Time for Oil and Gas

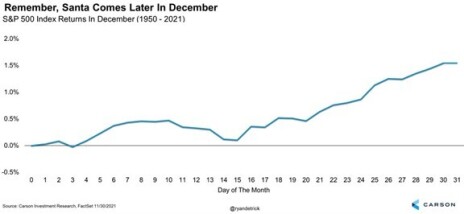

As we head into the second half of December, we enter the period of the year when the market tends to do quite well.

Who knows exactly why.

Perhaps, investors are done with their stock loss harvesting or maybe they are just feeling good about a new year and enjoying holiday parties.

No matter the reason, stocks tend to do quite well as shown in the chart below.

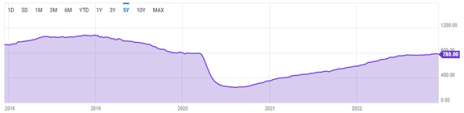

Today, I’m going to be recommending a stock in a sector that has performed very well over the past few years: energy.

Take a look at the Energy Select SPDR ETF below.

It has had quite a run since the depths of the pandemic.

Nonetheless, I think that outperformance is likely to continue.

Oil and gas companies have used the last two years of high prices to de-lever their balance sheets.

As a result, many have no debt and are using gushing cash flows to buy back stock and pay dividends.

Of all the energy stocks, one looks particularly attractive.

It has 33% of its market cap in cash and is trading at just 4.3x free cash flow. Finally, insiders own a ton of stock and management has been buying back stock aggressively in the open market.

With that, let’s dig into Unit Corp (UNTC).

New Recommendation: Unit Corp: Dirt-Cheap Oil & Gas Play

Company: Unit Corp

NYSE: UNTC

Price: 58.00

Market Cap: $550 million

Price Target: 93.00

Total Return Potential: 60%

Recommendation: Buy under 65.00

Recommendation Type: Rocket

Executive Summary

Unit Corp (UNTC) is a dirt-cheap energy company with 33% of its market cap in cash. It is gushing free cash flow yet trades at just 4.3x free cash flow, a dirt-cheap valuation. Insiders own over 30% of shares outstanding, and the company is buying back stock aggressively. It’s likely the company will be broken up and sold to the highest bidder as the company has already hired an investment banker to evaluate strategic alternatives.

Overview

Background

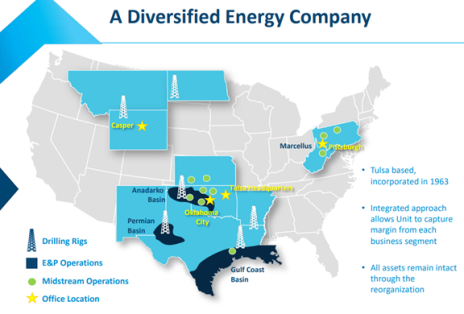

Unit Corporation was founded in 1963 as an oil and natural gas contract drilling company.

The company went bankrupt in May 2020 due to the pandemic-induced plunge in energy prices. It emerged from bankruptcy in May 2021 and trades over the counter under the symbol UNTC.

Today, Unit has three business segments:

Oil and Natural Gas Segment

- This is Unit’s traditional “upstream” business.

- This segment explores, develops, acquires, and produces oil and natural gas properties for their account.

- On January 20, 2022, the company announced that it has retained a financial advisor and launched the process to potentially sell all its upstream assets.

Contract Drilling

- This segment owns 14 BOSS drilling rigs.

- It drills onshore oil and natural gas wells for others and for Unit.

- The drilling operations are primarily located in Oklahoma, Texas, New Mexico, Wyoming, and North Dakota.

Mid-Stream

- Unit owns 50% of the Superior Pipeline company.

- This segment buys, sells, gathers, processes, and treats natural gas for third parties and their account.

- Mid-Stream operations are primarily located in Oklahoma, Texas, Kansas, Pennsylvania, and West Virginia.

Outlook

The outlook is quite strong.

