Investing in Thrifts

My recommendation this week is a “thrift” bank.

This is my first thrift recommendation, and so I want to spend my introduction this month talking about the thrift industry because it’s an interesting niche in the investment world.

Legendary investor Seth Klarman advocates investing in thrifts.

In fact, he dedicated a chapter of his famous book, Margin of Safety, to thrifts. Chapter 11 of the book is titled “Investing in Thrift Conversions.”

Margin of Safety is out of print, and the hardcover sells on Amazon for $2,599.

But save your money!

If you want a copy of the book, just email me and I will send you a PDF copy.

Mutual thrift institutions were first formed in the 19th century. Ownership of the institutions was “mutual,” meaning that the depositors in the thrift owned the institution.

But depositors have no way to benefit from their “ownership” unless the thrift goes public.

Since 1980, hundreds of mutual thrift institutions have converted to stock ownership through IPO, providing an attractive opportunity for depositors to make money.

Why are thrift IPOs so attractive?

I will leave it to Seth Klarman to explain:

“A thrift institution with a net worth of $10 million might issue one million shares of stock at $10 per share. Again ignoring costs of the offering, the proceeds of $10 million are added to the institution’s preexisting net worth, resulting in pro forma shareholders’ equity of $20 million. Since the one million shares sold on the IPO are the only shares outstanding, pro forma net worth is $20 per share. The preexisting net worth of the institution joins the investors’ own funds, resulting immediately in a net worth per share greater than the investors’ own contribution.”

Said simply, participating in a thrift IPO is like buying a dollar for 50 cents.

I personally opened a bank account at Needham Bank in Massachusetts near my home as I expect the bank to go public within the next few years. If the bank does go public, I will participate in the IPO.

But there are other opportunities that exist once thrifts go public.

According to research from Piper Jaffray, 70% of demutualized banks that went public were eventually acquired at an average multiple of 140% of tangible book value.

Therefore, public thrifts that have been public for three years (threshold after which thrift can get acquired) represent attractive investment opportunities.

With that, let’s get to my latest idea: William Penn Bancorp (WMPN).

New Recommendation- William Penn Bancorp: Low-Risk Take-Out Play

Company: William Penn Bancorp

NYSE: WMPN

Price: 12.00

Market Cap: $167 million

Price Target: 17.50

Total Return Potential: 48%

Recommendation: Buy under 12.50

Recommendation Type: Slow and Steady

Executive Summary

William Penn is a micro-cap “thrift” bank that is extremely cheap. Most “thrifts” sell themselves 3 years after their thrift conversation (acquisitions are prohibited before then). This anniversary will be in 12 months (March 2024). At that point, I expect the company to sell itself for a 50% premium to its current price (based on typical thrift acquisition premiums). Finally, insiders are buying shares on the open market and the company is buying back its own shares aggressively. Downside is low given the stock is trading below liquidation value.

Overview

Background

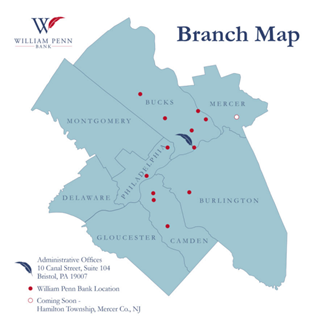

William Penn Bank is a Pennsylvania-chartered stock savings bank headquartered in Bristol, Pennsylvania, a suburb of Philadelphia. William Penn Bank has provided community banking services to individuals and small- to medium-sized businesses in the Delaware Valley area since 1870.

William Penn Bank currently has 12 branches.

In 2008, the bank went public. In 2021, the bank completed its second step conversion. It will be eligible to be acquired in 2024, 3 years after its second step conversion.

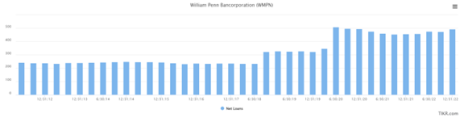

Over time, the bank has done a nice job of growing (the big jump in 2020 was due to an acquisition) over time.

