.5x EBITDA multiple is more appropriate (this would still represent a large discount to Iron Mountain).

At 9.5x EBITDA, RediShred is worth 1.20. Over time, I think the stock could be worth significantly more.

My official rating is Buy under 0.70.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

Roll-up strategies can blow up

- Some of the biggest frauds (MCI Worldcom, Tyco, etc.), were “roll-ups” but some of the best-performing stocks of all time were also “roll-ups” (Danaher, Constellation Software, etc.).

- Management owns a ton of stock, so we are highly aligned. The company isn’t just growing for growth’s sake.

Leverage

- The company relies on debt to make acquisitions, but leverage ratios are very reasonable (net debt to EBITDA is ~1.0x).

Recommendation Updates

Changes This Week

None

Updates

Aptevo (APVO) had no news this week. It reported earnings in early May. The company disclosed that it earned $10MM in milestone payments related to 2021 sales of RUXIENCE. It is optimistic that it will receive an additional $22.5MM in capital over the next two years. As of March 31, 2022, Aptevo has $30MM of net cash and, as detailed above, expects to receive an additional $22.5MM over the next few years. Aptevo’s cash burn over the past year was $22MM. As such, it can probably make it another two years without raising cash. However, the company probably does want to raise capital at some point. From a fundamental perspective, Aptevo continues to report good data for its lead compound APVO436 in patients with acute myeloid leukemia (AML). This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported earnings in May and has gotten absolutely crushed. This market is punishing stocks that miss expectations. Revenue came in at $1.45BN, up 5.7%, but missed consensus expectations slightly. The bigger issue is EBITDA decreased 10% to $35MM. The EBITDA shortfall was driven by lingering issues related to the cyber hack, higher inflation and the Omicron surge. Despite the weak quarter, management maintained its guidance for mid-single-digit constant currency revenue growth and 13.5% EBITDA margins. This may be optimistic, but the share price drop looks like an overreaction. At the end of the day, the stock is trading at just 3x EBITDA while peers trade at closer to 12x EBITDA. Original Write-up. Buy under 20.00

Cipher Pharma (CPHRF) reported earnings last week. They were great. Revenue was flat year over year, but EPS increased from $0.05 last year to $0.08 this year. The EPS increase was driven by cost cutting (operating expenses decreased 25%). Meanwhile, ~2% of shares were repurchased during the quarter. Currently has $22MM of net cash on its balance sheet, representing 48% of the company’s market cap. Cash flow should be stable for at least the next 4-5 years which will provide time for the pipeline to emerge. The company continues to move its pipeline forward and evaluate accretive acquisition opportunities. Original Write-up. Buy under 2.00

Cogstate Ltd (COGZF) had no news this week. It is a profitable, rapidly growing Australian company that is the market leader in computerized cognition testing. The biggest use case is Alzheimer’s Disease, which is a massive and growing market. Cogstate is benefiting from a boom in Alzheimer’s R&D spending which is driving 20%+ revenue growth. Longer term, Cogstate’s direct-to-consumer Alzheimer’s test could accelerate growth even further. Despite a terrific outlook, Cogstate trades at just 25x current earnings. Looking out a few years, this stock could easily double or more. Original Write-up. Buy under 1.80

Crossroads Systems (CRSS) had no news this week. It reported earnings results in April. PPP has ended, but Crossroads continues to process the forgiveness of loans. In addition, the company continues to focus on funding impact loans across the country. Book value currently sits at $11.68, slightly below the current stock price. The management team and board of directors have a track record of creating shareholder value (the company paid a special dividend of $40/per share in 2021 due to windfalls from the PPP program). As such, the current valuation looks attractive. Original Write-up. Buy under 15.00

Currency Exchange International (CURN) had no news but continues to drift up. The company is benefitting from the post-pandemic travel boom yet only trades at 6x EBITDA. It is growing revenue by 100% and is expanding margins rapidly. Insider ownership is high, and the company has a rock-solid balance sheet. Finally, Currency Exchange has a hidden asset (its payments business) which is highly valuable. I see 100% upside. Original Write-up. Buy under 16.00