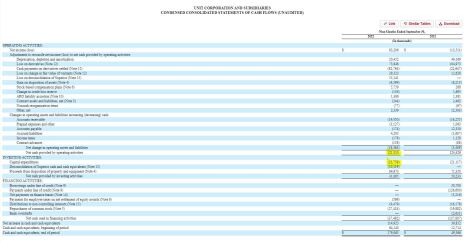

As of September 30, 2022, Unit is on pace to generate $130MM of free cash flow.

What is even more exciting is that Unit has had uneconomic energy price hedges in place.

What does this mean?

The company hasn’t been benefiting fully from elevated energy prices.

For example, the average oil price that Unit realized year to date through September was $57.72 due to its hedging program vs. $97.74, the average price of oil in 2022.

Similarly, the average natural gas price that Unit realized year to date through September was $3.72 due to its hedging program vs. $6.02, the average price of natural gas in 2022.

Unit has some production hedged in 2023, but it is hedged at a higher price ($70/bbl). Thus, free cash flow generation should be even better in 2023.

Insider Ownership

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

Phil Frohlich of Prescott Capital Management is on the board of directors at Unit Corp and owns 37% of shares outstanding. His ownership ensures that the company will do all that it can to maximize shareholder value.

As such, equity holders are well aligned with management and the board of directors.

Finally, management is buying back stock aggressively.

Since emerging from bankruptcy, Unit has repurchased 2.47MM shares (20.5% of shares outstanding).

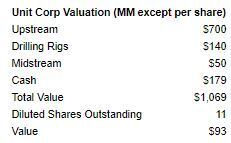

Valuation and Price Target

On a very simplistic basis, Unit is just too cheap.

Through the first 9 months of this year, it has generated $98MM of free cash flow. On an annualized basis, it’s generating $130MM of free cash flow.

As such, it’s currently trading at a price-to-FCF multiple of 4.2x and a price to enterprise value of 2.8x.

This is just too cheap.

What’s an appropriate valuation?

It’s tough to say with any precision, but I can say with confidence that it’s worth a lot more than is reflected in the current share price.

Reuters published an article that Unit was looking to sell its upstream assets for ~$1BN.

Let’s take a 30% haircut to that valuation to be conservative and assume the upstream division is worth $700MM.

As discussed above, Unit owns 14 BOSS drilling rigs that each cost $20MM to construct. In other words, Unit spent $280MM creating those drilling rigs.

Drilling rigs are in high demand given energy prices have recovered from the pandemic-induced swoon.

U.S. Drilling Rig Count

Source: Ycharts.com

Unit spent $280MM to create the drilling rigs. Let’s discount that by 50% and assume the rigs are now worth $140MM.

Finally, we can assign some value to Unit’s midstream business.

In 2018, Unit sold 50% of its midstream operation to Partners Group, a private equity group, for $300MM.

After April 1, 2023, Unit or the Partners Group can initiate a sale of the midstream assets.

In the case of a sale, Partners Group must receive its original $300MM plus a 7% minimal preferred return. As of September 30, 2022, Partners Group would receive $345.6MM before Unit would receive any additional proceeds.

During the past 12 months, the midstream business has generated $55MM of adjusted EBITDA. Midstream assets generally trade between 6x and 9x EBITDA implying no residual value for Unit to $150MM of residual value to Unit.

To be conservative, let’s assume $50MM of residual value.

Add it all up, and Unit is worth over $1BN or $93 per diluted share outstanding.

As a sanity check, this valuation implies a price to annualized free cash flow multiple of 8.2x which seems quite reasonable.

Add in the fact that the downside is protected (33% of its market cap in cash and no debt). Further, it’s gushing free cash flow currently.

As is always the case, micro-caps are illiquid. Be sure to use limits.

My official rating is Buy under 65.00.

Risks

Stock is well-liked on Twitter

- My favorite type of stocks are the ones that I’m the first to find. Unit Corp is not a stock that I found by myself. It is fairly well covered on Twitter, Seeking Alpha, and Value Investors Club. Nonetheless, I have a ton of respect for the investors who have pitched Unit Corp. and have independently verified that the opportunity is compelling.

Idiosyncratic negative event.

