Energy Stock Looks Too Cheap

The S&P 500 has had a surprisingly good year and it looks like we are in the middle of another bull market.

But there is one sector that has been left behind: energy.

The Energy Select SPRD ETF (XLE) is flat on the year and has suffered ~$3.8BN of investor outflows, as shown in the chart below.

Meanwhile, energy insiders are buying their own stock hand over fist.

And commentary from oil executives suggests we are at the beginning of a long up cycle.

“Demand for oil and gas is strong as demonstrated by demand growth of 10 million barrels per day in the first half of the year compared to the same period last year. Oil and gas continues to demonstrate its critical role in the global economy and meeting long-term demand requires sustained capital investment. Commodity prices remain attractive. When I talk to customers, they expect to work more, not less, and many of their activity plans extend into the next decade. Customers are settling in for a long-duration upcycle. Overall, I expect upstream spending to grow in 2023 and beyond.” - Haliburton CEO Jeffrey Allen Miller

In short, the outlook looks good for energy companies.

We already own several energy stocks in our Cabot Micro-Cap Insider portfolio, but today, I want to add one more.

This name has been on my watch list for the past couple of months. The company has been cheap for a long time, but I had one unresolved question: What will it do with its cash?

Finally, the company provided an answer: return it to shareholders and make small accretive acquisitions.

In my book, this is the perfect answer.

Without further delay, let’s discuss this month’s idea: Sandridge Energy (SD).

New Recommendation- Sandridge Energy: Cheap Energy Stock with Excellent Capital Allocation

Company: Sandridge Energy

NYSE: SD

Price: 16.13

Market Cap: $596 million

Price Target: 26.00

Total Return Potential: 60%

Recommendation: Buy under 17.00

Recommendation Type: Rocket

Executive Summary

Sandridge Energy is a dirt-cheap energy company that is gushing cash. It has no debt and 37% of its market cap in cash. The company is making accretive acquisitions that pay for themselves within three years while also paying a dividend and buying back stock. Finally, insider ownership is high. In short, there is a lot to like. I see 60% upside over the next 12 months.

Overview

Background

SandRidge Energy is an independent oil and natural gas exploration and production company. It was founded by Tom L. Ward in 2006 and is based in Oklahoma City, Oklahoma, USA. The company’s primary focus is on acquiring, exploring, and developing oil and natural gas reserves in various onshore regions in the United States.

SandRidge Energy filed for Chapter 11 bankruptcy protection in May 2016, citing a challenging commodity price environment and a significant debt burden. The company underwent a financial restructuring that included debt reduction and changes to its capital structure.

The company performed poorly coming out of bankruptcy and its stock price troughed during the COVID pandemic.

But the stock rebounded strongly post the pandemic.

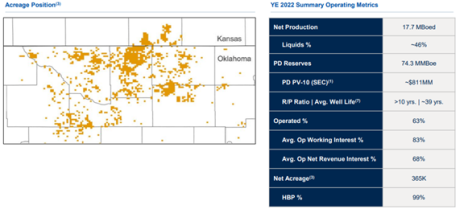

Today, SandRidge’s assets are in what is referred to as “Midcon” in Kansas and Oklahoma. It has exposure to oil and gas but is primarily focused on natural gas.

SandRidge has a stable, low-decline production base with estimated annual production declines of ~8% over the next 10 years.

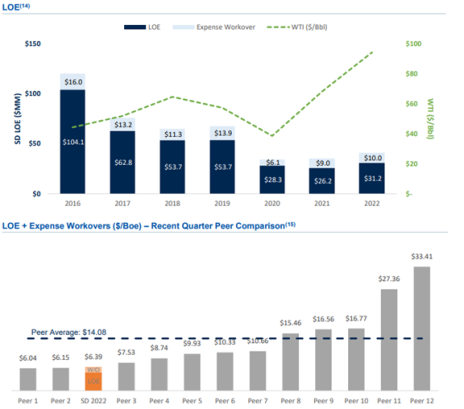

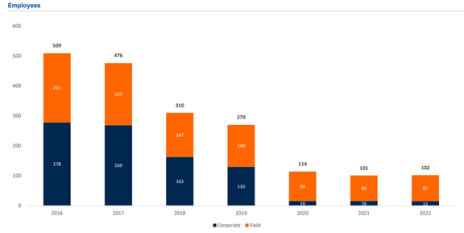

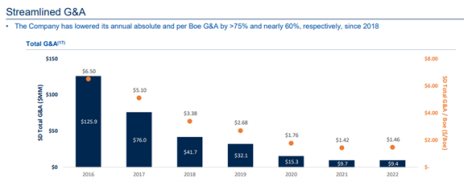

It has done an impressive job cutting costs and ranks very highly in the industry from an efficiency perspective (LOE: lease operating expense).

