Is the Bear Market Over?

The first half of the year was painful, with the S&P 500 falling ~20%.

July was a lot more fun, as the S&P 500 rallied 9%.

And many of our stocks rallied with it.

While that was good to see, I remain slightly cautious and believe we could see another leg down to the market.

Typically once the market crashes 20% it usually bottoms out at a total drawdown of ~36% (on average)

Nonetheless, I’m not overly concerned with the macro environment. Yes, inflation remains high and interest rates are going to have to continue to rise to bring them under control.

But I don’t believe there is anything structurally wrong with the economy.

Compared to the Great Financial Crisis, the current environment seems quite manageable.

No matter the macro environment, I’m looking for stocks with attractive fundamentals and cheap valuations, both relative and absolute.

My newest idea today is a perfect example.

It’s trading at a significant discount to its fair market value and is in the process of liquidating.

What is even better is we get paid a quite-juicy dividend as we wait for the liquidation to progress.

New Recommendation: Copper Property Trust (CPPTL): An Attractive Special Situation

Company: Copper Property CTL Pass Through Trust (“Copper Property”)

OTC: CPPTL

Price: 12.75

Market Cap: $971 million

Price Target: 18.00

Total Return Potential: 51%

Recommendation: Buy under 14.00

Recommendation Type: Slow and Steady

Executive Summary

Copper Property Trust (CPPTL) is an attractive special situation. It is a liquidating trust that will pay out all proceeds as its assets are sold over a period of five years. The proceeds should generate a 50% return over its current price. But the kicker is that this trust pays yield while we wait. The current yield is 10%. And the trust has no debt so our downside is protected. Copper Property CTL Pass Through Trust represents an attractive, low-risk idea.

Company Overview

Background

Copper Property is different from the typical Cabot Micro-Cap Insider idea in that it’s not a company but a liquidating trust.

Here’s how it was created:

After a decade of lackluster performance, financial fallout from COVID-19 forced longstanding retailer JCPenney to file Chapter 11 bankruptcy in May 2020.

The lack of in-store sales during the pandemic made debt servicing untenable, and by filing, JCPenney put itself in a stronger position to reorganize the business with creditors.

Copper Property CTL Pass Through Trust is one of the byproducts of that Chapter 11 bankruptcy.

In exchange for $1B in debt, secured lenders received ownership of the Trust, which consisted of 160 JCP retail locations and six JCP distribution centers.

The objective of the trust is the expedient liquidation of those assets, and the collection of rent on assets pending sale, with all net proceeds being distributed to certificate holders.

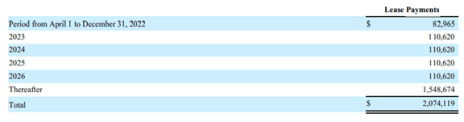

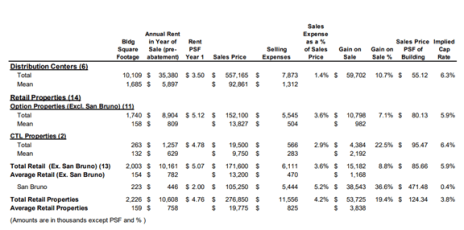

The entity went into effect on January 30, 2021, and has since sold the six distribution centers and 14 retail properties, leaving 146 retail properties for liquidation.

Currently the trust is obligated to dispose of all assets by December 10, 2025.

Trust Assets

All remaining assets are subject to a master lease with JCP as tenant, and the portfolio has 100% occupancy as a result.

The lease is triple-net and has a remaining term of 18 years.

What does triple-net mean? It means that all maintenance expenses and capital expenditures will be paid for by the tenant (in this case, JCPenney). Triple-net leases are very attractive to the owner.

While there was an initial rent abatement of 50% for the first year, there are no remaining tenant concessions, and rent increases up to 2% (based on CPI adjustments) are permitted each year beginning in year 3 (2023).

Although the preceding bankruptcy underscores concerns about JCP’s feasibility as a tenant, the prior closure of unprofitable stores, reduction in overall debt, and detachment from prior pension obligations as part of their Chapter 11 plan have improved their situation considerably.

