An Opportunity in the Biotech Bear Market

I’ve been closely following the micro-cap biotech market.

Unfortunately, it’s resulted in some pain (Aptevo), but on the positive side, it is providing a ton of opportunities today.

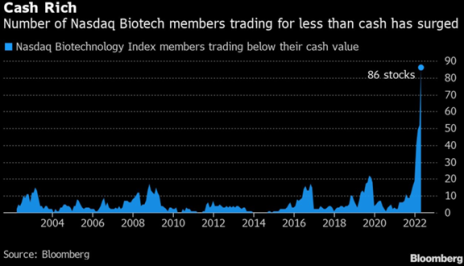

First, let’s step back and review what’s happening in the biotech market.

We are in the midst of a bear market. The current bear market for the sector has lasted 782 days and has resulted in a drawdown of 56%.

Only two biotech bear markets have lasted longer than this one (1992-1994 and 2000-2002).

Not many investors are eager to invest in biotech companies.

As such, the number of biotech companies trading below net cash is at an all-time high.

Typically, if you invest in negative enterprise companies (stocks trading for less than cash), you tend to do quite well.

For example, Alan Bochman of the CFA institute found that negative enterprise value stocks generated 50.4% average returns over a 12-month period.

Today, many biotech companies are trading below net cash.

My favorites are the ones that have indicated that they are undergoing a strategic review and cutting costs sharply.

That ensures that the net cash on the balance sheet won’t disappear too quickly.

Today, I’m recommending a failed biotech that is trading at a ~50% discount to its net cash.

Let me introduce you to Magenta Therapeutics (MGTA).

New Recommendation: Magenta Therapeutics: Low-Risk Liquidation Play

Company: Magenta Therapeutics

NYSE: MGTA

Price: 0.74

Market Cap: $45 million

Price Target: 0.98

Total Return Potential: 31%

Recommendation: Buy under 0.83

Recommendation Type: Quick Trade

Executive Summary

Magenta Therapeutics is a failed biotech that has fired 84% of its workforce including its CEO. It is evaluating strategic alternatives. It currently trades at a negative-$44MM enterprise value. Thus, the company is worth more dead than alive. Once the strategic review has concluded, the company will likely be sold to another company, merged with another company or liquidated. In either scenario, I believe the stock will trade at a premium to where it currently stands. I see limited downside and 31% to 92% upside over the next 12 months.

Overview

Background

Magenta Therapeutics (MGTA) has been public since 2018.

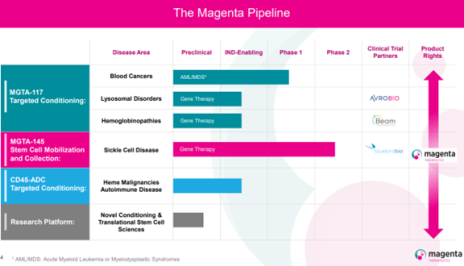

Up until the fall of 2022, the company had been focused on developing medicines designed to make cures possible for more patients with blood cancers, genetic diseases and autoimmune diseases.

Here is Magenta’s pipeline from its last investor deck in 2022.

The lead compound was MGTA-117 but unfortunately, a patient died after being treated with the drug and development of the drug has been halted as of January 15, 2023.

On February 2, 2023, the company announced that it is evaluating strategic alternatives.

The company wrote, “Magenta has made the determination to halt further development of its programs and conduct a comprehensive review of strategic alternatives focused on maximizing shareholder value.

“As part of our strategic review process, we are exploring potential strategic alternatives that include, without limitation, an acquisition, merger, business combination or other transaction. We are also exploring strategic transactions regarding our product candidates and related assets, including, without limitation, licensing transactions and asset sales. If the strategic review process is unsuccessful, our board of directors may decide to pursue a dissolution and liquidation of Magenta.”

In that February announcement, the company noted that it would reduce its work force by 84%.

Magenta is following in the footsteps of many failed biotechs that have decided to sell their assets and liquidate.