Dorchester Minerals LP (DMLP) continues to perform well. Dorchester recently announced its Q2 distribution of $0.75, which annualizes to an 9.6% yield. The company is benefiting from high commodity prices. While commodity prices will continue to be volatile, I expect them to remain elevated for the foreseeable future. Dorchester will pay out all windfall profits to shareholders. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) continues to perform well given rocketing natural gas prices. Last year, the company produced tremendous free cash flow and will likely do so again this year. The company currently has $27.1MM of cash (18% of its market cap) and no debt. Epsilon recently committed to paying a quarterly dividend of $0.0625 per share starting on March 31. This works out to a 3.3% dividend yield. In addition, the company approved a share repurchase authorization to buy 1.1MM shares. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) initiated a 9-cent quarterly dividend recently. This works out to a 1% yield. The company reported earnings in late March. Results were excellent, and the investment case remains on track. The company reported Q2 EPS of $0.66, a penny ahead of consensus. Return on equity increased y/y from 13.3% to 15.0%. Esquire remains well capitalized with excellent credit metrics. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca: “There is tremendous potential in both the litigation and payment markets primarily due to the limited number of players and fragmented and inefficient approach to coupling financing, payment processing, and technology. We believe Esquire will be a leader in all three categories in both industries.” Despite its strong outlook, the stock trades at just 12x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) announced quarterly results, and the stock sold off. On a high level, the quarter didn’t look great. Revenue decreased 12% y/y which was driven by a 17% decline in traditional communications revenue. This segment benefitted from the boom in paid calling during the pandemic, but that surge is normalizing. Most importantly, IDT’s high-growth segments continue to grow well. National Retail Solutions (NRS), IDT’s payment terminal business, grew 102% y/y. Net2phone, IDT’s other highly valuable subsidiary, grew recurring revenue by 42%. Further, IDT expects subsidiary growth to contribute to consolidated profitability in the second half of this year. While the spin-off of net2phone has been temporarily delayed, we know that it and NRS will ultimately be monetized. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) has had no news recently. It stopped trading on April 15 (the 14th was the last day of trading) because the SEC revoked the company registration. This sounds like horrible news, but I think it’s actually the opposite. Let me explain. Libsyn has been working with the SEC for ~2 years to restate its financials. Long story short, the prior CEO and CFO did a bad job managing the business and didn’t properly account for state sales tax. As a result, the company had to go back through its financials and restate them all. This process has taken longer than anyone anticipated. However, it appears that we are close to the end of the process. I recently spoke to the CEO, and he told me that the SEC had advised that it would be a more efficient path forward to de-register the stock and then refile financials rather than restate all previous financials. This makes intuitive sense to me. As such, this de-registration is step one. I don’t have a sense for when the financials will be refiled, but I believe it could happen within a few weeks. Once the financials are filed, I believe we will see a fast-growing, profitable company trading at less than 3x revenue. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded in short order. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) announced that the FDA has requested additional data and analysis related to its New Drug Application for Treosulfan. Medac (Medexus’ partner) believes it will be able to provide all the data and analysis by July 2022 (the original 12-month deadline). However, in the case that Medac can’t make the deadline, it can request an extension. In response to the news, the stock has gotten whacked, but I think it is a good buying opportunity. I think the stock is undervalued even if Treosulfan isn’t ultimately approved. I continue to believe that the risk/reward for Medexus looks attractive heading into the second half of the year. Original Write-up. Buy under 3.50

NexPoint Diversified REIT (NXDT) filed an SEC document this week. My take is the SEC should approve NexPoint’s application to deregister unless someone requests a hearing by June 27. As such, the company could get approval as soon as the end of the month. The investment case is on track for NexPoint. It continues to trade at a large discount to NAV, and I expect that gap to close quickly once the REIT transition is complete. Original Write-Up. Buy under 16.00