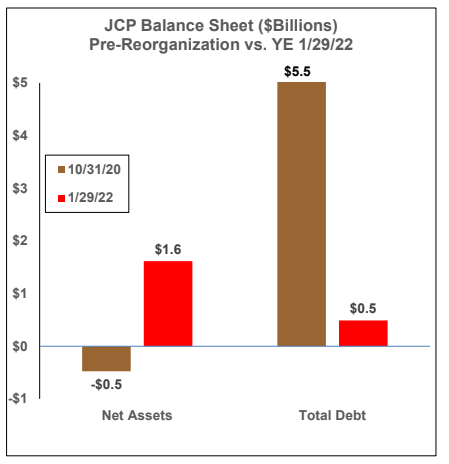

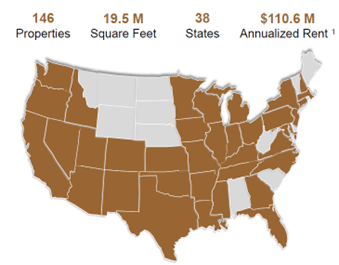

For example, JCPenney debt has decreased from $5.5BN to $500 million.

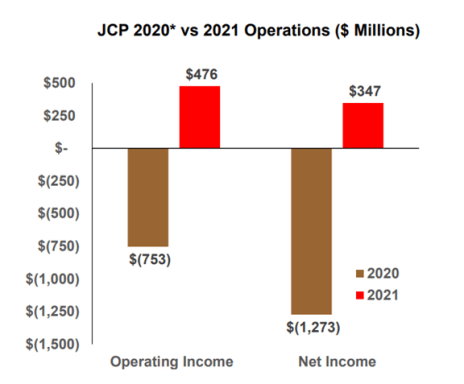

Further, operating income and net income for JCPenney have improved considerably:

These figures create new confidence in JCP’s ability to meet its new lease obligations (previously having owned these assets). Below is an overview of expected undiscounted lease payments as of March 31, 2022, assuming no sales:

This strong payment stream represents one of the most attractive elements of this investment opportunity. Even assuming net payments include costs and fees totaling 10% of lease payments, at the current certificate price, these payments equate to an annual dividend yield of roughly 10% over the vehicle’s remaining life in the event no properties were sold.

However, since the purpose of the trust is to liquidate these assets, this cash flow perspective is only one part of the CPPTL puzzle.

Although the lease risk is concentrated solely with JCP, the remaining retail properties are relatively diversified across the U.S. Below is a high-level overview of the current holdings:

California and Texas are the most concentrated states in the portfolio, with 48 properties representing 31% of square footage and approximately 34% of annual rent. Florida is the third most significant state with nine properties, but outside of those three states no single state holds more than six properties.

This diversification offers some protection against regional economic shocks, as management has the strategic flexibility to dispose of assets in any order they choose.

Trust Organization and Management

The trust’s administrative duties are handled by GLAS Trust Company, LCC, a multinational agency specializing in distressed and restructuring transactions.

They also serve as the trustee for another entity generated by JCP’s Chapter 11 filing. For asset management, GLAS enlisted the services of Hilco Real Estate, LLC, which provided individuals to serve as the officers of Hilco JCP, LLC (a newly created affiliate designed to dispose of these assets).

Hilco has been involved in the repositioning of over 35,000 leases and the disposition of over 200 million square feet of commercial real estate in the last 15 years.

These groups have extensive experience in their respective roles, and with the operational limits on the trust’s actions (effectively rent collection and sales only) there are minimal concerns surrounding their ability to execute.