My best guess is that Magenta sells whatever IP it can and then liquidates the company and distributes proceeds to investors.

Outlook

The outlook for Magenta is different than for most companies given its strategic review.

The key analysis that is crucial to understanding whether Magenta is a good investment is determining what proceeds will be left over to distribute to investors once the strategic process has been reviewed.

Here’s how I see it.

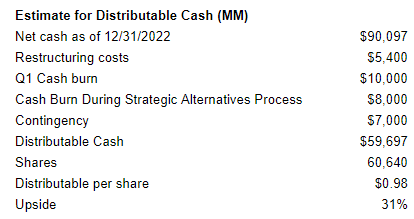

As of 12/31/2022, the company had current assets (proxy for cash) of $115.6MM.

It had total liabilities of $40.7MM.

Thus, it had net cash of $74.9MM.

However, the company announced that it had agreed to terminate its $30MM operating lease obligation by paying a $14.8MM termination fee to Novartis.

The net effect of that is it increases my calculation of net cash by $15.2MM.

So total cash available for distribution as of 12/31/2022 is $90MM. This looks pretty good when compared to Magenta’s $46MM market cap.

But we need to make several additional adjustments.

- Restructuring costs

- Magenta guided that the 84% reduction in employees is going to result in $5.4MM of restructuring costs.

- Q1 cash burn

- I expect a $10MM cash burn in the quarter.

- Cash burn during strategic review

- I closely followed another biotech (Catalyst Biosciences) that went through a liquidation and the CEO told me that it costs $6MM per year to keep a biotech operating even with few employees (public company costs). I’m going to round up and assume it costs Magenta $8MM to complete its strategic review by year end.

- Contingency

- When a company is liquidating, it needs to reserve for unanticipated claims and contingencies. Maybe there is a bill that wasn’t paid or a lawsuit that materializes. Either way, a reserve contingency is not unusual, and I think $7MM is a reasonable assumption (based on other liquidating biotechs that I’ve followed).

- When a company is liquidating, it needs to reserve for unanticipated claims and contingencies. Maybe there is a bill that wasn’t paid or a lawsuit that materializes. Either way, a reserve contingency is not unusual, and I think $7MM is a reasonable assumption (based on other liquidating biotechs that I’ve followed).

Add it all up, and I estimate Magenta will have $0.98 to distribute to investors.

I think the liquidation math that I’ve outlined above is fairly conservative.

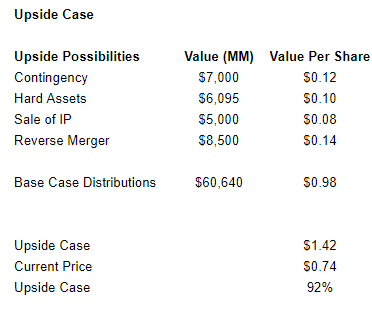

And there are some upside drivers that could materialize:

1. $7MM contingency reserve

- If no contingencies emerge, it’s likely that the contingency reserve will be distributed eventually. This would be worth $0.12 per share.

2. Sale of hard assets

- Magenta has $6.0MM of hard (non-current) assets that could be sold. This would be worth $0.10 per share.

3. Sale of IP

- This is hard to handicap. Catalyst Bio (another liquidating biotech) sold its preclinical data for $60MM in cash. It sold its phase III hemophilia assets for just $6MM.

- I’m assuming $5MM of proceeds for the sale of IP. This works out to $0.08 per share.

4. Reverse merger

- Catalyst Bio entered into a reverse merger and received $8.5MM of value for its shell. If Magenta entered into a similar transaction, it would be worth $0.14 per share.

If all the upside drivers play out, distributable proceeds could reach $1.40, more than 90% above the current share price.

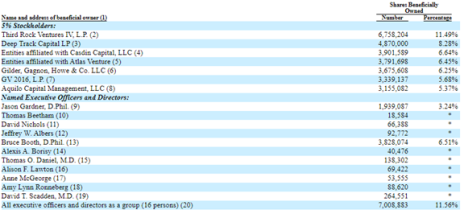

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

Insiders own 11.6% of shares outstanding ensuring they are aligned with minority investors.