Outlook

SandRidge is on pace to generate ~$80MM of free cash flow this year.

It has $1.6BN of net operating losses and will not pay taxes for the foreseeable future.

The company’s strategy is to manage costs efficiently while investing in new wells with high return potential.

The company generates more cash than it can deploy efficiently so it returns excess cash to shareholders.

It currently pays a modest (but attractive) dividend (2.5% yield) and has a buyback authorization to retire ~12.5% of its market cap.

Meanwhile, the company is focused on making small, accretive acquisitions with high returns.

The company recently announced an $11.25MM acquisition in Oklahoma and Kansas which will pay back in less than three years.

I expect SandRidge to produce strong free cash flow for the foreseeable future.

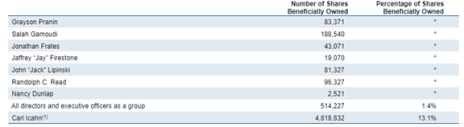

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

In the case of SandRidge, one of the best activist investors of all time, Carl Icahn, controls the board and owns 13% of shares outstanding.

As such, we are well aligned as minority shareholders.

Valuation and Price Target

SandRidge is objectively cheap.

It is currently trading at a price to annualized FCF multiple of 7.5x.

On an EV to annualized EBITDA basis, it trades at 3.6x.

It has SEC-proven reserves of $811MM yet trades at a market cap of just $596MM.

What is most exciting to me about SandRidge is its capital allocation. The company has remained on my watch list for about a year, but my main concern was what it would do with its cash.

But the company’s announcement in May 2023 was a major positive in my book.

At that time, the company announced that it would pay a $0.10 per quarter dividend (2.5% yield), pay a $2 special dividend, and buy back $75MM of its own stock (12.6% of market cap).

It announced that it would also make value-accretive acquisitions. And it followed through with this announcement with a $11.25MM acquisition of 26 wells in the Northwest Stack (Oklahoma and Kansas).

The acquisition will likely generate $4MM of free cash flow annually and will thus pay for itself in less than three years.

My biggest concern with SandRidge was what management was going to do with all of its cash, but that concern has been addressed.

We know what they are going to do:

1) Return it to shareholders,

2) Make small, accretive acquisitions.

Given that this overhang has been lifted, I believe a 12x free cash flow multiple is fair.

At that valuation, the stock is worth $26 per share. And we get to collect a 2.6% dividend while we wait.

As is always the case, micro-caps are illiquid. Be sure to use limits.

My official rating for SD is Buy under 17.00.

Risks

Recession Decreases Demand for Oil and Gas

- While it’s difficult to predict the macro environment, a recession would definitely decrease demand for oil and gas. However, SandRidge would be well positioned to withstand the recession given it has no debt and 37% of its market cap in cash.

Secular Challenges for Traditional Energy

- Few investors want to invest in industries with poor secular outlooks (such as traditional energy). As such, SandRidge is never going to command a premium valuation. Nonetheless, the company will continue to buy back stock and pay a dividend. And over time, the valuation should improve.

Updates

Changes This Week: Sell Magenta Therapeutics (MGTA) to make room for new recommendation

2seventy bio (TSVT) had no news this week but continues to trade off. The company filed an 8-K on July 27 disclosing that it expects sales for its blockbuster drug, Abecma, to be $115MM in the second quarter. This estimate is based on information received from Bristol-Myers. $115MM of U.S. Abecma sales is disappointing, but it’s not a disaster. It’s down $3MM sequentially from the first quarter but up 59% y/y. TSVT also noted that it expects Abecma sales to be at the low range of its full-year guidance range: $470MM to $570MM. This is somewhat surprising because previous guidance was that sales were going to be at the high end of the range. Let’s assume sales end up at the low end of the range: $470MM. This would represent 58% growth y/y which is still quite impressive. What is causing the weakness? According to BMY’s conference call, manufacturing challenges are the primary reason. However, management did note competition from other drugs (the key one would be JNJ’s Carvykti). Further, Morgan Stanley downgraded the stock on July 28 based primarily on competition. While competition is a real risk, I want to give TSVT time to prove itself. Abecma has a PDUFA date (FDA decision) date in early December which will decide if Abecma can be used in earlier rounds of treatment. Further, the two-year anniversary of TSVT’s spin-off passes in November which opens the door to potential acquisitions from Bristol-Myers, Regeneron Pharmacuticals (REGN) or other large pharma companies. The stock’s valuation remains objectively cheap. Original Write-up. Buy under 14.00