OutlookHistorical Performance

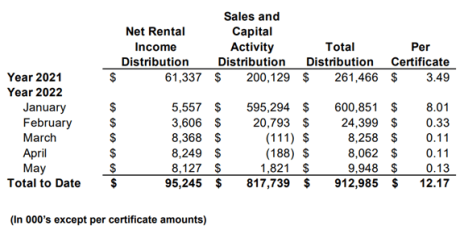

To date, the trust has liquidated 14 retail properties and six distribution centers, distributing $900 million, or approximately $12 per certificate. Below is an overview of distributions through May 2022:

There are two primary factors driving the future outlook for CPPTL: ongoing operations of JCP, and the real estate market for retail properties.

Regarding JCP, although threats to retail still abound, their current cash flows and reduced debt holdings make their solvency for the duration of this vehicle highly likely.

Their revenues for the three months ended April 30, 2022 were $1.7 billion, with net income (after expenses including the master lease) of $89 million. Their cash and cash equivalents on hand were $147 million, approximately $36 million greater than an entire year’s lease obligation. While substantial threats to their business model exist in the long run, we do not view JCP’s operation as the most significant risk to CPPTL given the trust’s expected life and purpose.

There is decidedly less certainty regarding the disposition of the remaining 146 retail properties. The factors impacting the sale of these assets range from the existential to the fundamental.

On the existential side: The accelerated rise of e-commerce raises questions about the use case of retail space, and it’s worth noting many companies are reexamining their geographical footprints after the pandemic.

While these concerns are material, it seems unlikely the economy will completely abandon brick and mortar models (particularly by the end of 2025).

Fundamental issues like retail revenues and interest rates are easier to quantify, but with the country possibly in a recession and an unclear path forward for the Fed, it is impossible to predict with certainty under what conditions the asset managers will be conducting their sales.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my check list and is critical when investing in micro-caps.

In the case of this trust, it’s a little different.

The trust company and asset managers are not permitted to hold certificates.

But we are well aligned, nonetheless.

GLAS’ sole business is administrating transactions such as this, and their fee structure is fixed; their only focus is the effective management of the assets, and avoiding any reputational fallout from the process. Hilco is paid fees based on rents collected and sale proceeds, which almost perfectly mirrors the certificate holder’s position.

The initial recipients of these 75 million certificates were the secured lenders of JCP, and many owners hold considerable stakes (such as Silver Point Capital, which owns over 12 million certificates).

In fact, Silver Point Capital is currently selling in the open market. I’m not concerned with this and believe it represents an opportunity as it creates a temporary overhang.

Silver Point has already made a considerable return on its investment and is likely just moving on to the next distressed debt investment.

Valuation and Price Target

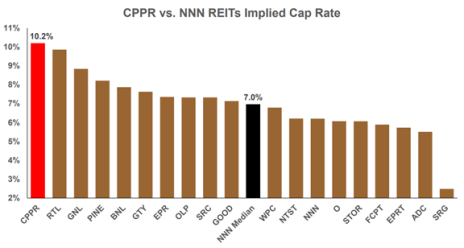

The best way to value real estate assets is using capitalization rates, or “cap rates.”

To get the cap rate for a real estate property, you divide the property’s net operating income by its sale or purchase price.

With cap rates, the higher the cap rate, the cheaper the property.

In Q1 2022, the Trust generated $23.6MM of operating income, or $94.4MM on an annualized basis.

Currently, the Trust has a market cap of $956MM. Therefore, it is trading at a cap rate of 9.9%.

This is very cheap.

As shown above, triple net REITs trade at an average cap rate of 7%. At a cap rate of 7%, Copper Property is worth $18 per certificate.

Importantly, sales to date have been at cap rates below 7%, as shown below.

Plus, you get to collect a 10% dividend yield while you wait for the certificate price to get close to my fair value estimate.

As always is the case, micro-caps are illiquid. Be sure to use limits.

My official rating is Buy under 14.00

Customer Concentration

- This is obvious, but the Trust is highly dependent on the performance of JCPenney. Given that JCPenney has reduced debt dramatically and is now profitable, I’m not particularly worried about this risk.

Selling Pressure from Legacy Shareholders

- I covered this one above in the “Insider Ownership” section, but the initial recipients of these 75 million certificates were the secured lenders of JCP, and many owners hold considerable stakes (such as Silver Point Capital, which owns over 12 million certificates).