At the same time, the bank has done a nice job managing credit losses.

As of December 31, 2022, non-performing assets as a percentage of total assets stand at just 0.49%.

Outlook

William Penn’s strategy is to open new branches to grow organically and to return cash to shareholders.

William Penn has been particularly aggressive in returning cash to shareholders. Because the company is buying back stock below tangible book value, share buybacks are accretive.

On March 11, 2022, the company announced its first stock repurchase program, to repurchase 758,528 shares. The company quickly completed this buyback by June 30, 2022, at an average share price of $11.84.

On June 9, 2022, the company announced its second stock repurchase program to repurchase up to 771,445 shares. This program was completed on January 10, 2023, at an average price of $11.60.

On August 18, 2022, the company announced its third stock repurchase program to repurchase up to 739,385 shares. So far, the company has repurchased 153,392 shares at an average price of $11.94 per share. 585,993 shares remain on this share repurchase authorization.

On February 17, 2023, the company announced its fourth stock repurchase program to repurchase 698,312 shares of its stock once the third stock repurchase program is completed.

In total, the company has repurchased 10.7% of its shares outstanding in the past year and will have repurchased a total of 18% of shares outstanding once it completes its fourth repurchase program.

Why is the management buying back its own stock like crazy?

My best guess is because they are buying the stock below its liquidation value and because they expect to sell the company in 2024 once the company reaches the third anniversary of its second step conversion.

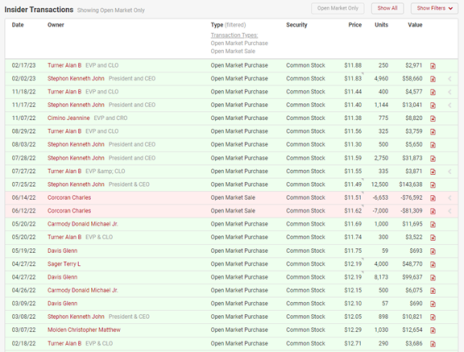

Finally, insiders have been buying shares for themselves like crazy…

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

Bank employees own 7.4% of shares outstanding through the William Penn Bank Employee Stock Ownership Plan. Further, management and directors own an additional 6.2% of shares outstanding.

This ownership ensures minority investors are aligned with management.

Finally, insiders have been aggressively buying shares on the open market, as shown below.

This signals that the bank is attractively priced and likely to be sold in 2024 at a premium to its current price.

Valuation and Price Target

William Penn’s current tangible book value is $12.67 (as of December 31, 2022).

Typically, thrifts are acquired at a 1.4x multiple of tangible book value.

A year from now, William Penn will be eligible to be acquired.

If it’s acquired at a 1.4x multiple of tangible book value, the acquisition price will be $17.74, or 49% above where the stock currently trades. In addition, the stock currently pays out a 1% dividend yield.

The one obvious caveat is that an acquisition is not guaranteed.

What happens if an acquisition doesn’t materialize?

In that scenario, downside should be limited given that:

1) The bank is overcapitalized.

2) The potential for acquisition will always hang over the shares.

Finally, I think it’s highly likely that an acquisition materializes given that ~70% of thrifts that go public are ultimately acquired (since 1982).

As is always the case, micro-caps are illiquid. Be sure to use limits.

My official rating is Buy under 12.50.

Risks

Credit Risk

- William Penn has done a great job managing its credit risk over time. Nonetheless, if the bank’s underwriting standards collapse, it will have a negative impact on the bank’s earnings and tangible book value.

Acquisition Doesn’t Materialize

- While this is certainly a risk, I think odds are likely that an acquisition materializes given that 70% of thrifts that go public have been acquired since the Great Financial Crisis and because insiders are buying so aggressively.

Updates

Changes This Week: Sell Atento (ATTO) to make room for new recommendation.