Cogstate Ltd (COGZF) will report full fiscal year results on August 22. On July 6, Eisai’s LEQEMBI (Alzheimer’s) was approved by the FDA. This is very positive news because it means significantly more revenue for Cogstate as the additional studies are greenlit. On May 3, Eli Lilly (LLY) announced positive results for its Alzheimer’s drug, donanemab. Patients treated with the drug saw their Alzheimer’s progression slow by 27% versus placebo. Eli Lilly plans to proceed with regulatory submissions to get approval as quickly as possible. I expect FDA approval in late 2023 or early 2024. Cogstate worked with Eli Lilly for its phase III trial of donanemab. If the drug is approved, it will mean significantly more revenue for Cogstate as the additional studies are greenlit. Cogstate reported fiscal Q3 results on April 26. Revenue declined 15% y/y to $11MM. The revenue shortfall is due to slow patient enrollment in Alzheimer’s clinical trials. This isn’t lost revenue but revenue that has just been pushed out a year or so. Management also mentioned that smaller biotechs are a little more cautious spending money given the macro environment. FDA approval of Eli Lilly’s donanemab (Alzheimer’s) in late 2023/early 2024 would be another significant catalyst for Cogstate. Positive news would mean significantly more revenue for Cogstate due to the need for additional clinical trials to expand the drugs’ labels and to monitor the effectiveness of the drugs in real patients. Finally, Cogstate announced that it is actively buying back its own stock. It currently has a $13MM authorization (5% of market cap). While Cogstate’s performance has been disappointing, I remain confident in the long-term outlook. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) announced on August 7 that it would pay out $0.103718 per trust certificate on August 10. The distribution is from cash flow that was generated from operations (minimal asset sales proceeds were included). As such, the run rate yield on the Trust is 11% – very attractive, in my opinion! The Trust has pulled back, but this is largely due to rising interest rates which have impacted all real estate companies. Copper Property Trust continues to look attractive. I’m very happy to recommend a security that has no debt, is paying an 11% dividend yield, and is liquidating properties over time. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported another strong quarter on June 13. Revenue grew 30% to $18.3MM, beating consensus expectations by $1.3MM. Net operating income grew 30% to $3.7MM. The company continues to benefit from a booming travel market. Currency Exchange’s valuation looks attractive at 9x forward earnings and 7x forward free cash flow. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week. It saw a flurry of insider buys in early July. Insider buys are encouraging but especially so when they are made in clusters. The company announced on June 20 that it is investing $14 million in the Permian Basin in Texas for a 25% working interest in 12,373 gross acres. This investment will start to generate positive revenue and earnings in 2024 when drilling commences. It reported Q1 earnings on May 10, 2023. The company generated $3.6MM of free cash flow (excluding positive movements in working capital) in the quarter, or $14.4MM annualized. EBITDA was $5.6MM in the quarter or $22.4MM annualized. Epsilon bought back 237k shares (1% of shares outstanding) at an average price of $5.72. It paid out $1.4MM in dividends. Despite both, net cash rose to $49.8MM. While depressed natural gas prices are negatively impacting Epsilon’s results, the company looks attractively valued even using draconian assumptions. In 2020, when natural gas prices were at similar levels, Epsilon generated $15.7MM of adjusted EBITDA. Thus, the stock is trading at just 3.6x 2020 (which I view as trough) EBITDA. This valuation appears compelling. Meanwhile, the company is paying a nice dividend and buying back stock. Downside is further limited given that cash represents 43% of Epsilon’s market cap. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) reported Q2 earnings on July 25. Results were solid. Diluted EPS increased 41% to $1.10. Esquire generated industry-leading returns on average assets and equity of 2.65% and 21.03%, respectively, as compared to 2.00% and 17.81% for the same period in 2022. The common equity tier 1 ratio stands at 14.27% and would be 12.41% including all after-tax unrealized losses. Credit losses remain low with no non-performing loans and a 1.34% allowance for credit losses. Total deposits were flat quarter over quarter at $1.3B but were up 9% from last year. Uninsured deposits are just 26% of total deposits, and importantly, more than 90% of uninsured deposits represent clients with full relationship banking (loans, payment processing, and other service-oriented relationships). Despite strong results, the stock is trading at just 12x forward earnings. Original Write-up. Buy under 45.00