- These owners will be selling to get liquidity. As such, it could put pressure on the stock.

Recommendation Updates

Changes This Week: None

UpdatesAptevo (APVO) has had no news in a few weeks. The company announced positive data during the week of June 9 from its phase 1b trial in MDS patients treated with APVO436. Thirty-six percent of patients achieved a remission. As of March 31, 2022, Aptevo has $30MM of net cash and expects to receive an additional $22.5MM over the next few years. Aptevo’s cash burn over the past year was $22MM. As such, it can probably make it another two years without raising cash. However, the company probably does want to raise capital at some point. From a fundamental perspective, Aptevo continues to report good data for its lead compound APVO436 in patients with acute myeloid leukemia (AML). This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported another weak quarter. Management lowered revenue guidance to flat versus consensus of +4% growth and previous guidance of “mid-single-digit” growth. EBITDA margin guidance has been reduced to 12% (at the midpoint) from 13.5%. While this quarter and guidance cut was disappointing, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) had no news this week. The company reported earnings in May. They were great. Revenue was flat year over year, but EPS increased from $0.05 last year to $0.08 this year. The EPS increase was driven by cost cutting (operating expenses decreased 25%). Meanwhile, ~2% of shares were repurchased during the quarter. Cipher currently has $22MM of net cash on its balance sheet, representing 48% of the company’s market cap. Cash flow should be stable for at least the next 4-5 years which will provide time for the pipeline to emerge. The company continues to move its pipeline forward and evaluate accretive acquisition opportunities. Original Write-up. Buy under 2.00

Cogstate Ltd (COGZF) reported preliminary fiscal year results last week. In total, revenue increased 38% to $45MM driven by continued strong Alzheimer’s trial revenue. EBIT came in at $10.5MM, up over 200% y/y. The company executed $82.5MM of new clinical trial sales contracts, up 74% from the prior year. The one slight negative was Q4 2022 revenue was negative, impacted by slower-than-expected patient enrollment in a key Alzheimer’s trail that delayed revenue recognition. Contracted revenue increased 72% on a y/y basis. The backlog did decrease slightly q/q due to 1) manufacturing problems for a drug and 2) enrollment issues.

Nevertheless, the long-term outlook for Cogstate looks excellent.

- Eisai’s lecanemab is expected to read out the Phase III data towards the end of this year (November estimate).

- Roche’s gantenerumab data is expected in Q4 2022.

- Lilly’s donanemab data is expected mid-2023.

If these data read-outs are positive, it’s going to result in even more spending on clinical trials as pharma companies try to further understand their drugs and get additional data. Further, a positive read-out would increase optimism for Cogstate’s healthcare (DTC testing) business. All things considered, the thesis remains on track. Original Write-up. Buy under 1.80

Crossroads Impact Corp. (CRSS) had no news this week. On July 11, the company announced that P10 Holdings (PX), another CMCI recommendation, is investing $180MM of equity capital (through one of its investment funds) at $10.76 a share with the ability to commit an additional $310MM of equity capital at the same price. This will enable Crossroads to really ramp up its ESG lending ability and grow earnings. It will also enable Crossroads to scale up and eventually explore an uplisting to a major exchange. Original Write-up. Buy under 15.00

Currency Exchange International (CURN) reported earnings on June 14. Results were strong but not strong enough, as the stock has sold off since. Revenue increased 109% y/y to $13.3MM. Net operating income increased to $2.9MM up from a loss of $0.6MM last year. Both Banknotes (+103%) and Payments (+127%) grew very strongly. Importantly, management noted that it expects a strong summer travel season which should drive (my opinion) record results. The stock continues to look very cheap. Original Write-up. Buy under 16.00

Dorchester Minerals LP (DMLP) reported Q2 results last Thursday, August 4. They were great, as expected. EPS increased 108% to $0.96 driven by higher commodity prices. In July, Dorchester announced its latest distribution of $0.97 (payable this Thursday, August 11). The company continues to print free cash flow. Dorchester’s latest distribution annualizes to a 14% yield. While commodity prices will continue to be volatile, I expect them to remain elevated for the foreseeable future. Dorchester will pay out all windfall profits to shareholders. Original Write-up. Buy under 25.00

