An Attractive Set-Up

In the past, I’ve talked about how, historically speaking, you do quite well if you invest three months after the S&P 500 hits the 20% drawdown threshold. It doesn’t matter what you buy – value, growth, small or large – your 12-month prospective returns look quite attractive.

September was the three-month anniversary of the 20% drawdown in the S&P 500.

This week, I’ve found some more data that reinforces my belief that now is probably a good time to be putting money to work.

Research from Fama and French data suggests that forward returns are quite attractive following a 20% drawdown. Specifically, on average, a 20% drawdown is following by a 22.2% one-year return, 41.1% three-year return, and 71.8% five-year return.

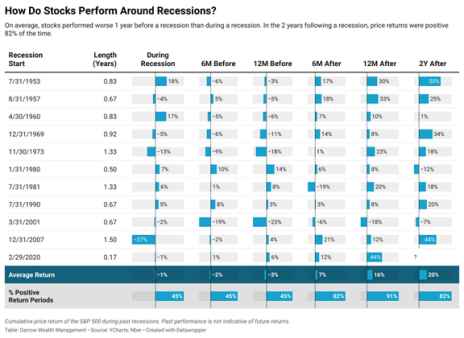

Another important point to remember is that stocks typically perform worse leading up to a recession than during the recession. Most would assume that we are heading into a recession. The chart below shows that the market on average has returned -3% in the 12 months leading up to a recession while only falling 1% on average during the actual recession.

The last point that I want to note is that I’m personally seeing many attractive opportunities in the market.

I touched on this last week, but I want to reemphasize it because it’s the most important point for me.

Two or three months ago, I wasn’t seeing many stocks that looked like obvious opportunities but that has changed.

Speaking of attractive opportunities, let’s get right to my latest idea: Transcontinental Realty Investors (TCI).

New Recommendation: Transcontinental Realty Investors: 100% Upside Real Estate Play

Company: Transcontinental Realty Investors

NYSE: TCI

Price: 40.18

Market Cap: $343 million

Price Target: 80.00

Total Return Potential: 100%

Recommendation: Buy under 45.00

Recommendation Type: Rocket

Executive Summary

Transcontinental Realty Investors (TCI) is a real estate company that just completed a massive asset sale. As a result of the sale, the company now has ~87% of its market cap in cash. Once the transaction is reflected in Q3 2022 financials, Transcontinental should see a big boost as investors recognize value that has been crystalized. Finally, insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price.

Overview

Background

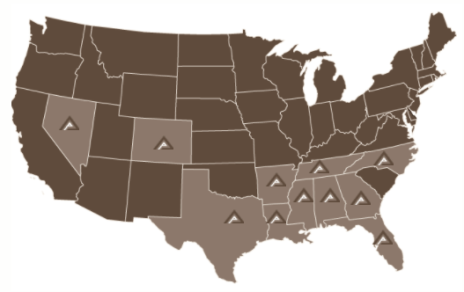

Transcontinental Realty Investors (“TCI”) is an externally managed real estate company with a portfolio of Class A multifamily apartments in the Southeast, and several commercial buildings and land.

The trust of late billionaire Gene Phillips owns 86% of the company. The trust is controlled by his children. Mr. Phillips passed away in 2019 and, given the recent large monetization (more details below), this could serve as a catalyst for a company sale.

TCI owns the following assets:

- 51 multifamily complexes with 9,888 units in the JV with Macquarie.

- This JV was recently monetized (more details below).

- 6 commercial buildings – 5 offices and 1 retail. All leased.

- Land

- 1,961 acres of developed and undeveloped land.

- 1% stake in a mortgage loan trust.

Here is the geographic footprint of the company’s assets:

TCI’s crown jewel was its 50% interest in the Victory Abode Apartments (VAA) joint venture with Macquarie. VAA owns 10,000 units in 52 MF properties in the Sunbelt (TX, FL, AR, LA, CO).

In June 2022, TCI announced that the joint venture was recently sold for $2.04BN. The transaction closed in September 2022.