IDT Corporation (IDT) had no news this week. It has been weak since reporting earnings on June 5. It looked like a solid quarter albeit not quite as strong as previous quarters. Highlights were as follows: 1) Strong NRS (National Retail Solutions) growth continues. While growth slowed down from 100%+ in prior quarters to 65% growth in the current quarter, the performance was still impressive. NRS is profitable and has a huge runway for future growth. The division was negatively impacted by a pullback in advertising. This will eventually come back. 2) net2phone continued to grow nicely as well. Revenue decelerated from 30%+ to 20% but was still impressive. The division is approaching cash flow breakeven. 3) The company generated $20.5MM of EBITDA. Thus, it’s generating $82MM of EBITDA on an annualized basis. As such, it’s trading at 7.8x annualized EBITDA. 4) The company bought back ~77,000 shares of its own stock. Given challenging market conditions for high-growth companies, IDT’s subsidiaries won’t be spun off soon, but we know that, ultimately, they will be monetized either through a sale or a spin-off. The investment case remains on track. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. It filed its annual report on May 30. Some takeaways: 1) The company generated €190MM of free cash flow in 2022. The market cap of the entire company today is €200MM. This company is insanely cheap. 2) Kistos is focused on diversifying away from the U.K. and Netherlands given the regressive policy of “windfall” taxes. 3) The company is positioned exceptionally well given its recently announced acquisition of Mime Petroleum, a Norwegian company. Given high insider ownership and operating excellence from the management team, I remain an enthusiastic shareholder of Kistos. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) had no news this week. I spoke to Libsyn’s CFO on June 14. Here are the main takeaways: 1) Their main priority continues to be to get shareholders liquidity (the two largest shareholders want liquidity). Options include selling the company, a private equity minority investment, “turn-on” trading, and a merger with a SPAC. Really anything is on the table, but it has to make sense. Nothing appears imminent. 2) Business is growing but growth has slowed given weakness in the advertising market. 3) The podcast and website hosting business is a steady cash cow. 4) The annual meeting isn’t scheduled, but management does want to hold one. From a financial perspective, revenue grew from $42MM in 2021 to $57MM in 2022. On a pro forma basis (full-year contribution from the acquisition of Julep), revenues are over $60MM. Profitability is down as the company is focused on expanding into the podcasting advertising market which has lower profitability than the hosting business. Still, I’m optimistic that Libsyn has a bright future. Original Write-up. Hold

M&F Bancorp (MFBP) had no news this week. There was a good article written on Seeking Alpha in June that you can read here. The company reported excellent earnings on May 5. EPS increased 82% to $0.89. ROE reached 32% vs. 12% a year ago. This windfall is due to M&F’s deployment of new capital from the Emergency Capital Investment Program. The bank’s CEO stated, “We are pleased with our results for the first quarter of 2023, which exceeded our expectations. We achieved significantly increased earnings available to stockholders of $1.8 million and achieved a 1.55% return on assets, which is outstanding.” The bank remains overcapitalized with stockholders’ equity representing 26.95% of total assets. Non-performing loans represent 0.19% of total assets. M&F is trading at just 6.5x annualized earnings. I expect EPS to grow to $4.74 in 2025 (this might happen by 2024). Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Magenta Therapeutics (MGTA) has an upcoming shareholder vote to approve the reverse merger with Dianthus Therapeutics. The merger is disappointing because Magenta will distribute no cash to shareholders and legacy shareholders will only own 21% of the new company. I do think downside is limited if the deal goes through because the company will be well-capitalized and backed by many prominent healthcare investors including Fidelity and Venrock Healthcare. Nonetheless, I think there is a risk that the deal gets approved. And if that happens, the stock is likely to trade down. Therefore, I’m moving my rating on Magenta to Sell.