Further, several institutions have meaningful investments in Magenta and want to see value maximized.

Valuation and Price Target

The valuation exercise is simple for Magenta Therapeutics.

In a base case liquidation scenario (more details above), I see distributable proceeds of $0.98 (+31%).

In an upside scenario, I see as much as $1.42 (+92%) in distributable proceeds (more details above).

Importantly, I think the risk of losing money is low given 84% of employees have been fired including the CEO.

The main risk is that the company decides to continue as is. And while this is a possibility, I think the risk is minimal given that 84% of the employees have been fired including the CEO.

In my opinion, the company either liquidates or enters into a transaction that results in significantly more value than is reflected in Magenta’s current stock price.

As is always the case, micro-caps are illiquid. Be sure to use limits.

My official rating is Buy under 0.83.

Risks

Company Doesn’t Liquidate

- As noted above, this is a possibility, but shareholders could still do very well even if the company isn’t liquidated. For example, a private company could decide to merge with Magenta for its public listing, and Magenta could pay out a large special dividend prior to that transaction closing.

Shareholder Rights Plan Could Stretch Out Strategic Alternative Process

- Magenta filed a “poison pill” which prevents any individual shareholder from buying 10% or more of the company. Theoretically, this prevents an activist from buying a majority stake in the company and forcing a liquidation. While this is true, an activist could still establish a meaningful (9.9%) stake and agitate for a liquidation.

- Further, whatever the conclusion of the strategic review, shareholders are going to have to vote on the recommended course of action (a sale, merger, or liquidation). Therefore, the Board is going to be aware that its recommended plan going forward must be attractive to all shareholders.

Updates

Changes This Week: Sell Zedge (ZDGE) to make room for the new recommendation.

Cogstate Ltd (COGZF) had no news this week. It reported disappointing fiscal 1H 2023 results on February 27. Revenue declined 15% y/y due to timing of clinical trials which can be quite lumpy and difficult to project. For the full fiscal year, management expects revenue to be down 6% to 9%. The revenue shortfall is due to slow patient enrollment in Alzheimer’s clinical trials. This isn’t lost revenue but revenue that has just been pushed out a year or so. Eisai and Eli Lilly each have a phase III Alzheimer’s drug that could be approved this year. If they are approved, there will need to be many more trials to gather additional data. Cogstate will benefit as cognition will need to be measured in a systematic manner. Finally, management mentioned on the call that it approved a share repurchase authorization of $13MM (5% of market cap). Management stated, “We’ve announced that Cogstate will buy up to $13MM of stock. This really reflects the Board’s position that the future commercial prospects that we see in the business aren’t really reflected in our share price as it sits today.” While Cogstate’s performance has been disappointing, I remain confident in the long-term outlook. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) paid out $0.204134 on April 10. ~50% of the distribution came from rental income and ~50% came from sales proceeds. The Trust has pulled back but this is largely due to rising interest rates which has impacted all real estate companies. Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported another excellent quarter on March 15. Revenue grew 32% to $16.5MM, beating consensus expectations by ~$1MM. While we have grown accustomed to 100%+ revenue growth, typical seasonality is returning to the business (Q1 is typically the weakest quarter while Q3 is typically the strongest). Banknote revenue grew 26% while Payments revenue increased 60%. Currency Exchange’s valuation looks attractive at 9x forward earnings and 7x forward free cash flow. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week. It reported solid year-end results on March 23. In 2022, revenue increased 64% to $70MM. Adjusted EBITDA increased 120% to $53MM. During the year the company bought back 4% of shares outstanding and the board of directors authorized another one-year share repurchase authorization to buy back up to 10% of shares outstanding. The company has hedged ~20% of production at a natural gas price of $3.96. The balance sheet remains strong with $45.8M of net cash, representing 38% of its market cap. While lower natural gas prices will hurt results in 2023, it will still be profitable. In 2020, when natural gas prices were at similar levels, Epsilon generated $15.7MM of adjusted EBITDA. Thus, the stock is trading at just 4.2x 2020 (which I view as trough) EBITDA. This valuation appears compelling. Meanwhile, the company is paying a nice dividend and buying back stock. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported on March 15 that its CFO bought 1,500 shares in the open market. This is reassuring given the current banking crisis. The company reported Q4 results on January 25. Net income increased 18%. The company generated an industry-leading ROA and ROE of 2.8% and 24%, respectively. Loan growth and strong underwriting are driving the excellent results. Non-performing loans remain at 0%. Despite strong fundamentals, Esquire trades at just 10x forward earnings. Original Write-up. Buy under 45.00