Epsilon Energy (EPSN) announced in June that its CEO and CFO have retired. I’ve gotten more color on this announcement and understand that it was part of a planned transition and that the CEO and CFO will both stay on as consultants for some time. Natural gas prices have stabilized after pulling back and remain quite elevated. Last year, the company produced tremendous free cash flow and will likely do so again this year. The company currently has $30MM of cash (20% of its market cap) and no debt. Epsilon recently committed to paying a quarterly dividend of $0.0625 per share starting on March 31. This works out to a 4% dividend yield. In addition, the company is actively buying back shares (1.1MM share repurchase authorization). Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) reported earnings on July 25. Results were excellent. Revenue grew 23% y/y while EPS grew 37%. Credit metrics look very strong as the company has an allowance to loans ratio of 1.2%. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca: “There is tremendous growth potential in both our national platforms due to the limited number of participants and the fragmented approach to finance and technology in both markets.” Despite its strong outlook, the stock trades at just 14x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) had no news this week. The company reported quarterly results on June 2. At a high level, the quarter didn’t look great. Revenue decreased 12% y/y which was driven by a 17% decline in traditional communications revenue. This segment benefitted from the boom in paid calling during the pandemic, but that surge is normalizing. Most importantly, IDT’s high-growth segments continue to grow well. National Retail Solutions (NRS), IDT’s payment terminal business, grew 102% y/y. Net2phone, IDT’s other highly valuable subsidiary, grew recurring revenue by 42%. Further, IDT expects subsidiary growth to contribute to consolidated profitability in the second half of this year. While the spin-off of net2phone has been temporarily delayed, we know that it and NRS will ultimately be monetized. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. It is a U.K. natural gas provider and is run by an experienced oil and gas operator that created a 40x return on his last public energy company. Kistos is taking advantage of a booming natural gas market in Europe yet only trades at 1x current free cash flow. It has very little debt. The management team is excellent, and they own ~20% of the company, ensuring that we are well aligned. I see at least 100% upside ahead. Original Write-up Buy under 5.50

Liberated Syndication (LSYN) has had no news recently. However, I had a chance to speak to the CEO on June 20. He said the team is working through re-filing its financials, and he expects to “go public” again by the end of September. Instead of just “turning on” trading, he would like to raise a little capital and also pick up coverage from some sell-side analysts. He noted the advertising business is growing very well and that the podcast hosting business is growing again. It had experienced limited growth last year given free hosting competition, but business has picked back up. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded by the end of September. Since you can’t actually buy the stock until then, I rate it a Hold for those who already own it. Original Write-up. Hold

Medexus Pharma (MEDXF) reported earnings yesterday, August 9. They were excellent. Revenue in the quarter increased 33% y/y to $23MM. Sales drivers were IXINITY and Gleolan sales in the U.S. Adjusted EBITDA was $1.9MM. A huge positive was Medexus announced that it has amended its agreement with Medac to extend the payment date for regulatory milestones triggered by an FDA approval to October 2023, which therefore allows Medexus to launch and begin commercialization well before these license payments must be paid. This is a major positive. Recently, Medac provided the FDA with the information that it requested for its Treosulfan review. We will find out within a month whether the FDA deems the re-submission complete. If it does, the FDA will decide on Treosulfan’s approval within six months. Approval would be a huge catalyst for Medexus as its revenue potential would double. I continue to think the risk/reward profile of Medexus is asymmetric to the upside. Original Write-up. Buy under 3.50

NexPoint (NXDT) had no news this week. In mid-July, we saw more insider buying by CEO Peter Dondero. On July 12, the company announced that its long-awaited transition to a REIT is complete. NexPoint will hold an update call today, August 10 (date got pushed back by a week). This is exciting news, and I’m eager to hear more about the strategy going forward. The thesis remains on track, and I see ~50% upside in the next 12 months. Original Write-Up. Buy under 17.00