Medexus Pharma (MEDXF) had no news this week. It announced on July 12 that it expects revenue to exceed $31MM in its upcoming quarter, representing 34.5% y/y growth. This is very impressive. The stock continues to perform very well following a strong quarter in June and increasing clarity on refinancing its convertible debentures. In its last quarter (June 21), revenue increased 41% to $28.6MM. Adjusted EBITDA increased 336% to $4.8MM. Most importantly, the company generated $3.2MM of free cash flow in the quarter and expects to generate an additional $7MM between March 31 and September 30 or $14MM on an annualized basis. Management noted that it expects to have $20MM of cash on hand as of September and up to $20MM from its accordion debt facility. Therefore, Medexus could have $40MM in liquidity which it could use to repay its convertible debenture which is due in October. The convertible debenture is $40MM. On the call, management noted that it does not want to repay the debentures in stock given the current low stock price. I’m hoping that’s the case, but I’m assuming Medexus is able to repay $35MM in cash and $5MM in stock (assuming $1.04 share price). In this scenario, Medexus would have to issue 5MM shares and the share count would increase by 25%. But the stock still looks cheap in that situation. By my math, the valuation metrics (assuming a 25% increase in share count) would be as follows: 1.8x annualized FCF, 5.3x annualized EBITDA, and 0.9x annualized EBITDA. Of course, there is reflexivity at play. The lower the share price goes, the more the dilution. But I tend to think Medexus will be able to raise additional non-dilutive financing to address any cash shortfall. What is the right valuation for Medexus assuming the share count increases by 25%? I think a $5 share price is reasonable. That would imply valuation multiples of 8.9x FCF, 10.5x EBITDA, and 1.8x revenue. Original Write-up. Buy under 3.50

Merrimack Pharma (MACK) had no news this week. On June 14, Ipsen submitted, and the FDA accepted, a new drug application for Onivyde to be approved for first-line treatment of pancreatic cancer. The FDA will decide by February 13, 2024. Assuming approval (odds at 90%+), Merrimack should receive $225MM (or ~$15 per share), and shortly thereafter, pay the proceeds out to shareholders. Merrimack is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~9 months, representing more than 125% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

P10 Holdings (PX) had no news this week. It announced on July 12 that RCP Advisors closed on $797MM in capital commitments for RCP Secondary Opportunity Fund IV, above its target of $500MM. This is impressive in the current challenging fundraising environment and adds valuable fee-paying AUM to P10 Holdings. P10 announced an excellent quarter on March 6. Fee-paying assets under management increased 23% y/y. Revenue increased 32% and adjusted EBITDA grew 29%. P10 continues to benefit from secular tailwinds in the private equity industry. Despite strong growth, P10 trades at just 12.9x EBITDA and just 13x cash earnings. This is too cheap a valuation. The investment case is on track. Original Write-up. Buy under 15.00

Park Aerospace (PKE) had no news this week. It looks compelling. The company has no debt and 38% of its market cap is in cash. It is poised to double revenue and triple earnings over the next three years yet trades at a reasonable valuation. The company pays a competitive dividend (3.7% yield) and is buying back stock in the open market. Insiders own over 11% of the company. I see 100% upside over the next three years. Original Write-up. Buy under 15.00.

RediShred (RDCPF) had no news this week. It reported another excellent quarter on April 21. Revenue grew 57% to $57MM CAD while EBITDA grew 67% to $15.3MM. The strength was driven both by acquisitions and organic growth, the latter of which is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins, but these are starting to moderate. The stock continues to look cheap at 5.8x forward EBITDA. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Trinity Place Holdings (TPHS) had no news this week. It is a high-risk, high-reward stock. I see a legitimate case for the stock to go up 7x. At the same time, the stock could decline by 100%. The company’s real estate is well located and based in New York City. The stock represents an asymmetric opportunity with a 7:1 upside-to-downside ratio. Insiders own a significant portion of shares. Original Write-up. Buy under 0.45

Truxton (TRUX) reported Q2 earnings on July 20. The quarter was solid. EPS came in at $1.53. Asset quality remains high with $0 in non-performing loans as of June 30. The bank’s capital position remains strong with tier 1 leverage at 10.4%. My one concern from last quarter was that deposits shrank (albeit only by 4%). The good news in this quarter is that deposits grew again. Deposits grew by 2% q/q to $771MM and increased 1% y/y. Truxton continues to look attractive at just 10x earnings. This isn’t the most exciting stock, but it’s a slow-and-steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) had no news this week. It paid its $2.50 per share quarterly dividend on June 26. The company did not indicate whether a Q3 dividend will be paid. My sense is it will, but the company/board of directors is still finalizing the plan. Based on conversations with Unit’s CFO, I believe Unit’s dividend policy will include a standard “normal quarterly dividend” that is sustainable (perhaps $1 per quarter) and then periodic special dividends to return excess cash. This clarity will be a major positive. On May 11, Unit Corp filed its 10-Q, and the fundamentals look terrific. The company generated over $50MM of free cash flow in Q1. My estimate for the entire year was $94MM so I’m obviously too low. Areas of upside: 1) Upstream operation expenses are tracking $25MM lower than I had modeled (this is obviously a source of material upside). 2) BOSS day rates were $30.8MM in the quarter, but 8/14 of the BOSS rigs will reprice higher in Q2. 3) Drilling operating expenses are tracking slightly lower than I expected. As a result of the strong free cash flow generation, Unit currently has $171MM of cash on its balance sheet, or 35% of its market cap. All in all, it was a very strong quarter, and the investment case remains on track. Original Write-up. Buy under 65.00