TCI will receive ~$300MM in net proceeds (after repaying debt and sharing proceeds with its JV partner).

The size of the distribution is impressive when considering that TCI has a market cap of $343MM. In other words, once all proceeds are paid out from this transaction, the company will have cash on its balance sheet representing 87% of its market cap.

Outlook

Post the closing of the JV sale, Transcontinental owns the following:

- 6 commercial buildings – 5 offices and 1 retail. All leased.

- Land

- 1961 acres of developed and undeveloped land.

- 1% stake in a mortgage loan trust.

These assets are located in the southeast, an attractive geography from a demographic perspective (low tax, high population growth, etc.).

But the most exciting part of Transcontinental is that its crown jewel asset (Macquarie JV) has been realized (as discussed above). Pro forma for the distribution, TCI will have 87% of its market cap in cash.

The key question is:

“What will the company do with the cash?”

In this situation, I like to remember Charlie Munger’s words.

“Show me the incentive, and I will show you the outcome.”

Currently insiders own 86% of TCI’s shares. The minority shares that they don’t control are trading at about a 50% discount to fair value by my estimate.

Insiders are incentivized to buy the remaining 14% of shares that they don’t control.

What will they pay?

They probably want to pay a lot less than fair value ($80/share) but to get minority shareholders to accept the deal, they probably have to pay a significant premium to the stocks current share price (~$40).

Perhaps, they offer $60 to take the company fully private.

Another alternative is a large special dividend is paid out.

Even if a buyout doesn’t happen, I still believe TCI is well positioned.

Book value per share has compounded at a nice clip, as shown in the chart below.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

As detailed above, the trust of late billionaire Gene Phillips owns 86% of the company. The trust is controlled by his children.

They are highly incentivized to maximize value. The one caveat is we need to be careful that these majority shareholders don’t “squeeze” us out. In other words, buy the rest of the company for a minimal premium.

While this is a possibility, I think it’s unlikely as the company would likely be sued.

Valuation and Price Target

The VAA joint venture was held on TCI’s books at $50.6MM. Given that TCI will realized ~$300MM of proceeds from the transaction book value per share is going to increase materially.

Book value per share currently stands at $44 per share and over the past 5 years, TCI has traded on average at ~1.0x book value per share.

Once TCI receives all proceeds from the sale of its JV, book value per share will increase to the high $70 range / low $80 range. This book value is conservative as U.S. GAAP accounting undervalues real estate holdings as it is typically held at historical cost basis, not fair market value.

If TCI eventually trades at 1x new book value per share, shares will re-rate sharply higher.

The other important thing to note is that Brixton Capital and Shidler Group made an offer to buy all TCI shares for $44.4/share. However, the Board of Directors ignored the offer – probably because they see fair value as significantly higher.

Nonetheless, this offer is another datapoint that suggests TCI is undervalued at its current valuation.

As always is the case, micro-caps are illiquid. Be sure to use limits.

My official rating is Buy under 45.00

Risks

Lack of Catalysts

- For this investment to work in the near term, we need either 1) a tender offer to buyout minority shareholders or 2) investors to recognize the increase in book value per share due to the JV sale.

- If neither of these come to pass, shares may languish. Nonetheless, I’m comfortable owning the stock, regardless, as the company has historically grown book value per share and has a fortress balance sheet. Further, the stock is very cheap on an absolute basis.

Corporate Governance

The trust of late billionaire Gene Phillips owns 86% of the company. The trust is controlled by his children. As detailed above, the majority shareholders could try to “squeeze” out minority shareholders by buying shares at a minimal premium to the stock’s current price. Nonetheless, this would open the Board of Directors to lawsuits, an outcome that they want to avoid.