Atento S.A. (ATTO) moves to sell this week to make room for my new idea. Atento is very cheap. Nonetheless, my conviction in it has decreased, and it will require several years to turn the ship around. Therefore, I’m moving it to sell. Sell

Cogstate Ltd (COGZF) reported disappointing fiscal 1H 2023 results. Revenue declined 15% y/y due to timing of clinical trials which can be quite lumpy and difficult to project. For the full fiscal year, management expects revenue to be down 6% to 9%. While this is disappointing, the long-term outlook for the company is very strong given development in the Alzheimer’s market and future demand for Cogstate’s cognitive test. One other interesting tidbit is Cogstate was approached as an acquisition candidate and while the deal fell through, it does signal that the company has strong strategic value. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) paid out $0.084330 per trust certificate on February 10. This distribution doesn’t include any proceeds from asset sales and implies an 8% yield while trust holders wait for more assets to be sold with proceeds to be distributed. Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) reported another excellent quarter on January 23. Revenue increased 96% to $19.7MM, beating consensus by $3.5MM. The company continues to benefit from a booming travel market. The banknotes business grew 108% while the payments business grew 53%. EPS increased to $0.68 in the quarter, up over 100% from $0.25 a year ago. Despite rapid growth, the stock is trading at just 8.7x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week but has been lagging the market due to weak natural gas prices. Nonetheless, I believe the natural gas weakness will be short-lived and that Epsilon remains a compelling long-term play. Epsilon reported an excellent quarter on November 10. Revenue increased 6% sequentially. In the quarter, Epsilon generated $9.6MM of net income and $11.2MM in free cash flow. This is quite significant for a company with a market cap of $130MM. The company continues to buy back shares and pay dividends. Due to the strong cash generation in the quarter, Epsilon currently has $40MM of cash on its balance sheet and no debt. The stock continues to look attractive. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) reported Q4 results on January 25. Net income increased 18%. The company generated an industry-leading ROA and ROE of 2.8% and 24%, respectively. Loan growth and strong underwriting are driving the excellent results. Non-performing loans remain at 0%. Despite strong fundamentals, Esquire trades at just 10x forward earnings. Given strong results and a cheap valuation, I’m increasing my buy limit to 45.00. Original Write-up. Buy under 45.00

IDT Corporation (IDT) reported another good quarter on December 5. Revenue was down 13% y/y, mainly due to tough comps from last year. The two most important value drivers continue to chug along. NRS revenue grew 107% y/y to $17.6MM. Net2phone subscription revenue increased 33% to $15.5MM. During the quarter, IDT repurchased 203,436 shares (~0.8% of shares outstanding). Eventually, both of these divisions will be monetized (either through a spin-off or an asset sale). The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) reported an operational update on January 18. By my math, Kistos generated €100MM in the second half of 2022 or €200MM on an annualized basis. As such, Kistos is trading at a price to free cash flow multiple of 1.6x. Further, Kistos has 40% of its market cap in cash. Management stated that the regulatory environments in the Netherlands and the U.K. have made investment decisions more difficult (excess profit tax). Nevertheless, the company is evaluating acquisitions outside of the Netherlands and the U.K. It is also considering returning cash to shareholders. Kistos continues to look compelling to me. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) is working to gain liquidity for shareholders. I spoke to the CEO on February 17 and got an update. He is pursuing any and all liquidity options for investors including: 1) partnering with a SPAC, 2) merging with another public NOL shell, 3) raising money through an IPO, and 4) taking on a private equity. I don’t have a sense of timing in terms of when LSYN shareholders can expect liquidity, but I know it is a big focus for the company. From a financial perspective, Libsyn continues to grow strongly. Revenue grew from $42MM in 2021 to $57MM in 2022. On a pro forma basis (full-year contribution from the acquisition of Julep) revenues are over $60MM. Profitability is down as the company is focused on expanding into the podcasting advertising market which has lower profitability than the hosting business. Still, I’m optimistic that Libsyn has a bright future. Original Write-up. Hold