William Penn (WMPN) had no news this week. It announced on May 6 that it has authorized another share repurchase representing 10% of shares outstanding. It will commence this share repurchase after the existing authorization is complete. The bank also announced earnings on May 6. Despite the turmoil in the banking market, William Penn grew deposits in the quarter. The bank remains well capitalized with a tangible common equity ratio of 19.7%. The company continues to aggressively repurchase shares. During the quarter, the Board of Directors authorized a fourth repurchase program to buy back up to 698,312 shares. The company is being quite aggressive. In the first half of April, it repurchased nearly 400,000 shares in the open market. Tangible book value is $12.54 so the stock is currently trading at 75% of book value. This looks like a compelling valuation. Downside is low given the stock is trading below liquidation value. Original Write-up. Buy under 10.80

Watch List

Enhabit (EHAB) stays on my watch list. It is a home health and hospice company that was spun off in 2022. It has performed poorly and cannot be sold until 2024. But there is tremendous consolidation in the home health market. Last year, UNH paid 21x EBITDA for LHC Group and currently Option Care Health and UNH are in a bidding war for Amedisys for 15x EBITDA. EHAB currently trades at 9.5x EBITDA. I need to do more work to understand the current issues facing Enhabit and whether they are cyclical or secular. But this idea looks very interesting.

FFBW, Inc (FFBW) stays on my watch list. It is a similar setup to William Penn Bancorp. It is a thrift that probably will get acquired for a nice premium. The CEO will even get a nice bonus if a sale materializes. The only reason that I went with William Penn Bancorp instead of FFBW is because of the aggressive insider buying currently at William Penn. But FFBW looks like another low-risk idea.

Gravity Co (GRVY) is a new addition to my watch list. It’s a mobile gaming company trading at a dirt-cheap valuation (2.1x LTM EBITDA). The one caveat is it’s highly dependent on a hit multi-player game, Ragnarok. Mobile games are notoriously boom and bust. Nonetheless, the current valuation looks extremely cheap.

Recommendation Ratings

| Stock | Price Bought | Date Bought | Price on 8/1/23 | Profit | Rating |

| 2seventy bio (TSVT) | 10.87 | 6/14/23 | 5.86 | -46% | Buy under 14.00 |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 0.99 | -42% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 11.49 | 5% | Buy under 14.00 |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 19.4 | 38% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 6.12 | 22% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 50.73 | 49% | Buy under 45.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 23.71 | 22% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 2.4 | -50% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 17.52 | -9% | Buy under 21.00 |

| Magenta (MGTA) | 0.79 | 4/12/23 | 0.8 | 1% | Sell |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.2 | 24% | Buy under 3.50 |

| Merrimack Pharma (MACK) | 11.99 | 2/7/23 | 12 | 0% | Buy under 12.50 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.83 | 297% | Buy under 15.00 |

| Park Aerospace (PKE) | 13.96 | 7/12/23 | 14.29 | 2% | Buy under 15.00 |

| RediShred (RDCPF) | 3.3 | 6/14/22 | 2.77 | -16% | Buy under 3.50 |

| Sandridge Energy (SD) | -- | NEW | -- | --% | Buy under 17.00 |

| Trinity Place Holdings Inc. (TPHS) | 0.4 | 5/10/23 | 0.52 | 30% | Buy under 0.45 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 59 | -15% | Buy under 75.00 |

| Unit Corp (UNTC) | 57.44 | 12/14/22 | 46.82 | 1% | Buy under 65.00 |

| William Penn Bancorp (WMPN) | 11.91 | 3/8/22 | 11.25 | 3% | Buy under 10.80 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on September 13, 2023.