- With energy companies, there can be negative idiosyncratic events that can negatively impact the company’s stock price. A good example involves a company called Amplify Energy which had a pipeline leak. It was determined that the leak was not the fault of Amplify but the event created heightened volatility in the stock. Something similar, while unlikely, could occur with Unit Corp.

Recommendation Updates

Changes This Week

Sell Richardson Electronics (RELL) to make room for new recommendation.

Aptevo (APVO) reported positive results from its Phase 1 trial and the stock rocketed higher before coming back down to earth. The stock should continue to perform well as positive readouts are shared with investors. Aptevo currently has $18MM of net cash. Its market cap is $16MM. I expect Aptevo to receive an additional $22.5MM of income from its Ruxience royalty over the next 18 months. Nonetheless, cash is getting tight and Aptevo will need to sell shares to increase its runway. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported earnings on November 15. Revenue was flat but EBITDA margin increased 3.3 percentage points to 11.1% in the quarter driven by cost efficiencies. The company generated operating cash flow of $8MM in the quarter. It has a cash balance of $66MM with no near-term debt maturities. Investors were relieved with the quarter as the stock has almost doubled. Subsequent to the quarter, MCI Capital announced a tender offer to buy 1.5MM shares of Atento for 5 per share. It’s unlikely that any shareholders will accept this offer given the stock is trading well over the offer price. While Atento is in a turnaround, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) reported a solid quarter on November 10. Revenue increased 6% to $4.8MM. Adjusted EBIDTA increased 4% to $2.4MM. Cipher’s cash balance continues to grow. The company now has $27.5MM of cash on its balance sheet, over 50% of its market cap. Management continues to buy back shares. Longer term, upside will be driven by Cipher’s two pipeline products (MOB-015 for nail fungus and Piclidenoson for psoriasis). Both drugs are progressing in Phase 3 trials. Original Write-up. Buy under 2.50

Cogstate Ltd (COGZF) had no news this week. The company got a boost when Esai and Biogen announced positive results for its Phase 3 Alzheimer’s trial on September 27. This is massively positive news as it will drive more Alzheimer’s trials (and revenue for Cogstate). Ultimately, Cogstate’s revenue potential this year and beyond will be determined by key Alzheimer’s drug read-outs which are expected this year and next year: 1) Lecanemab from Eisai (Phase 3 data: already announced and positive), 2) Gantenerumab from Roche (Phase 3 data expected in Q4 2022), and 3) Donanemab from Eli Lilly (Phase 3 data in mid-2023). The Cogstate thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) paid out $0.28 on December 12 to certificate holders. On September 12, the trust announced that it sold seven of its properties for $65MM. The blended cap rate of the transactions was 7.3%. The trust on an aggregate basis is trading at a ~10% cap rate (the higher the cheaper). Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported earnings on September 13. They looked great! Revenue increased 139% to $21MM, beating consensus expectations by $5MM. This was truly a massive beat. Revenue in the fiscal third quarter was 67% higher than 2019 FQ3 (pre-pandemic). The company’s Payments business grew revenue 65% to $3.6MM. Year to date, Currency Exchange has generated EPS of $1.15 or $1.53 on an annualized basis. As such, the stock is trading at just 9x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week. Epsilon reported an excellent quarter on November 10. Revenue increased 6% sequentially. In the quarter, Epsilon generated $9.6MM of net income and $11.2MM in free cash flow. This is quite significant for a company with a market cap of $170MM. The company continues to buy back shares and pay a dividend. Due to the strong cash generation in the quarter, Epsilon currently has $40MM of cash on its balance sheet and no debt. The stock continues to look attractive. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. It reported earnings on October 25. EPS increased 21% to $0.94. Return on assets and equity were 2.48% and 20.60%, respectively. Credit metrics remain strong with nonperforming loans of 0.67% and a reserve for loan losses of 1.24%. I continue to believe Esquire dominates an attractive niche and is set to grow nicely for the foreseeable future. Despite 21% EPS growth and strong credit metrics, Esquire trades at just 11x forward earnings. Original Write-up. Buy under 42.00