M&F Bancorp (MFBP) reported quarterly results on February 10. EPS increased 115% to $0.82. Return on equity increased to 34% from 12.2% a year ago. As expected, M&F is benefiting from new funds from the Emergency Capital Investment Program. M&F’s balance sheet remains strong with 0.2% non-performing loans. Stockholders’ equity represents 26% of total assets. The investment case is on track. Despite an appreciating stock price, M&F is trading at just 7.7x annualized earnings. I expect EPS to grow to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) reported record earnings on February 8. Revenue of $28.7MM grew 35% y/y. Adjusted EBITDA grew to $5.2MM. The company is currently trading at 1.1x annualized revenue and 6.1x annualized adjusted EBITDA. Despite the strong quarter, the stock had a muted response. My best guess: All eyes are on the imminent debt/debenture maturities in 2023. I also had a chance to talk to the CFO last week after earnings. Medexus has a $10MM term loan and a $20MM asset-backed loan maturing on July 17, 2023. $50MM U.S. of debentures will come due in October 2023. Medexus would prefer to find a non-dilutive financing option to address both maturities, but the first priority is the debt coming due in July. Medexus is exploring all options and is running a process to secure the most attractive financing option. While Medexus does have a good amount of debt on its books, my sense is the company will be able to refinance it at a reasonable cost. Based on $20MM of annualized EBITDA, the company has 4x of gross debt. This is high but not outrageous in my opinion (private equity deals get done with 5-7 turns of leverage). All in all, my conviction level remains high. An attractive refinancing will be a major catalyst for the stock. Original Write-up. Buy under 3.50

Merrimack Pharma (MACK) had no news this week. It is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Onivyde will likely be approved for first-line metastatic small-cell lung cancer in early 2024 which will trigger a $225MM royalty payment. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~15 months, representing more than 125% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

NexPoint (NXDT) had no news this week. It filed its 10-Q to report earnings on November 14. The results looked good. Operating cash flow is healthy. NAV as of September 30, 2022, is $28.17 so the stock is still trading at a big discount to fair value. The company generated $0.55 of funds from operations in the quarter. As such, it’s trading at ~7x, a discount to peers who trade closer to 12x. NexPoint has underperformed recently, but it remains a high-conviction idea. Original Write-Up. Buy under 17.00

Opera (OPRA) reported an excellent quarter on February 27. Revenue grew 33%, beating consensus expectations by 7%. EPS of $0.27 beat consensus expectations by $0.70. The company is expecting revenue growth of 15% and EBITDA growth of 12%. This seems very conservative which is the company’s typical approach to guidance. The investment case remains on track. Original Write-Up. Buy under 8.00

P10 Holdings (PX) reported an excellent quarter on March 6. Fee-paying assets under management increased 23% y/y. Revenue increased 32% and adjusted EBITDA grew 29%. P10 continues to benefit from secular tailwinds in the private equity industry. Despite strong growth, P10 trades at just 12.9x EBITDA and just 13x cash earnings. This is too cheap a valuation. The investment case is on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week and will report year-end 2022 results in March. The company announced good quarterly results on November 27. Revenue grew 50% y/y to $14.7MM CAD (47% constant currency growth). EBITDA increased 27% to $3.6MM CAD. On an organic basis, EBITDA grew 13% y/y. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins. However, the company plans to pass through price hikes which will help offset these headwinds. RediShred is also active on the acquisition front. The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) had no news this week. It disclosed its quarterly earnings on November 10. The sale of the joint venture (JV) has closed, and Transcontinental reported that it intends to use $182.9MM of the proceeds to “invest in income-producing real estate, pay down debt and for general corporate purposes.” The company hasn’t disclosed what it intends to do with the second installment of proceeds from the JV sale ($203.9MM). The company continues to look attractive with 96% of its market cap in cash. Insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price. Original Write-up. Buy under 45.00