Recommendation Updates

Changes This Week: None

Updates

Aptevo (APVO) had no news this week. On September 19, 2022, the company announced that the FDA has approved the company and its partner, Alligator Bioscience, to proceed with a new investigational drug ALG.APV-527 to treat multiple solid tumors. This isn’t major new but shows that the company has several promising shots on goal. Aptevo reported quarterly results on August 11. The company continues to report positive results from its key drug, APVO436. Further, it has additional drugs that are progressing well. Aptevo renegotiated its royalty agreement with Pfizer which allows Aptevo to recognize a gain and regain compliance with Nasdaq’s shareholder equity listing requirement. This is a positive. Currently Aptevo has $25MM of net cash on its balance sheet and projects that it has enough liquidity to continue to operate for 12 more months without raising capital. This biotech bear market is no fun, but Aptevo continues to be an asymmetric bet. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) had no news this week. It announced on September 7 that it has reached an extension on its lockup agreement with its largest shareholders (who represent 71% of shares outstanding) for 12 months. This is meaningful as it shows the largest shareholders of the company have conviction in the stock and believe it’s undervalued. On August 3, Atento reported another weak quarter. Management lowered revenue guidance to flat versus consensus of +4% growth and previous guidance of “mid-single-digit” growth. EBITDA margin guidance has been reduced to 12% (at the midpoint) from 13.5%. While this quarter and guidance cut were disappointing, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) announced on September 22 that it has approved a share repurchase authorization to buy back 1.4MM shares (10% of float, 6% of shares outstanding). This is a positive. The company reported strong results on August 11. Revenue declined 8% driven primarily by lower Absorica sales (as expected); however, adjusted EBITDA grew sequentially to $3.6MM. The company’s cash balance stands at $24.2MM, ~50% of its market cap. This limits downside risk. Further, the company continues to generate significant free cash flow and buy back shares. Finally, the company had positive pipeline developments with two compounds (MOB-015 for nail fungus and Piclidenoson for psoriasis). Both drugs are progressing in phase III trials. Original Write-up. Buy under 2.50

Cogstate Ltd (COGZF) recently got a lift when Esai and Biogen announced positive results for its Phase 3 Alzheimer’s Trial. This is massively positive news as it will drive more Alzheimer’s trials (and revenue for Cogstate). Ultimately, Cogstate’s revenue potential this year and beyond will be determined by key Alzheimer’s drug read-outs which are expected this year and next year: 1) Lecanemab from Eisai (phase 3 data: already announced and positive), 2) Gantenerumab from Roche (Phase 3 data expected in Q4 2022), and 3) Donanemab from Eli Lilly (phase 3 data in mid-2023). The Cogstate thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) announced that it paid out $0.76 per trust certificate on October 11. On September 12, the Trust announced that it sold 7 of its properties for $65MM. The blended cap rate of the transactions was 7.3%. The trust on an aggregate basis is trading at a ~10% cap rate (the higher the cheaper). Proceeds will be paid out next month as well as net rental income. The trust remains attractive. The current yield is 10%. And the trust has no debt, so our downside is protected. Original Write-up. Buy under 14.00

Crossroads Impact Corp. (CRSS) reported earnings on September 13. The quarter was relatively uneventful as the business is in transition from processing PPP loans to focusing on growing its loan portfolio. To that end, the business recently announced a $180MM equity infusion in July and has since added a $150MM credit line. The company is well capitalized and will be growing strongly going forward. Further, delinquencies remain very low. Original Write-up. Buy under 15.00