P10 Holdings (PX) reported another great quarter recently. Revenue increased 32% to $43.3MM while adjusted EBITDA increased 31% to $22.5MM. Assets under management increased 34% to $17.6BN. Higher assets under management will drive continued revenue and earnings growth. The company also announced a $20MM share repurchase. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

Truxton (TRUX) reported another great quarter in April with the company reporting its best quarterly earnings ever. The private banking team continues to grow assets in the Nashville area and rising rates are benefiting the portfolio’s net interest margin. Asset quality remains sound with $0 in non-performing loans and $0 in net charge-offs (that’s pretty good!). The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 12.3x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge Inc (ZDGE) continues to see more insider buying. In total, three different insiders have purchased shares on the open market over the past three weeks. Zedge announced a transformative acquisition in April. It has acquired GuruShots, a company that combines photography with mobile gaming for $18MM up front and an additional potential earnout of $16.8MM in cash or stock. GuruShots is an Israel-based company whose app allows amateur photographers to compete in a wide variety of contests, showcasing their photos. The app generates an impressive ARPMAU of $3.50 (compared to Zedge at $0.06). The app generated $8MM of revenue but is growing rapidly. I had a chance to talk to Zedge investor relations and am optimistic about the opportunity for the Zedge team to scale up GuruShots and cross-sell to its existing Zedge app users. Pro-forma for the acquisition, Zedge is trading at 3.0x EBITDA and looks very attractive. Original Write-up. Buy under 6.00

Watch List

Fortitude Gold (FTCO) continues to look attractive. It is a Nevada-based gold producer that is generating tremendous cash flow from its Isabella Pearl mine. The mine only has three more years of remaining life, but the company is aggressively looking to develop an adjacent property. It also pays a nice dividend.

SWK Holdings (SWKH) is an interesting idea. The thesis is simple (my favorite kind of thesis): The company is a specialty finance company that specializes in small pharmaceutical and health care financing. The company trades at book value yet has valuable hidden assets. Carlson Capital is the company’s largest shareholder and has tried to buy the company twice outright (the board rejected Carlson’s acquisition offers). Finally, SWK could be added to the Russell 2000 Index in June which would drive “forced buying” from index funds.

Unit Corp (UNTC) is a post-bankruptcy re-org energy company that looks interesting. The business is made up of an upstream oil and gas business that is for sale, a contract drilling business, and a midstream business. The press reported that Unit is seeking up to $1BN for its upstream assets. However, the company currently has unprofitable hedges that it would have to cover in the event of a sale. Nonetheless, the potential sale proceeds compare favorably to the company’s current market cap of $582MM and enterprise value of $750MM. Besides the upstream business that is listed for sale, Unit has a valuable contract drilling business and midstream business.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price on 6/7/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 5.20 | -84% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 13.20 | -39% | Buy under 20.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 1.88 | 4% | Buy under 2.00 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.18 | -31% | Buy under 1.80 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 13.50 | -4% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 15.53 | 10% | Buy under 16.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 30.46 | 191% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 7.02 | 40% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 36.73 | 8% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 25.40 | 31% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.71 | -4% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 15.44 | 9% | Buy under 16.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.39 | 282% | Buy under 15.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 69.89 | -2% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 5.59 | -2% | Buy under 6.00 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PX, MEDXF, LSYN, IDT, DMLP, and NXDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on July 13, 2022.

Analyst Bio

Rich Howe

Rich is a trained economist and Chartered Financial Analyst (CFA). He has researched and invested in stocks for more than 20 years and has become a recognized expert in micro-cap stock investing. He started his career at investment advisory firm Eaton Vance where he covered a wide range of sectors including software and internet, financials, and health care.

Following his time at Eaton Vance, Rich joined the Citi Private Bank Private Equity Research team and led the creation of a private equity and real estate fund-of-fund that raised over $300 million in capital commitments from sophisticated high net worth individuals and institutions.

Rich left Citi to launch Stock Spin-off Investing, a research service focused on tracking and identifying the most promising stock spin-offs and special situations.

His recommendations have consistently outperformed the market.