Truxton (TRUX) reported Q4 earnings on January 26. For the full year, diluted EPS increased 15% to $5.02. Credit quality and loan growth continue to look good. Most importantly, Truxton authorized a $5MM share repurchase, raised its dividend by 12%, and declared a $1 per share special dividend. Truxton continues to look attractive at 14x earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) announced that its CEO is resigning but will remain chairman of the Board. While management transition is usually not good, I’m not concerned in this case. Phil Frohlich was named interim CEO. His firm (Prescott Capital) owns over 30% of shares outstanding. As such, I’m confident that Unit’s capital allocation strategy will not change (lots of dividends and share repurchases). Unit will pay a $2.50 dividend in Q2. This works out to a ~20% yield. Unit continues to look attractive at ~4x free cash flow. Original Write-up. Buy under 65.00

Zedge, Inc. (ZDGE) had no news this week. It reported Q1 2023 earnings on December 13. Revenue increased 14.5% y/y. However, EBITDA decreased 71% y/y to $1.0MM and operating cash flow decreased 60% y/y to $1.1MM. The decline was due to lower advertising revenue and expenses related to the integration of GuruShots. The quarter was disappointing, but management commentary suggests that advertising rates have already improved. Further, the stock is ridiculously cheap. It trades at 3.0x annualized EBITDA and 9.5x FCF. And it has 66% of its market cap in cash. Original Write-up. Buy under 6.00

Watch List

Amplify Energy (AMPY) stayed on my watch list this month. In 2021, one of the company’s pipelines was ruptured off the coast of California creating a massive oil spill. It turned out the accident was not the fault of Amplify but rather a ship that dragged its anchor across the pipeline. Insurance is going to cover the damages and the pipeline is almost back. Once the pipeline is completely fixed, the company will be gushing free cash flow. To add to the upside case, Amplify just announced an $85MM (net) settlement with the shipping company that caused the damage. Amplify’s valuation continues to look attractive.

FFBW, Inc (FFBW) is a similar set-up to William Penn Bancorp. It is a thrift that probably will get acquired for a nice premium. The CEO will even get a nice bonus if a sale materializes. The only reason that I went with William Penn Bancorp instead of FFBW is because of the aggressive insider buying currently at William Penn. But FFBW looks like another low-risk idea.

Sio Gene Therapies (SIOX) is a biotech liquidation. The stock trades at $0.41 and the guidance is for an initial distribution of $0.40 (at the midpoint). Further, the company has a reserve that could eventually be distributed, resulting in an additional distribution of $0.08 to $0.09. This is a low-risk/low-upside situation.

| Stock | Price Bought | Date Bought | Price on 3/7/23 | Profit | Rating |

| Atento SA (ATTO) | -- | 4/14/21 | -- | --% | Sell |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1.05 | -38% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 11.5 | -11% | Buy under 14.00 |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 18.35 | 30% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 5.81 | 16% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 43.94 | 29% | Buy under 45.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 30.43 | 57% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 3.15 | -34% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 28.5 | 48% | Buy under 21.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.31 | -26% | Buy under 3.50 |

| Merrimack Pharma (MACK) | 11.99 | 1/11/23 | 11.81 | -2% | Buy under 12.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 11.6 | -18% | Buy under 17.00 |

| Opera Ltd. (OPRA) | 7.04 | 2/8/23 | 8.81 | 25% | Buy under 8.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.52 | 253% | Buy under 15.00 |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 2.81 | -15% | Buy under 3.50 |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 43.8 | 9% | Buy under 45.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 68.77 | -3% | Buy under 75.00 |

| Unit Corp (UNTC) | 57.44 | 12/14/22 | 46.82 | 1% | Buy under 65.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.68 | -53% | Buy under 6.00 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on April 12, 2023.