IDT Corporation (IDT) reported another good quarter last week. Revenue was down 13% y/y, mainly due to tough comps from last year. The two most important value drivers continue to chug along. NRS revenue grew 107% y/y to $17.6MM. net2phone subscription revenue increased 33% to $15.5MM. During the quarter, IDT repurchased 203,436 shares (~0.8% of shares outstanding). Eventually, both of these divisions will be monetized (either through a spin-off or an asset sale). The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. The company reported first-half 2022 results on September 7. They looked great. The company reported revenue growth of 745% and EBITDA growth of 768%. It generated free cash flow of £93MM or $186MM annualized. Kistos has pulled back due to falling natural gas prices in Europe. As such, Kistos is currently trading at 0.7x annualized EBITDA and 1.8x annualized free cash flow. This is too cheap. Another risk is that the EU is considering instituting a windfall profit tax on energy companies. While this would be a negative, I think it’s reflected in Kistos’ valuation. Further, Kistos generated $89MM of EBITDA in 2021. Thus, it’s trading at just 3.5x “normalized” EBITDA, not a demanding valuation. I continue to see at least 100% upside ahead. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. Libsyn’s plan was to “go public” again in September. Obviously, that didn’t happen. It isn’t too surprising given the market volatility. I’ve reached out to Libsyn’s CEO and hope to catch up with him soon. Libsyn has posted several press releases in the past couple of months. I remain optimistic about Libsyn’s prospects. Once financials are re-filed, I’m looking forward to seeing: 1) How Libsyn’s core hosting business is doing. Podcasting conferences were a key way that Libsyn marketed. When COVID shut down in-person events, it negatively impacted Libsyn’s new customer acquisition. Now that COVID is behind us, I expect the core business to accelerate. 2) Revenue growth for AdvertiseCast. This is an exciting business opportunity. Revenue grew 50% in 2021 for AdvertiseCast, and I expect continued strong growth going forward. 3) The growth of Glow. Libsyn acquired Glow in 2021. Glow enables podcast creators to offer premium shows (think substack but for podcasts). I think this is a big market opportunity. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded. Original Write-up. Hold

M&F Bancorp (MFBP) is my newest recommendation. It had no news this week. M&F is taking advantage of an interesting opportunity (Emergency Capital Investment Program) available to many small banks. As a result, I expect EPS to grow from $1.36 in 2021 to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying almost 150% upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) reported fiscal Q2 results on November 8. The report was excellent! Revenue grew 55% y/y and EBITDA was $4.2MM, a y/y improvement of $6.3MM. The company generated positive free cash flow and is actively exploring options to refinance its convertible debentures which come due next fall. The stock’s valuation looks cheap at 1.1x revenue and 7.6x adjusted EBITDA. The investment case remains on track. Original Write-up. Buy under 3.50

NexPoint (NXDT) filed its 10-Q to report earnings on November 14. It will not host an earnings call but will post a robust earnings supplement. The results look good. Operating cash flow is healthy. NAV as of September 30, 2022, is $28.17 (I miscalculated NAV earlier) so the stock is still trading at a big discount to fair value. The company generated $0.55 of funds from operations in the quarter. As such, it’s trading at ~7x, a discount to peers who trade closer to 12x. The company also was recently added to the MSCI index. As such, there will be index fund buying throughout the rest of the month. Original Write-Up. Buy under 17.00

P10 Holdings (PX) announced Q3 2022 results on November 10. They were great. Adjusted EBITDA grew 28% in the quarter while adjusted net income grew 56%. Assets under management increased 17% to $19BN. The investment case remains on track. Despite very strong fundamentals, the stock is trading at just 12.5x adjusted earnings. Original Write-up. Buy under 15.00

RediShred (RDCPF) announced good quarterly results on November 27. Revenue grew 50% y/y to $14.7MM CAD (47% constant currency growth). EBITDA increased 27% to $3.6MM CAD. On an organic basis, EBITDA grew 13% y/y. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins. However, the company plans to pass through price hikes which will help offset these headwinds. RediShred is also active on the acquisition front.