IDT Corporation (IDT) had no news this week. It reported another solid quarter on March 8. Consolidated revenue decreased 7% due to continued tough comps, but NRS continues to grow like crazy (+103%) and net2phone does as well (+30%). The company generated $23.2MM of consolidated EBITDA. Thus, it’s trading at 6.2x consolidated annualized EBITDA. So the stock now looks cheap on both a consolidated and SOTP basis. Given challenging market conditions for high-growth companies, IDT’s subsidiaries won’t be spun off soon, but we know that ultimately, they will be monetized either through a sale or through a spin-off. The investment case remains on track. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week but I expect the company to report full 2022 results within the next few weeks. Kistos reported an operational update on January 18. By my math, Kistos generated €100MM in the second half of 2022, or €200MM on an annualized basis. As such, Kistos is trading at a price to free cash flow multiple of 1.6x. Further, Kistos has 40% of its market cap in cash. Management stated that the regulatory environments in the Netherlands and the U.K. have made investment decisions more difficult (excess profit tax). Nevertheless, the company is evaluating acquisitions outside of the Netherlands and the U.K. It is also considering returning cash to shareholders. Kistos continues to look compelling to me. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) is working to gain liquidity for shareholders. I spoke to the CEO on February 17 and got an update. He is pursuing any and all liquidity options for investors including: 1) partnering with a SPAC, 2) merging with another public NOL shell, 3) raising money through an IPO, and 4) taking on private equity. I don’t have a sense of timing in terms of when LSYN shareholders can expect liquidity, but I know it is a big focus for the company. From a financial perspective, Libsyn continues to grow strongly. Revenue grew from $42MM in 2021 to $57MM in 2022. On a pro forma basis (full-year contribution from the acquisition of Julep), revenues are over $60MM. Profitability is down as the company is focused on expanding into the podcasting advertising market which has lower profitability than the hosting business. Still, I’m optimistic that Libsyn has a bright future. Original Write-up. Hold

M&F Bancorp (MFBP) had no news this week. It reported quarterly results on February 10. EPS increased 115% to $0.82. Return on equity increased to 34% from 12.2% a year ago. As expected, M&F is benefiting from new funds from the Emergency Capital Investment Program. M&F’s balance sheet remains strong with 0.2% non-performing loans. Stockholders’ equity represents 26% of total assets. The investment case is on track. Despite an appreciating stock price, M&F is trading at just 7.7x annualized earnings. I expect EPS to grow to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) announced this week that it expects record fiscal year results. This is encouraging. On March 22, the company announced that it has secured a new licensing agreement to sell a topical treatment called Terbinafine. The product could be approved in Canada this year. Management hasn’t provided sales potential, but it will be a positive contributor. On March 8, Medexus announced that it has secured new credit facilities amounting to $58.5MM. The interest rate for the facilities is only 8.58%, an attractive rate. The new facilities include a $35 million loan, of which $30MM will be used to repay long-term debt, and an additional $5MM that can be used to pay off debentures. Additionally, there is a possibility of accessing an extra $20MM of uncommitted capital. Medexus plans to use this capital to repay convertible debentures in cash, which could potentially halve the dilution. Overall, this is a big positive. All in all, my conviction level remains high. The stock’s valuation looks cheap. Original Write-up. Buy under 3.50