P10 Holdings (PX) reported another great quarter in May. Revenue increased 32% to $43.3MM while adjusted EBITDA increased 31% to $22.5MM. Assets under management increased 34% to $17.6BN. Higher assets under management will drive continued revenue and earnings growth. The company also announced a $20MM share repurchase. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week. It’s a Canada-based, leading document destruction services company. Insiders own more than 30% of the company. It has grown revenue at a 31% CAGR and EBITDA at an 80% CAGR over the past 10 years through organic and inorganic growth. Future growth is poised to continue, yet the stock trades at just 5x forward EBITDA. I see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 0.70

Truxton (TRUX) reported a great quarter on July 21. Despite a volatile market, pre-provision net revenue grew 9% sequentially 30% y/y. EPS grew 16% y/y. Credit metrics remain strong. The bank has $0 in non-performing loans and $0 in net charge-offs. During the quarter, the company repurchased 22,000 shares for an average price of $70.05. The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 14x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge, Inc. (ZDGE) had no news this week. In mid-July, the company did disclose some insider buying – a welcome sign after investors seemed underwhelmed following the company’s June 18 earnings report. The stock fell as revenue grew by 18% but declined sequentially. Monthly active users (MAUs) in both developing and developed countries also fell sequentially. However, management noted that MAUs are growing again and that they are cautiously optimistic that these trends will continue. Further, the recent quarter included no contribution from the recent acquisition of GuruShots. Given strong recent insider buying, I’m expecting positive news when we hear more details about the integration of GuruShots. The stock remains very cheap trading at 3.4x EBITDA. Original Write-up. Buy under 6.00

Watch List

Bisichi PLC (BISI.L) remains on my watch list. It trades in the United Kingdom but owns coal mines in South Africa. It is very small, with a market cap of only £29MM. As such, it has no sell-side coverage. However, coal prices continue to boom and Bisichi will generate gobs of cash for the foreseeable future. I estimate that it’s trading at a price to free cash flow multiple of 1.5x. Liquidity is very low as insider ownership is high.

Harbor Diversified (HRBR) is a new addition to my watch list. It is the holding company for Wisconsin Airlines, which has a capacity agreement with United. HRBR trades at a negative enterprise value (net cash balance is higher than its market cap) and is profitable. It trades at such a cheap valuation because there is uncertainty on whether its agreement with United will be renewed beyond 2023. Nonetheless, the stock looks very cheap.

Serica Energy (SQZZF) remains on my watch list. It is a U.K. natural gas company. Like Kistos, it’s benefiting from a booming natural gas market and trades way too cheaply (0.8x EBITDA and 1.7x free cash flow). The reason why I prefer Kistos to Serica is that Kistos’ management has more “skin in the game” and are proven operators. That said, I wouldn’t be surprised if both stocks did well. In fact, both companies are trying to buy each other!

Recommendation Ratings

| Stock | Price Bought | Date Bought | Price on 8/9/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 4.27 | -87% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 5.80 | -73% | Buy under 10.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 1.71 | -5% | Buy under 2.00 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.22 | -28% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | -- | NEW | 12.75 | --% | Buy under 14.00 |

| Crossroads Impact (CRSS) | 14.10 | 2/9/22 | 12.24 | -13% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 13.30 | -6% | Buy under 16.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 27.29 | 161% | Buy under 25.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.13 | 23% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 37.99 | 11% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 24.67 | 27% | Buy under 45.00 |

| Kistos PLC (KIST) | 3.06 | 7/13/22 | 4.83 | 58% | Buy under 5.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.22 | 25% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 15.99 | 13% | Buy under 17.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 12.20 | 309% | Buy under 15.00 |

| RediShred (RDCPF) | 0.66 | 6/8/22 | 0.57 | -14% | Buy under .70 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 68.15 | -4% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 3.28 | -43% | Buy under 6.00 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, and KIST. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on September 14, 2022.