Currency Exchange International (CURN) reported earnings on September 13. They looked great! Revenue increased 139% to $21MM, beating consensus expectations by $5MM. This was truly a massive beat. Revenue in the fiscal third quarter was 67% higher than 2019 FQ3 (pre-pandemic). The company’s Payments business grew revenue 65% to $3.6MM. Year to date, Currency Exchange has generated EPS of $1.15 or $1.53 on an annualized basis. As such, the stock is trading at just 9x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week. The company announced strong results on August 11. Epsilon continues to benefit from high natural gas prices. Revenue increased 46% sequentially, driven by 68% higher natural gas prices. Revenue should continue to soar as long as natural gas prices remain elevated and Epsilon is mostly unhedged. During the quarter, the company generated $5.9MM of free cash flow, or $23.4MM on an annualized basis. The stock looks attractive given its $31MM of net cash and strong earnings power. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported earnings in July. Results were excellent. Revenue grew 23% y/y while EPS grew 37%. Credit metrics look very strong as the company has an allowance-to-loans ratio of 1.2%. The company has a long runway for growth, as articulated by CEO Andrew Sagliocca: “There is tremendous growth potential in both our national platforms due to the limited number of participants and the fragmented approach to finance and technology in both markets.” Despite its strong outlook, the stock trades at just 14x earnings. Original Write-up. Buy under 35.00

IDT Corporation (IDT) reported fiscal Q4 earnings on October 6th. Similar to last quarter, revenue declined y/y (down 16%), mainly due to tough comps from last year. However, the two most important segments, NRS and net2phone, continued to generate excellent results. NRS revenue grew 157% to $17.7MM, with full-year 2022 recurring revenue increasing 129% to $45.3 million. net2phone subscription revenue increased 37% to $15.1MM. Overall, it was a solid quarter. The investment case remains on track and my price target is $55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. The company reported first-half 2022 results on September 7. They looked great. The company reported revenue growth of 745% and EBITDA growth of 768%. It generated free cash flow of £93MM or $186MM annualized. As such, Kistos is currently trading at 1x current EBITDA and 2.5x current free cash flow. The only downside is that the EU is considering instituting a windfall profit tax on energy companies. While this would be a negative, I think it’s partially reflected in Kistos’ valuation. Further, Kistos generated $89MM of EBITDA in 2021. Thus, it’s trading at just 5.1x “normalized” EBITDA, not a demanding valuation. I continue to see at least 100% upside ahead. Original Write-up Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. I had a chance to speak to the CEO in June. He said the team is working through re-filing its financials, and he expected to “go public” again by the end of September (this proved optimistic). Instead of just “turning on” trading, he would like to raise a little capital and also pick up coverage from some sell-side analysts. He noted the advertising business is growing very well and that the podcast hosting business is growing again. It had experienced limited growth last year given free hosting competition, but business has picked back up. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded. Unfortunately, the market volatility may have delayed Libsyn’s IPO further, but ultimately, I’m highly confident the business will go public again. Since you can’t actually buy the stock until then, I rate it a Hold for those who already own it. Original Write-up. Hold

Medexus Pharma (MEDXF) announced preliminary revenue results for FQ2 2023 on October 6th. Revenue is expected to exceed $27.0 million, which will be the strongest quarter in history. Primary drivers stemming from organic increases in net sales across Medexus’ portfolio, a highlight being recognition of 100% of revenue from Gleolan sales in the U.S. starting September 2022. Assuming a 20% EBITDA margin (backing out Treo expenses), the business is trading at an EV/EBITDA multiple of 3x, very cheap for a profitable and growing business. Original Write-up. Buy under 3.50

NexPoint (NXDT) reported consistent insider buying last week by CEO, James Dondero. While rising interest rates will impact REIT valuations, I remain confident that NXDT is trading well below fair value. The company had its shareholder update call on August 10, during which they provided significant detail into the assets that make up NAV. Management spent a lot of time discussing how they are confident that they can close the gap to NAV. Unfortunately, no comments were made on an increase to the dividend or whether the company will start buying back stock. Both of these would be significant catalysts for NXDT shares. The thesis remains on track, and I see ~50% upside in the next 12 months. Original Write-Up. Buy under 17.00