Merrimack Pharma (MACK) had no news this week. It is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Onivyde will likely be approved for first-line metastatic small-cell lung cancer in early 2024 which will trigger a $225MM royalty payment. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~15 months, representing more than 125% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

NexPoint (NXDT) filed its 10-K on March 31. A few takeaways: 1) NexPoint’s current NAV (net asset value) is $25.14. As such, the stock is still trading at a massive discount. 2) NexPoint is trading to refinance its debt ($145MM) for its Cityplace Tower in Dallas. The debt was originally due in September, but the maturity has continually been pushed out to May 8 and it could be pushed out further, to September 8. Management remains confident that it can complete the refinancing, but I’m watching this closely as Cityplace represents ~10% of NXDT’s NAV. 3) The company authorized a share repurchase agreement in October of $20MM over a two-year period. So far, the company has not bought back any stock. I believe this is because the company is retaining liquidity to support the Cityplace refinancing. NexPoint remains a high-conviction idea. Original Write-Up. Buy under 17.00

Opera (OPRA) had no news this week but continues to perform well. It reported an excellent quarter on February 27. Revenue grew 33%, beating consensus expectations by 7%. EPS of $0.27 beat consensus expectations by $0.70. The company is expecting revenue growth of 15% and EBITDA growth of 12%. This seems very conservative, which is the company’s typical approach to guidance. The investment case remains on track. Original Write-Up. Buy under 8.00

P10 Holdings (PX) had no news this week. The company filed a form 4 statement on March 16 that seemed to indicate that an insider is selling. But it appears that the company repurchased those shares at an 8% discount to the market (privately negotiated transaction). What appears like a negative is actually a positive. P10 announced an excellent quarter on March 6. Fee-paying assets under management increased 23% y/y. Revenue increased 32% and adjusted EBITDA grew 29%. P10 continues to benefit from secular tailwinds in the private equity industry. Despite strong growth, P10 trades at just 12.9x EBITDA and just 13x cash earnings. This is too cheap a valuation. The investment case is on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week and will report year-end 2022 results in April. The company announced good quarterly results on November 27. Revenue grew 50% y/y to $14.7MM CAD (47% constant currency growth). EBITDA increased 27% to $3.6MM CAD. On an organic basis, EBITDA grew 13% y/y. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins. However, the company plans to pass through price hikes which will help offset these headwinds. RediShred is also active on the acquisition front. The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) filed Q4 and 2022 results last week. The results look great. As of December 2022, Transcontinental has $471MM of cash and note receivables on its balance sheet. Its current market cap is $362MM. The company does have some debt for which it has no recourse as it’s tied to additional real estate that Transcontinental owns. Long story short, this stock is very, very cheap. Unfortunately, there is no hard catalyst now and we don’t know what management is going to do with the stock, but we know that the stock is extremely cheap. Insiders are incentivized to buy out minority shareholders at a premium to the current stock price but at a discount to book value. Currently, the stock trades at price to book value multiple of just 0.4x. Original Write-up. Buy under 45.00

Truxton (TRUX) had no news this week. The stock has generally sold off in 2023 in sympathy with the fallout from Silicon Valley Bank. However, Truxton should experience no impact from the SVB disaster. It reported Q4 earnings on January 26. For the full year, diluted EPS increased 15% to $5.02. Credit quality and loan growth continue to look good. Most importantly, Truxton authorized a $5MM share repurchase, raised its dividend by 12%, and declared a $1 per share special dividend. Truxton continues to look attractive at 14x earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Unit Corp. (UNTC) released both its 10-K and an investor presentation for 2022 on March 17. The company generated $130MM FCF in 2022, in-line with what I had expected. With a market cap of $390MM, UNTC is trading at 3.1x FCF. With net cash of $118MM, its enterprise value (EV) is just $277MM (EV/FCF 2.2x). The company sold its 50% interest in the midstream joint venture with SP Investor for $20MM, $12MM of which they will get at close, the other $8MM deferred over 12 months. UNTC reiterated its plan to monetize non-core drilling locations and continue to sell minor interests in outlying areas. Within its core fields, Unit expects to drill in 1 to 2 net wells per year, with development capex of ~$10-$20MM per year. UNTC has been weak recently. While oil and gas have sold off, UNTC is just too cheap (I think 100% undervalued). Further, downside is limited with a net cash balance sheet. Original Write-up. Buy under 65.00