On November 2, the company announced that it acquired Proshred Philadelphia for $7.3MM to $8.3MM (depending on earn-outs). I estimate the acquisition took place at a 6x EV/EBITDA multiple. This is a good deal. The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Richardson Electronics (RELL) has almost reached my 2-year price target of $28 within 3 months of my original recommendation. As such, I’m moving the stock to sell to make room for my new recommendation. I still like Richardson and may recommend it again if it pulls back. Original Write-up. Sell

Transcontinental Realty Investors (TCI) filed its quarterly earnings on November 10. The sale of the JV has closed, and Transcontinental reported that it intends to use $182.9MM of the proceeds to “invest in income-producing real estate, pay down debt and for general corporate purposes.” The company hasn’t disclosed what it intends to do with the second installment of proceeds from the JV sale ($203.9MM). The company continues to look attractive with 96% of its market cap in cash. Insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price. Original Write-up. Buy under 45.00

Truxton (TRUX) reported Q3 earnings on October 20. They were very good. Net income in the quarter of $1.49 grew 11% y/y. Net revenue also grew ~11%. Credit metrics remain excellent with $0 in non-performing loans. On an annualized basis, Truxton is generating $5.96 in EPS. It is trading at 10.4x annualized earnings. Historically it has traded at 13.5x. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge, Inc. (ZDGE) announced full quarterly results recently. Revenue in the quarter grew 42% while operating revenue grew 117%. For the full year, Zedge reported adjusted EBITDA of $12MM. As such, it’s trading at just 2.2x EBITDA, a draconian valuation. The company continues to buy back stock. Management believes the company can grow significantly over the next couple of years but will not give guidance for 2023 given economic uncertainty. Original Write-up. Buy under 6.00

Watch List

Merrimack Pharma (MACK) is a new name on my watch list. It has a drug approved to treat second-line metastatic pancreatic cancer and just released positive data for the same drug in first-line treatment of metastatic pancreatic cancer. If the drug is approved in first-line therapy, it will receive $225MM from Ipsen (milestone payment). That cash will be paid out to investors. Currently, MACK has a market cap of $156MM. I need to do more work on this name, but it’s promising.

Enhabit (EHAB) remains on my watch list. It is a 2021 spin-off that has performed poorly. It is focused on the home health and hospice space. Revenue is currently declining slightly due to health care worker shortages, but eventually, I expect revenue to reaccelerate. The stock looks very cheap, trading at 6.0x free cash flow. Meanwhile, insiders have been aggressively buying shares. The stock chart looks horrible, but this stock probably has significant upside looking out 2-3 years.

Harbor Diversified (HRBR) remains on my watch list. It is the holding company for Wisconsin Airlines, which has a capacity agreement with United. HRBR trades at a cheap valuation because there was uncertainty regarding whether United would extend its contract with Harbor. However, the company recently disclosed that the contract has been extended for five years. No terms have been released yet, but the stock should re-rate higher over time.

| Stock | Price Bought | Date Bought | Price on 12/13/22 | Profit | Rating | |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 3.01 | -91% | Buy under 7.50 | |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 4.95 | -77% | Buy under 10.00 | |

| Cipher Pharma (CPHRF) | 1.8 | 10/11/21 | 2.85 | 58% | Buy under 2.50 | |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1.15 | -32% | Buy under 1.80 | |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 13.14 | 2% | Buy under 14.00 | |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 13.82 | -2% | Buy under 16.00 | |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 6.67 | 33% | Buy under 8.00 | |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 42.27 | 24% | Buy under 42.00 | |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 28.52 | 47% | Buy under 45.00 | |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 4.4 | -8% | Buy under 7.50 | |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold | |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 19.25 | 0% | Buy under 21.00 | |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.37 | -23% | Buy under 3.50 | |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 12.81 | -9% | Buy under 17.00 | |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.53 | 253% | Buy under 15.00 | |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 2.91 | -12% | Buy under 3.50 | |

| Richardson Electronics (RELL) | 15.72 | 9/14/22 | 26.1 | --% | Sell | |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 46.91 | --% | Buy under 45.00 | |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 64 | -10% | Buy under 75.00 | |

| Unit Corp (UNTC) | -- | NEW | -- | --% | Buy under 65.00 | |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.41 | -58% | Buy under 6.00 | |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on January 11, 2022.