P10 Holdings (PX) had no news this week. It announced a meaningful acquisition in August. The company is acquiring Western Technology Investment, a market leader in venture debt. The acquisition will add $12.5MM of additional EBITDA to P10. It appears that P10 is paying ~12x EBITDA for the acquisition, a cheap but not dirt-cheap price. This acquisition will add to P10’s growth potential. P10 is currently trading at 15x 2022 adjusted EBITDA which is a very reasonable valuation for such a stable business with strong organic growth potential. The investment case remains on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week. It last reported earnings on August 26. Results were excellent! Revenue grew 68% to $14.6MM CAD while EBITDA grew 73% to $4.5MM CAD. While acquisitions are helping, organic growth is very strong (+40% y/y). The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Richardson Electronics (RELL) reported earnings on October 6th. Revenue grew 26% to $68MM, beating consensus expectations by $5MM. EPS of $0.45 beat consensus expectations by $0.21. The stock reacted well. The company is a rapidly growing micro-cap that is benefiting from many “green” initiatives (electric trains, wind turbines, etc.). Despite strong growth expectations and a pristine balance sheet ($40MM of net cash), the stock trades at just 12x next year’s earnings. Insider ownership is high, and I see ~50% upside over the next couple of years. Original Write-up. Buy under 17.00

Truxton (TRUX) had no news this week. It reported a great quarter in July. Despite a volatile market, pre-provision net revenue grew 9% sequentially and 30% y/y. EPS grew 16% y/y. Credit metrics remain strong. The bank has $0 in non-performing loans and $0 in net charge-offs. During the quarter, the company repurchased 22,000 shares for an average price of $70.05. The Truxton investment case remains on track. The bank will continue to grow loans and earnings prudently while returning excess cash to shareholders through dividends and share buybacks. The stock is trading at just 14x annualized earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge, Inc. (ZDGE) announced on August 16 that it has authorized a 1.5MM share repurchase (10% of shares outstanding). This is a positive as it conveys management’s conviction in Zedge’s fundamentals and cheap valuation. The stock remains very cheap, trading at 3.4x EBITDA. Original Write-up. Buy under 6.00

Watch List

Biohaven (BHVN) is a new name on my watch list. It is a recent spin-off that is capitalized with ~$230MM of net cash and no debt. It has a number of interesting pipeline assets including a phase 3 drug focused on OCD. A company in a similar position (OCD Drug), Relmada (RLMD), trades with a $1BN market cap. Biohaven’s market cap is currently $391MM.

Harbor Diversified (HRBR) remains on my watch list. It is the holding company for Wisconsin Airlines, which has a capacity agreement with United. HRBR trades at a cheap valuation because there was uncertainty regarding whether United would extend its contract with Harbor. However, the company recently disclosed that the contract has been extended for five years. No terms have been released yet, but the stock should re-rate higher over time.

Inventronics Limited (IVX.V) is a new name on my watch list that was flagged by a subscriber. It’s a Canadian micro-cap that designs, manufactures, and sells protective enclosures for the telecommunications, electric transmission, cable and energy industries. It’s growing revenue 50% yet only trades at an EV/EBITDA multiple of 7.8x. It even just declared an 8% dividend. I will continue to watch this name. It has run up and looks a little extended. If I get more comfortable with the sustainability of the growth and the stock consolidates, I will likely recommend it.

| Stock | Price Bought | Date Bought | Price on 10/11/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 2.84 | -91% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 4.21 | -80% | Buy under 10.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 2.31 | 28% | Buy under 2.50 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.49 | -12% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 13.45 | 4% | Buy under 14.00 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 11.00 | -22% | Buy under 15.00 |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 13.34 | -5% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 6.59 | 32% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 37.40 | 10% | Buy under 35.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 28.79 | 49% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 4.80 | 0% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 0.88 | -51% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 11.81 | -17% | Buy under 17.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.24 | 244% | Buy under 15.00 |

| RediShred (RDCPF) | 3.30 | 6/8/22 | 2.97 | -10% | Buy under 3.50 |

| Richardson Electronics (RELL) | 15.83 | 9/14/22 | 19.58 | 24% | Buy under 17.00 |

| Transcontinental Realty Investors (TCI) | -- | NEW | 40.18 | --% | Buy under 45.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 63.53 | -11% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.30 | -60% | Buy under 6.00 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on November 9, 2022.