William Penn (WMPN) had no news this week. It reported that its CEO bought 50,000 shares on the open market at a price of 10.68 per share on March 13. This is encouraging given the current banking crisis. William Penn is a micro-cap “thrift” bank that is extremely cheap. Most thrifts sell themselves three years after their thrift conversion (acquisitions are prohibited before then). This anniversary will be in 12 months (March 2024). At that point, I expect the company to sell itself for a 50% premium to its current price (based on typical thrift acquisition premiums). Finally, insiders are buying shares on the open market and the company is buying back its own shares aggressively. Downside is low given the stock is trading below liquidation value. Original Write-up . Buy under 12.50

Zedge, Inc. (ZDGE) has been a disappointing idea. The stock is extremely cheap and downside is limited given strong cash balance sheet. But the fundamentals have deteriorated. As a result, I’m closing this recommendation to make room for my newest idea. I will keep it on my watch list and may recommend it once the fundamentals show signs of improving. Sell

Watch List

Amplify Energy (AMPY) stayed on my watch list this month. In 2021, one of the company’s pipelines was ruptured off the coast of California creating a massive oil spill. It turned out the accident was not the fault of Amplify but rather a ship that dragged its anchor across the pipeline. Insurance is going to cover the damages and the pipeline is almost back. Once the pipeline is completely fixed, the company will be gushing free cash flow. To add to the upside case, Amplify just announced an $85MM (net) settlement with the shipping company that caused the damage. Amplify’s valuation continues to look attractive. My only concern is what Amplify will do with all its cash.

FFBW, Inc (FFBW) is a similar set-up to William Penn Bancorp. It is a thrift that probably will get acquired for a nice premium. The CEO will even get a nice bonus if a sale materializes. The only reason that I went with William Penn Bancorp instead of FFBW is because of the aggressive insider buying currently at William Penn. But FFBW looks like another low-risk idea.

Sio Gene Therapies (SIOX) is a biotech liquidation. The stock trades at 0.41 and the guidance is for an initial distribution of $0.41 (at the midpoint). Further, the company has a reserve that could eventually be distributed, resulting in an additional distribution of $0.08 to $0.09. This is a low-risk/low-upside situation.

| Stock | Price Bought | Date Bought | Price on 4/11/23 | Profit | Rating |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1.02 | -40% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 10.65 | -2% | Buy under 14.00 |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 18.5 | 31% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 5.48 | 10% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 36.15 | 6% | Buy under 45.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 32.89 | 70% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 2.85 | -41% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 24 | 25% | Buy under 21.00 |

| Magenta (MGTA) | -- | 4/12/23 | 0.76 | --% | Buy under 0.83 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.15 | -35% | Buy under 3.50 |

| Merrimack Pharma (MACK) | 11.99 | 1/11/23 | 12.79 | 7% | Buy under 12.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 10.92 | -19% | Buy under 17.00 |

| Opera Ltd. (OPRA) | 7.04 | 2/8/23 | 10.45 | 48% | Buy under 8.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 9.89 | 232% | Buy under 15.00 |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 2.71 | -18% | Buy under 3.50 |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 39.6 | -2% | Buy under 45.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 65.5 | -6% | Buy under 75.00 |

| Unit Corp (UNTC) | 57.44 | 12/14/22 | 43 | -6% | Buy under 65.00 |

| William Penn Bancorp (WMPN) | 11.91 | 3/8/23 | 10.83 | -1% | Buy under 12.50 |

| Zedge (ZDGE) | -- | 3/9/22 | -- | --% | Sell |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on May 10, 2023.